Welcome to our Asset Management Monthly Update series, which we began in May 2020 to give Groundfloor investors a monthly snapshot of how our asset management team is managing our outstanding loan portfolio. This report provides details on loans repaid in the previous month, as well as insight into how Groundfloor acted to manage troubled loans.

This latest installment looks at activity from July 2022. You may view activity from previous periods by clicking the links below.

June 2022

May 2022

April 2022

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

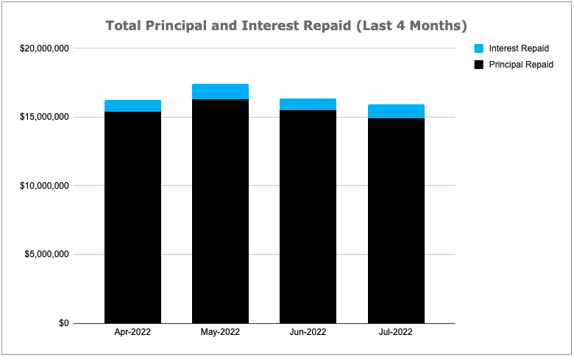

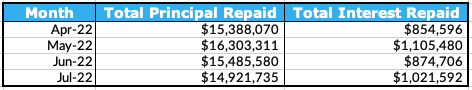

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

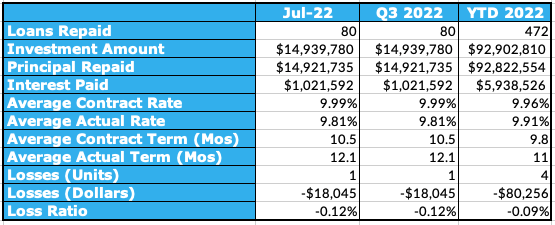

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q3 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

