As the financial and real estate markets continue to experience upheaval due to the COVID-19 pandemic, we understand that some Groundfloor investors may become more concerned than usual with the status of their investments.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As we move into a new year, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from February 2021.

You may view activity from previous periods by clicking the links below.

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

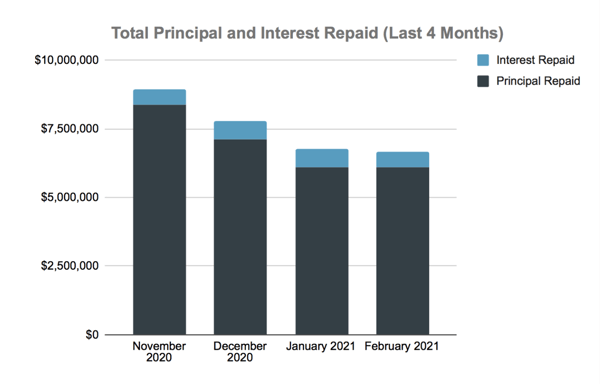

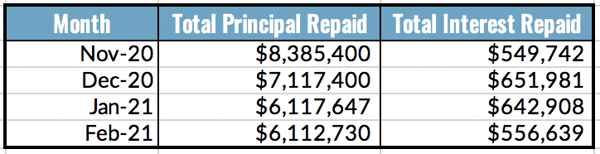

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

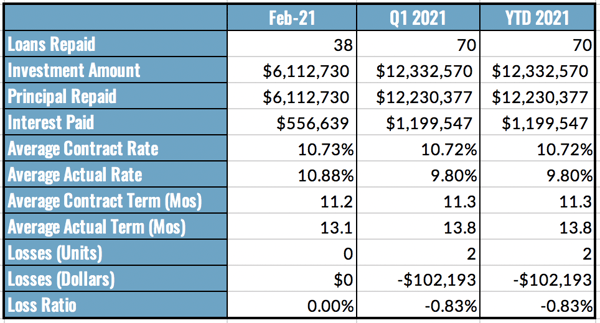

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q1 2020, and loans repaid year-to-date in 2021.

It’s important to underscore that this table showcases the performance of loans that were repaid during the delineated periods, not the performance of loans originated during these timeframes.

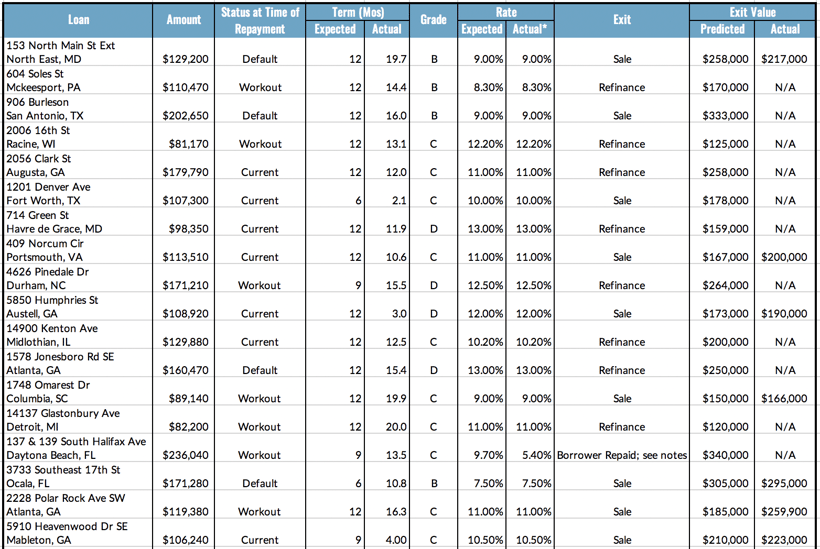

Last Month’s Repayments - February 2021

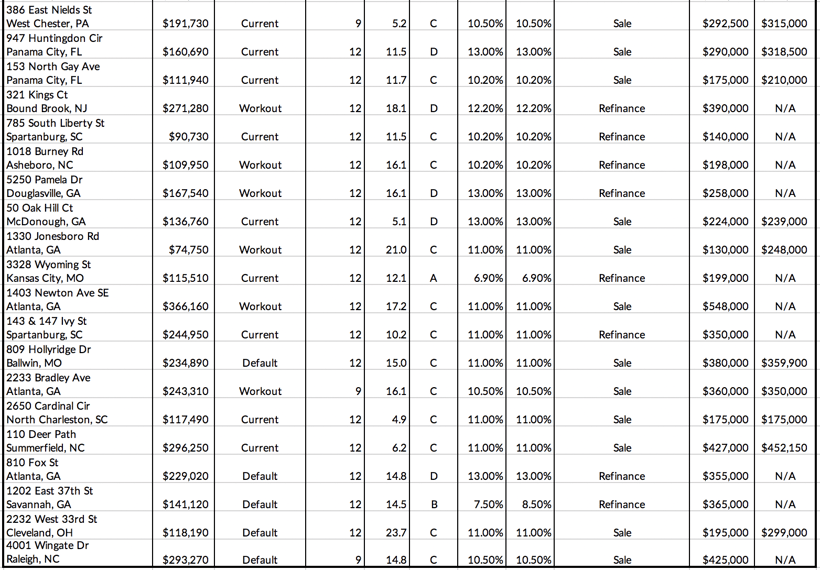

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

**NOTE: The borrower did not disclose the source of repayment proceeds.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Default - loan was resolved while in default

