Welcome to our Asset Management Monthly Update series, which we began in May 2020 to give Groundfloor investors a monthly snapshot of how our asset management team is managing our outstanding loan portfolio. This report provides details on loans repaid in the previous month, as well as insight into how Groundfloor acted to manage troubled loans.

This latest installment looks at activity from June 2022. You may view activity from previous periods by clicking the links below.

May 2022

April 2022

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

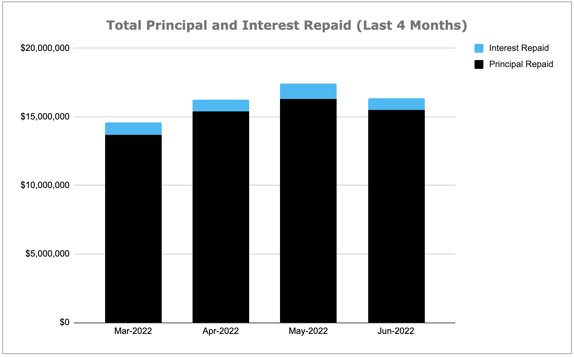

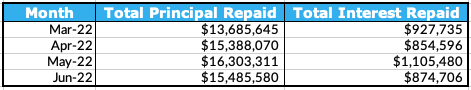

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

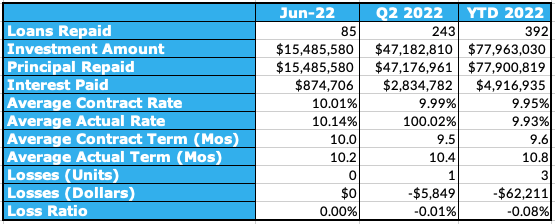

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q2 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