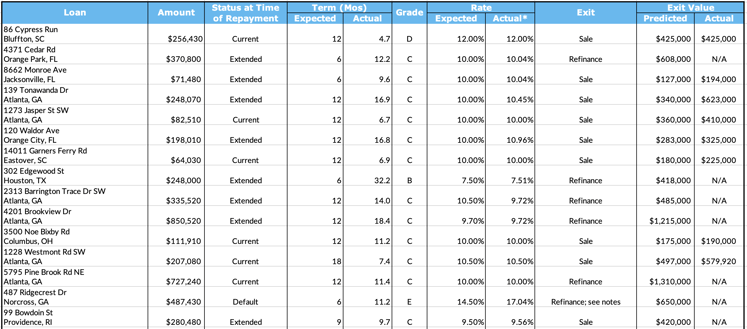

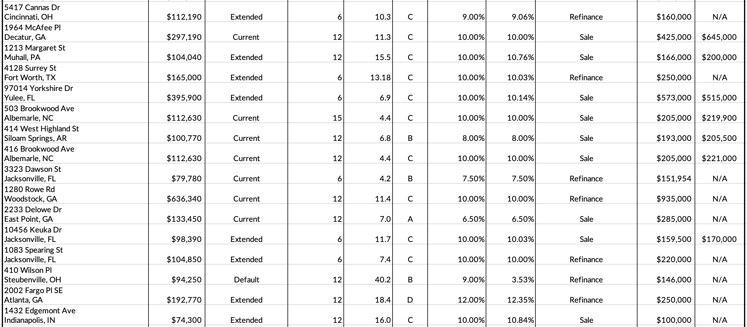

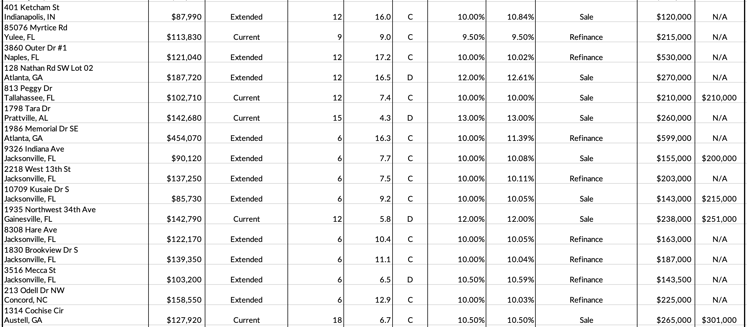

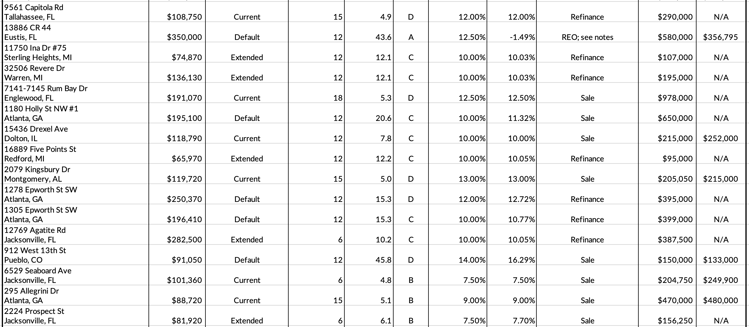

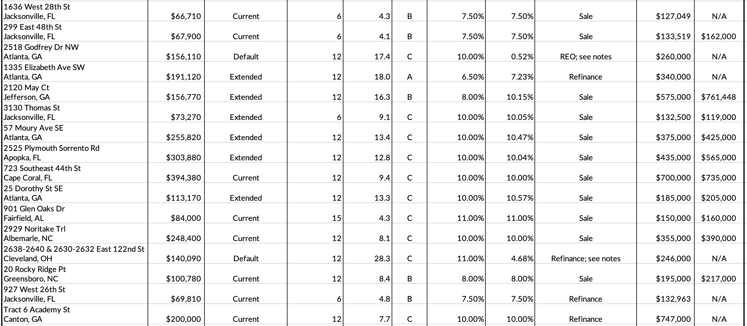

Last Month’s Repayments - July 2022

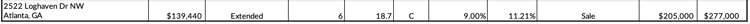

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

86 Cypress Run

4371 Cedar Rd

8662 Monroe Ave

139 Tonawanda Dr (LRO #1, LRO #2)

1273 Jasper St SW

120 Waldor Ave (LRO #1, LRO #2)

14011 Garners Ferry Rd

302 Edgewood St

2313 Barrington Trace Dr SW

4201 Brookview Dr (LRO #1, LRO #2)

3500 Noe Bixby Rd

1228 Westmont Rd SW (LRO #1, LRO #2, LRO #3)

5795 Pine Brook Rd NE (LRO #1, LRO #2, LRO #3, LRO #4, LRO #5, LRO #6)

487 Ridgecrest Dr (LRO #1, LRO #2)

99 Bowdoin St

5417 Cannas Dr

1964 McAfee Pl

1213 Margaret St

4128 Surrey St

97014 Yorkshire Dr (LRO #1, LRO #2, LRO #3)

503 Brookwood Ave

414 West Highland St

416 Brookwood Ave

3323 Dawson St

1280 Rowe Rd (LRO #1, LRO #2)

2233 Delowe Dr

10456 Keuka Dr

1083 Spearing St (LRO #1, LRO #2)

410 Wilson Pl

2002 Fargo Pl SE

1432 Edgemont Ave

401 Ketcham St

85076 Myrtice Rd

3860 Outer Dr #1

128 Nathan Rd SW Lot 02

813 Peggy Dr

1798 Tara Dr

1986 Memorial Dr SE (LRO #1, LRO #2)

9326 Indiana Ave

2218 West 13th St (LRO #1, LRO #2)

10709 Kusaie Dr S

1935 Northwest 34th Ave

8308 Hare Ave

1830 Brookview Dr S

3516 Mecca St (LRO #1, LRO #2)

213 Odell Dr NW

1314 Cochise Cir

9561 Capitola Rd

13886 CR 44

11750 Ina Dr #75

32506 Revere Dr

7141-7145 Rum Bay Dr (LRO #1, LRO #2)