Workout - a workout plan was put into effect and the loan was resolved under the terms of the workout agreement

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property.

Links to the loan detail pages for the above loans:

153 North Main St Ext

604 Soles St

906 Burleston

2006 16th St

2056 Clark St

1201 Denver Ave

714 Green St

409 Norcum Cir

4626 Pinedale Dr

5850 Humphries St

14900 Kenton Ave

1578 Jonesboro Rd SE

1748 Omarest Dr

14137 Glastonbury Ave

137 & 139 South Halifax Ave

3733 Southeast 17th St

2228 Polar Rock SW

5910 Heavenwood Dr SE

386 East Nields St

947 Huntingdon Cir

153 North Gay Ave

321 Kings Ct

785 South Liberty St

1018 Burney Rd

5250 Pamela Dr

50 Oak Hill Ct

1330 Jonesboro Rd

3328 Wyoming St

1403 Newton Ave SE (LRO #1 and LRO #2)

143 & 147 Ivy St

809 Hollyridge Dr

2233 Bradley Ave

2650 Cardinal Cir

110 Deer Path

810 Fox St

1202 East 37th St

2232 West 33rd St

4001 Wingate Dr (LRO #1 and LRO #2)

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 38 loans were repaid. 16 of them were current, repaying on time and in full. 22 were special situation loans, the details of which are below.

153 North Main St Ext - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Groundfloor issued a Notice of Default. The borrower subsequently advised that the property was completed and actively listed on the market. In November 2020, the property went under contract, with an expected closing date of January 14, 2021.

604 Soles St - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower needed a bit more time to complete a refinance on the loan. Groundfloor extended forbearance for 45 days for the borrower to exit via refinance. The loan was repaid under the terms of that workout agreement and repaid in full on February 1st, 2021.

906 Burleston - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Renovations on the property were completed in March 2020 and the property was listed on the market. It remained on the market with no offers for over 8 months. In November 2020, Groundfloor issued a Notice of Default and prepared to initiate foreclosure proceedings if the default was not cured. In January 2021, the borrower advised that the property was under contract, and the loan was repaid in February 2021.

2006 16th St - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower needed a bit more time to complete the project, line up a renter for the property, and then obtain a refinance on the loan. Groundfloor extended forbearance for 90 days for the borrower to exit via refinance. The loan was repaid under the terms of that workout agreement and repaid in full on February 1st, 2021.

4626 Pinedale Dr - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Groundfloor issued a Notice of Default. A workout agreement was then reached with the borrower, with a new maturity date of January 26, 2021, and the loan was repaid under the terms of that workout agreement.

1578 Jonesboro Rd SE - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Groundfloor provided a few refinance lender options for the borrower. The borrower decided to refinance the loan, and Groundfloor provided a forbearance agreement so the borrower had time to refinance. The loan was repaid under the terms of that workout agreement.

1748 Omarest Dr - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Due to the COVID-19 pandemic, Groundfloor provided loan leniency in the form of a 90-day extension so the borrower had adequate time to complete and sell the property. The property went under contract in September 2020, with an expected closing date in October; however, the closing fell through because the property was broken into and the plumbing was vandalized. The borrower subsequently secured a new buyer and went under contract in October 2020, with an expected closing date in November 2020. The closing process experienced delays, and Groundfloor granted another extension to provide additional time for the closing to go through. The property was sold in January 2021, and the loan was repaid in February 2021.

14137 Glastonbury Ave - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was unable to sell or refinance the home by the maturity date; therefore, Groundfloor extended two rounds of forbearance. After the second term of forbearance expired, Groundfloor was notified that the borrower had the property under contract. The loan was repaid in full on February 5, 2021 under the terms of the second forbearance agreement.

137 & 139 South Halifax Ave - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the Maturity date. The borrower was unable to refinance the home by the maturity date and therefore, Groundfloor attempted to work out some sort of forbearance agreement. The borrower and Groundfloor were unable to come to terms on a forbearance; however, a resolution was found nonetheless. In lieu of foreclosure Groundfloor agreed to a reduced payoff to repay principal and reduced interest. The loan was repaid in full on February 5th, 2021.