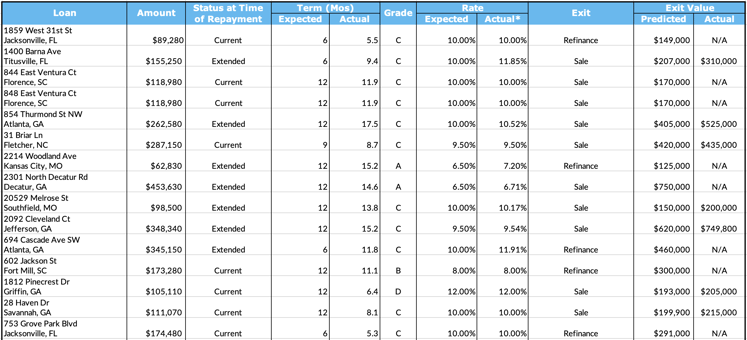

Last Month’s Repayments - June 2022

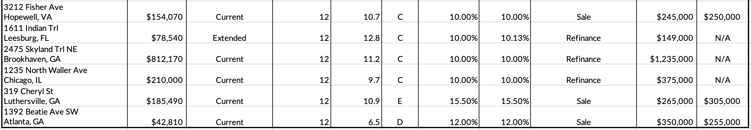

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

1859 West 31st St

1400 Barna Ave

844 East Ventura Ct

848 East Ventura Ct

854 Thurmond St NW

31 Briar Ln

2214 Woodland Ave

2301 North Decatur Rd (LRO #1, LRO #2)

20529 Melrose St

2092 Cleveland Ct (LRO #1, LRO #2, LRO #3, LRO #4)

694 Cascade Ave SW

602 Jackson St

1812 Pinecrest Dr

28 Haven Dr

753 Grove Park Blvd

4832 Windrush Ln

3673 Turret Ct NE

259 Mimosa Rd

595 Twilley Rd NW

127 Detroit St

184-186 North Hague Ave

408 Messner St

758 Charlotte Pl NW

1918 North Liberty St

2337 Tom Jones St

10113 Leisure Ln N (LRO #1, LRO #2)

5126 Delphin Ln

6153 Autlan Dr

2022 Deren Way NE (LRO #1, LRO #2)

12971 East 33rd St

132 J Y Carmichael Rd

528 East Stadium Dr

7331 East St

922-924 North Lasalle St

6380 Jess Ct (LRO #1, LRO #2)

974 Brookview Dr N

5114 Harvey Grant Rd

2919 Dignan St

1471 Hardee St

3102 Thomas St

1423 Lanvale Dr SW

2147 Trailwood Dr

4120 Grant Dr SW

1634 Dockside Dr

6985 Wycombe Rd (LRO #1, LRO #2)

439 3rd Ave

2927 Noritake Trl (LRO #1, LRO #2)

25 Village Del Lago Cir

7837 Denham Rd W

1545 Ionia St

2925 West 15th St #1

7803 Rock Rose Ln

768 Mamie Rd (LRO #1, LRO #2)

346 Mount Vernon Ave

2970 Barkway Dr

415 Washington St

4106 Kelly Ave

3458 Rockhaven Cir NE (LRO #1, LRO #2)

741 Brookline St SW

12955 Barbezieux Dr

1920 Lakewood Terr SE (LRO #1, LRO #2)

1425 McCulloh St

612 South Epperson St (LRO #1, LRO #2)

5882 Nutbush Pl

2202 Charlestown Ave

193 Mickler Dr

3140 Thomas St

4926 Dearborn St

251 Travella Blvd

31 Screven St NE (LRO #1, LRO #2)

2064 Meharry Ave

1262 Mull St

7805 Rock Rose Ln

3900 Arkansas Ave

697 Garibaldi St SW (LRO #1, LRO #2, LRO #3)

2173 West 41st St (LRO #1, LRO #2)

3240 Green St

92 Bowdoin St

8644 7th Ave

3212 Fisher Ave

1611 Indian Trl

2475 Skyland Trl NE (LRO #1, LRO #2, LRO #3, LRO #4, LRO #5, LRO #6, LRO #7)

1235 North Waller Ave

319 Cheryl St

1392 Beatie Ave SW

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 85 loans were repaid. 44 of them were current, repaying on time and in full. 37 loans were granted an extension last month and were repaid after the stated maturity date. 4 were special situation loans, the details of which are below.

3673 Turret Ct NE - Repaid Out Of Default

The project began in September 2020 and the loan had an original maturity date in September 2021. As the maturity date approached, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in January 2022. As this date approached, the borrower advised they were in the process of refinancing the loan. Refinancing continued as Groundfloor entered into more workout discussions in an effort to avoid foreclosure. As discussions continued, in May 2022, Groundfloor began foreclosure proceedings. As the project was incomplete, Groundfloor was able to negotiate a full principal repayment and avoid taking an incomplete project into REO. The loan was repaid with full principal in June 2022.

595 Twilley Rd NW - Repaid Out Of Default

The project began in October 2020 and the loan had an original maturity date in October 2021. In September 2021, the borrower advised that they were in the process of refinancing their loan. The refinance process was still ongoing as the maturity date arrived. In November 2021, Groundfloor began foreclosure proceedings. In tandem, the borrower continued to work on the refinance, and in December 2021 foreclosure proceedings were paused when a forbearance agreement was completed, giving a new maturity date in January 2022. As the new maturity date approached, Groundfloor received a payoff request good through April 1, 2022. However, the loan was still outstanding by April, so Groundfloor recommenced foreclosure proceedings, setting a foreclosure sale date for May 2022. The borrower subsequently advised that they were finalizing closing and requested a payoff good through the end of May. The refinance process was completed and the loan was repaid in full in June 2022.

758 Charlotte Pl NW - Repaid Out Of Default

The project began in August 2020 and the loan had an original maturity date in August 2021. The maturity date arrived with no repayment planned, so Groundfloor issued a Notice of Default to the borrower. After examining the work done on the property, Groundfloor decided to pursue foreclosure and commenced foreclosure proceedings in September 2021. Foreclosure proceedings were paused as a workout agreement was reached with the borrower to provide more time to complete the project as permitting delays had caused the loan to extend, giving a new maturity date in January 2022. As this new maturity date passed, Groundfloor notified the borrower that no more extensions would be given and that foreclosure would resume once the default period expired. Foreclosure proceedings began again in April 2022. In tandem, Groundfloor began an internal refinance process on the project. The internal refinance completed and the loan was repaid in full in June 2022.

1425 McCulloh St - Repaid Out Of Default

The project began in February 2020 and the loan had an original maturity date in February 2021. As the maturity date approached, Groundfloor began workout discussions with the borrower in an attempt to avoid foreclosure. Due to a state foreclosure moratorium, Groundfloor worked closely with the borrower to explore refinancing options over the next several months. In June 2021, the borrower advised that they were preparing the property for a refinance appraisal and that renovations had been delayed due to an outbreak of COVID-19. As the refinancing process continued experiencing delays, Groundfloor began foreclosure proceedings in September 2021. Per communications with the borrower, delays were occurring due to the city’s slow-moving permitting and approval process. Groundfloor granted an extension, giving a new maturity date in November 2021. Refinancing continued through the next several months as Groundfloor worked to connect the borrower to an amenable lender. Foreclosure proceedings continued in the background as well. Refinancing was finally completed and the loan was repaid in June 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

We proceeded with foreclosure actions on the following properties last month:

- 515 James P Brawley Dr NW

- 523 Joseph E. Lowery Blvd NW

- 1041 Stonewall Dr SE

- 1301 Lavista Rd NE

- 1629 Afton Ln NE

- 4848 Castle Dargan Dr

- 600 West Brown St

- 633 Lincoln Ave

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We did not go under contract to sell any properties last month.

We did not sell any real estate owned properties last month.