1180 Holly St NW #1

15436 Drexel Ave

16889 Five Points St

2079 Kingsbury Dr

1278 Epworth St SW

1305 Epworth St SW

12769 Agatite Rd

912 West 13th St

6529 Seaboard Ave

295 Allegrini Dr

2224 Prospect St

1636 West 28th St

299 East 48th St

2518 Godfrey Dr NW

1335 Elizabeth Ave SW

2120 May Ct (LRO #1, LRO #2)

3130 Thomas St

57 Moury Ave SE

2525 Plymouth Sorrento Rd

723 Southeast 44th St (LRO #1, LRO #2)

25 Dorothy St SE

901 Glen Oaks Dr

2929 Noritake Trl (LRO #1, LRO #2, LRO #3)

2638-2640 & 2630-2632 East 122nd St

20 Rocky Ridge Pt

927 West 26th St

Tract 6 Academy St

2522 Loghaven Dr NW

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 80 loans were repaid. 33 of them were current, repaying on time and in full. 38 loans were granted an extension last month and were repaid after the stated maturity date. 9 were special situation loans, the details of which are below.

487 Ridgecrest Dr - Repaid Out Of Default

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance was not making progress, so in April 2022 Groundfloor began foreclosure proceedings. Property inspections occurred in May 2022, and a foreclosure sale date was set for July 2022.

410 Wilson Pl - Repaid Out Of Default

The project began in March 2019 and the loan had an original maturity date in March 2020. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process continued through the next several months after being delayed due to COVID-19. The borrower advised they were pursuing refinancing with multiple different lenders, and refinancing efforts continued through the end of 2020. Groundfloor entered into workout negotiations with the borrower in an attempt to avoid foreclosure in December 2020, and in January 2021 a refinance lender provided a commitment for refinancing. However, after all documentation was collected, the appraisal came back as too low, which caused the refinance lender to back out. As such, Groundfloor began foreclosure proceedings in May 2021. Foreclosure remained ongoing through the next several months; in parallel, the borrower continued to work to refinance the loan. Upon inspection of the property for foreclosure, a tenant was found occupying the property in October 2021, which necessitated procedures to have them vacate. Foreclosure legal proceedings remained ongoing through the end of 2021 and into 2022. Groundfloor continued negotiating with the borrower in an attempt to speed up payoff, and in June 2022 the borrower advised that a refinance was imminent. The refinance went through and the loan was repaid with full principal and partial interest in July 2022.

13886 CR 44 - Repaid Via REO

The project began in November 2018 and the loan had an original maturity date in November 2019. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. Additionally, the borrower agreed to a global resolution with Groundfloor for this loan as well as three other loans with the same borrower. Pursuant to the global resolution, if this loan was not resolved by October 2019, Groundfloor would begin foreclosure proceedings. The borrower defaulted on the global resolution, so in October 2019 Groundfloor began foreclosure proceedings. Legal proceedings continued through the end of 2019 and through 2020, with the court hearings getting delayed due to COVID-19 as well as foreclosure moratoriums. Finally, Groundfloor’s attorney advised that a foreclosure sale date was set for February 2021; however, this date was pushed back due to foreclosure moratoriums in place. In March 2021, the courts granted the borrower additional time to obtain a refinance loan in order to keep the property. A foreclosure hearing was scheduled for July 2021, and the borrower continued to try to refinance the loan in parallel. A foreclosure sale date was scheduled for October 2021. At the sale, Groundfloor was the successful bidder and the property became REO. Groundfloor undertook preparations to sell the property through the next few months. In December 2021, the property went under contract; however, the contract fell through and the property was put back on the market in January 2022. The property remained for sale for the next few months. In June 2022, the property went back under contract, and in July 2022 the property was sold and the loan was repaid with a principal loss.