3733 Southeast 17th St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was unable to sell or refinance the home by the maturity date; therefore, Groundfloor forbearance was extended to the borrower. The property went under contract and subsequently was repaid in full on February 10, 2021 under the terms of the forbearance agreement.

2228 Polar Rock Ave SW - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was experiencing delays due to COVID-19. Groundfloor provided loan leniency in the form of a 90-day extension. In December 2020, the property was completed and listed for sale, with an expected closing date of late January 2021. The loan was repaid in full in February 2021.

321 Kings Ct - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was experiencing significant delays due to COVID-19. Groundfloor granted forbearance so the borrower could have adequate time to complete the project. The borrower advised they were pursuing a refinance of the loan. The forbearance agreement expired in October 2020 with no repayment, so Groundfloor sent a Notice of Default to the borrower in November 2020. To avoid foreclosure, a workout agreement was reached and the borrower gave satisfactory evidence that a lender had committed to refinancing the loan. The loan was repaid under the terms of this workout agreement in February 2021.

1018 Burney Rd - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Groundfloor provided loan leniency in the form of a 90-day extension. The borrower advised that the property was in the process of being refinanced, and the loan was repaid in February 2021.

5250 Pamela Dr - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Groundfloor provided loan leniency in the form of a 90-day extension. The borrower advised that the property was in the process of being refinanced, and the loan was repaid in February 2021.

1330 Jonesboro Rd - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. Due to COVID-19, Groundfloor provided loan leniency in the form of a 90-day extension, with a maturity date in August 2020. The property was listed on the market but received no offers to buy. Once the new maturity date was reached, Groundfloor provided further loan leniency to allow the property to sell on the market, with a maturity date in November 2020. The borrower advised that they were pursuing refinancing for the loan. In December 2020, the borrower advised that the property was under contract, with an expected closing date in January 2021. The loan was repaid in full in February 2021.

1403 Newton Ave SE - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was completed and listed on the market by the maturity date. Groundfloor provided loan leniency in the form of 90-day extension so the property would have time to sell. The borrower advised that they had received multiple offers on the property, but none with favorable terms. Groundfloor provided an additional forbearance of 75 days to allow more time for the property to sell. The property went under contract in January 2021, and the loan was repaid in full in February 2021.

809 Hollyridge Dr - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was completed and listed on the market, and the property went under contract with an expected closing date of January 31, 2021. However, the maturity date arrived before the loan was paid off, so Groundfloor sent a Notice of Default on February 4, 2021. The loan was repaid in full on February 16, 2021.

2233 Bradley Ave - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was actively listed on the market but had received no offers. Groundfloor provided loan leniency in the form of a 90-day extension so the borrower had adequate time to sell the property. The new maturity date arrived with no change in the status of the home. To avoid foreclosure, Groundfloor granted an additional 90-day forbearance to allow more time for the property to sell, and the loan was repaid in full in February 2021.

810 Fox St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was in the process of refinancing the loan, but the refinance had not been completed by the maturity date. Groundfloor sent a Notice of Default to the borrower on February 3, 2021, and the loan was repaid in full on February 26, 2021.

1202 East 37th St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was in the process of refinancing the loan and advised that the refinance process was taking longer than expected. Groundfloor entered into workout discussions with the borrower, but no workout agreement was reached. Groundfloor sent a Notice of Default to the borrower on February 3, 2021. The loan was repaid in full on February 25, 2021.

2232 West 33rd St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was unable to sell or refinance the home by the maturity date; therefore, Groundfloor extended two rounds of forbearance. After the second term of forbearance expired, Groundfloor proceeded with foreclosing on the property. During foreclosure, the borrower’s attorney reported that the property was under contract to sell by February 23, 2021 for $299,000. The loan was repaid in full on February 26, 2021.

4001 Wingate Dr - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The borrower was unable to sell or refinance the home by the maturity date and remained unresponsive to Groundfloor's outreach post maturity. Therefore, Groundfloor proceeded with foreclosing on the property. During the foreclosure process, a local investor reached out to Groundfloor to purchase the note. Groundfloor negotiated a note sale that provided for full principal recovery and 2.2% interest repayment. The loan was repaid in full on February 26th, 2021

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We entered into workout agreements on the following loans last month:

- 310 Griggs Ave

- 2722 Transmitter Rd

- 1402 Arkansas Ave

- 13935 Warwick St

- 1255 Canyon Lake Dr

- 1527 South Spaulding Ave

- 21 Damon St

- 886 Custer Ave SE

We proceeded with foreclosure actions on the following properties last month:

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

- 16935 Lakeview Ave

- 51 Wafford St

We went under contract to sell the following properties last month:

- 16935 Lakeview Ave

- 51 Wafford St

We did not sell any real estate owned properties last month.