The property was sold for $356,795.17. After adding the remaining escrow balance and subtracting foreclosure costs and legal fees, the net recovery on this property was $331,956.45, which represents a 95% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

1180 Holly St NW - Repaid Out Of Default

The project began in November 2020 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor began workout discussions with the borrower in an effort to avoid foreclosure. Workout discussions were ultimately unsuccessful and foreclosure proceedings began in December 2021. In February 2022, our attorney advised that a foreclosure sale date was set for April. This date was then pushed back to June 2022. Separately, the borrower was attempting to sell the property, which was ultimately successful. The loan was repaid in July 2022.

1278 Epworth St SW - Repaid Out Of Default

The project began in April 2021 and the loan had an original maturity date in April 2022. As the maturity date approached, Groundfloor entered into workout discussions in an attempt to avoid foreclosure. In June 2022, Groundfloor advised the borrower that the loan was in default, with foreclosure actions to follow if the loan was not repaid. The borrower subsequently advised that they were in the process of refinancing the loan. The loan was subsequently repaid in July 2022.

1305 Epworth St SW - Repaid Out Of Default

The project began in April 2021 and the loan had an original maturity date in April 2022. In June 2022, Groundfloor advised the borrower that the loan was in default, with foreclosure actions to follow if the loan was not repaid. The borrower subsequently advised that they were in the process of refinancing the loan. The refinance completed and the loan was repaid in July 2022.

912 West 13th St - Repaid Out Of Default

The project began in September 2018 and the loan had an original maturity date in September 2019. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. However, the refinance did not go through, and in October 2019 Groundfloor engaged counsel to proceed with foreclosure actions. Foreclosure proceedings continued through the remainder of 2019, and in January 2020 our attorney advised that a foreclosure sale date was set for May 2020. In the meantime, the borrower continued to seek alternative financing to avoid foreclosure. The foreclosure sale was delayed due to a state foreclosure moratorium because of COVID-19, and Groundfloor continued to work with our attorney to schedule a new hearing date. The foreclosure moratorium remained in effect through the end of 2020 and into 2021. In parallel, the borrower continued to try to find financing to repay the loan and avoid foreclosure. In July 2021, Groundfloor obtained new counsel to expedite the foreclosure process. Foreclosure continued into 2022. In March 2022, Groundfloor discovered the property was occupied and referred it for eviction proceedings. In May 2022, a foreclosure sale date was set for July 2022. The property was sold and the loan was repaid in July 2022.

2518 Godfrey Dr NW - Repaid Via REO

The project began in February 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that they were in the process of negotiating with a buyer. The sale did not go through and in April 2022 the property was referred to our legal counsel for foreclosure. The foreclosure sale was set for June 2022; the property did not sell at the auction and thus became REO. Groundfloor then received an offer on the property and the loan was repaid in July 2022.

2638-2640 & 2630-2632 East 122nd St - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. Because this was a multi-unit property, refinancing took longer than a traditional refinance loan. The refinance continued through the next few months, with the borrower advising that a purchase agreement was in place and inspections were scheduled as of August 2021. As time progressed, the loan was still outstanding, and in December 2021 Groundfloor began foreclosure proceedings. Foreclosure proceedings continued through the first half of 2022, with the borrower pursuing alternative payoff methods in parallel. Finally, in July 2022, Groundfloor negotiated a settlement on the property that resulted in full principal and partial interest repayment in order to avoid a lengthier and more costly foreclosure process.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 1313 Metropolitan Pkwy SW

- 9634 South Winchester Ave

- 1952 Duncans Mill Rd

- 140 Kings Mill Ct

- 509 Thoreau Ln

- 701 West 36th St

- 1506 Avon Ave SW

- 6224 Ellis St

- 2419 North Capitol Ave

- 975 North Main St

- 1304 Iranistan Ave

- 14820 Clark St

- 1244 Aubert Ave

- 2090 East Mclemore Ave

- 38 Wickham Dr

- 1302 Shiloh Trail East NW

- 1423 Vesta Terr

- 18075 Roselawn St

- 17527 Stoepel St

- 7327 Santiago St

- 7325 Santiago St

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We did not go under contract to sell any properties last month.

We sold the following real estate owned properties last month: