After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

We are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from April 2022.

You may view activity from previous periods by clicking the links below.

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

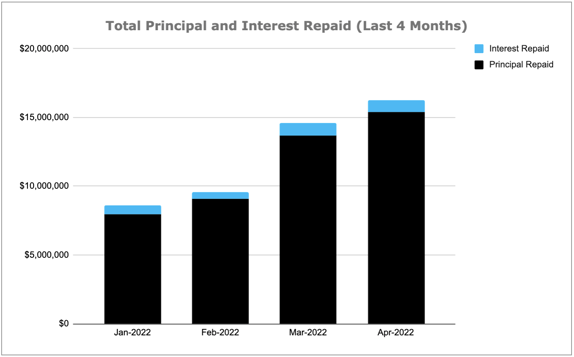

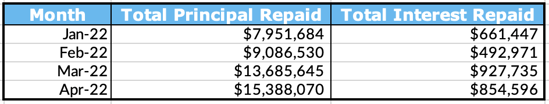

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

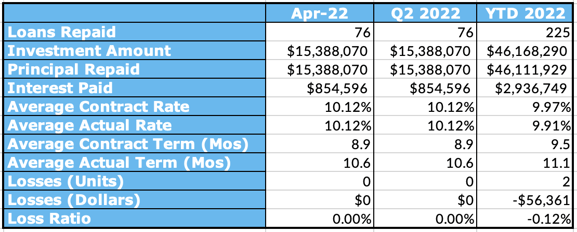

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q2 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

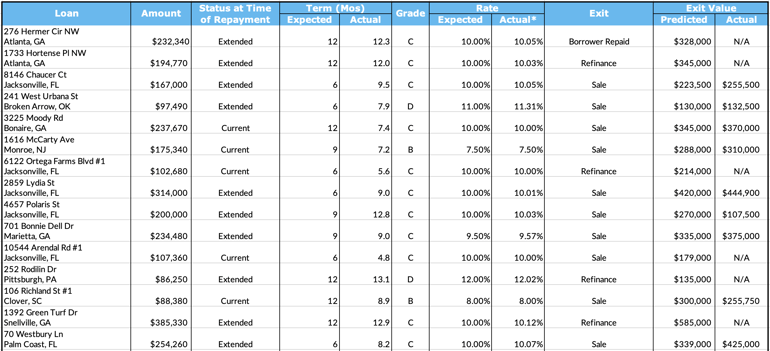

Last Month’s Repayments - April 2022

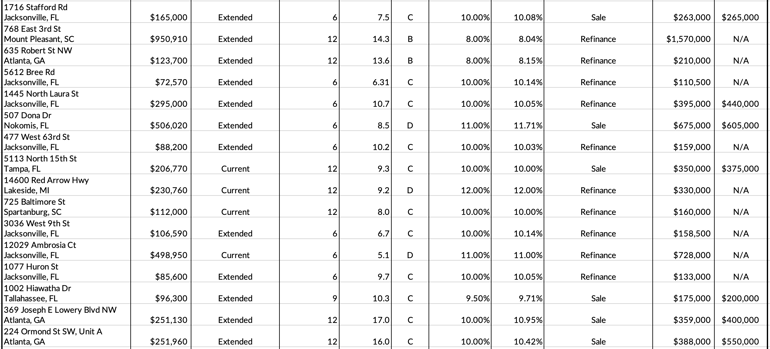

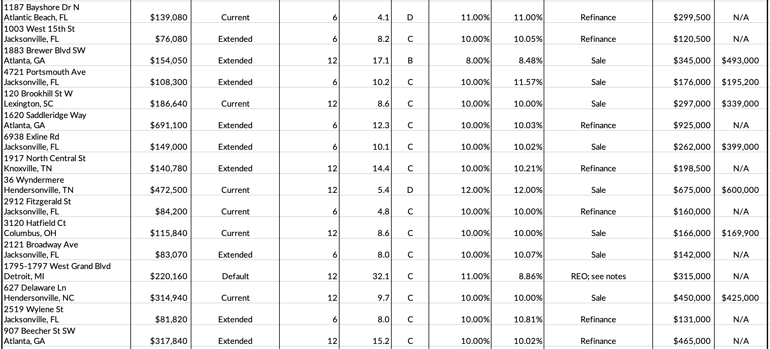

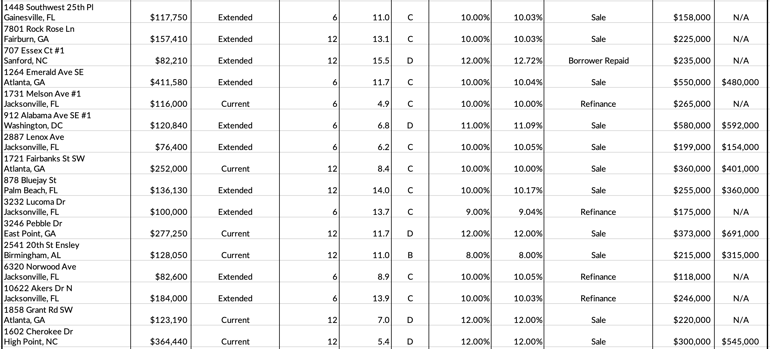

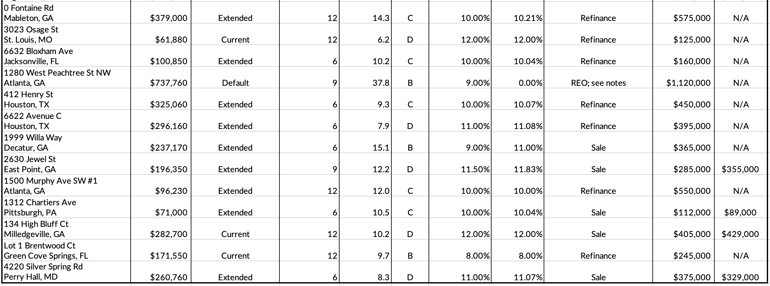

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

276 Hermer Cir NW

1733 Hortense Pl NW

8146 Chaucer Ct

241 West Urbana St

3225 Moody Rd

1616 McCarty Ave

6122 Ortega Farms Blvd #1

2859 Lydia St

4657 Polaris St

701 Bonnie Dell Dr

10544 Arendal Rd #1

252 Rodilin Dr

106 Richland St #1

1392 Green Turf Dr (LRO #1, LRO #2)

70 Westbury Ln

1716 Stafford Rd

768 East 3rd St (LRO #1, LRO #2, LRO #3)

635 Robert St NW

5612 Bree Rd

1445 North Laura St

507 Dona Dr (LRO #1, LRO #2)

477 West 63rd St

5113 North 15th St

14600 Red Arrow Hwy

725 Baltimore St

3036 West 9th St

12029 Ambrosia Ct (LRO #1, LRO #2)

1077 Huron St

1002 Hiawatha Dr

369 Joseph E Lowery Blvd NW

224 Ormond St SW, Unit A

1187 Bayshore Dr N

1003 West 15th St

1883 Brewer Blvd SW

4721 Portsmouth Ave

120 Brookhill St W

1620 Saddleridge Way (LRO #1, LRO #2, LRO #3)

6938 Exline Rd

1917 North Central St

36 Wyndermere (LRO #1, LRO #2)

2912 Fitzgerald St

3120 Hatfield Ct

2121 Broadway Ave

1795-1797 West Grand Blvd

627 Delaware Ln

2519 Wylene St

907 Beecher St SW

1448 Southwest 25th Pl

7801 Rock Rose Ln

707 Essex Ct #1

1264 Emerald Ave SE (LRO #1, LRO #2)

1731 Melson Ave #1

912 Alabama Ave SE #1

2887 Lenox Ave

1721 Fairbanks St SW

878 Bluejay St

3232 Lucoma Dr

3246 Pebble Dr (LRO #1, LRO #2, LRO #3)

2541 20th St Ensley

6320 Norwood Ave

10622 Akers Dr N

1858 Grant Rd SW

1602 Cherokee Dr (LRO #1, LRO #2)

0 Fontaine Rd

3023 Osage St

6632 Bloxham Ave

1280 West Peachtree St NW (LRO #1, LRO #2)

412 Henry St

6622 Avenue C

1999 Willa Way

1500 Murphy Ave SW #1

2630 Jewel St

1312 Chartiers Ave

134 High Bluff Ct

Lot 1 Brentwood Ct

4220 Silver Spring Rd

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 76 loans were repaid. 24 of them were current, repaying on time and in full. 52 were special situation loans, the details of which are below:

276 Hermer Cir NW - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that they were considering a refinance but instead would be paying off the loan themselves. Groundfloor provided them with a new payoff letter and the loan was repaid at the end of March 2022.

1733 Hortense Pl NW - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised they were interested in a refinance. The refinance process was completed and the loan was repaid in April 2022.

8146 Chaucer Ct - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that renovations were nearing completion. Groundfloor granted an extension to enable the borrower to complete renovations and list the property. In January 2022, the borrower advised that renovations were completed. The property went under contract in March 2022 and the loan was repaid in April 2022.

241 West Urbana St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised they were in the process of refinancing the loan. Shortly after, the borrower advised that the property was under contract, with an expected closing date in March 2022. The sale was completed and the loan was repaid in April 2022.

2859 Lydia St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that they were finishing up renovations and listing the property on the market. The property went under contract in March 2022. The loan was repaid in April 2022.

4657 Polaris St - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was expected to close in January 2022. However, the contract fell through and the property went back on the market. The borrower reduced the listing price to attract interest, and in March 2022 the property again went under contract. The sale was successful and the loan was repaid in April 2022.

701 Bonnie Dell Dr - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that the property was actively listed on the market. The property was sold and the loan was repaid in April 2022.

252 Rodilin Dr - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised they were looking into a refinance. The loan was repaid in April 2022.

1392 Green Turf Dr - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The loan was repaid in April 2022.

70 Westbury Ln - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in July 2022. The property was sold and the loan was repaid in April 2022.

1716 Stafford Rd - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that the property had been under contract but the contract had fallen through. The property was back on the market in March 2022. The loan was repaid via sale in April 2022.

768 East 3rd St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in January 2022. As the maturity date approached the borrower advised that renovations remained ongoing. Groundfloor reached a workout settlement with the borrower, giving a new maturity date in April 2022. The loan was subsequently repaid under the terms of this workout agreement.

635 Robert St NW - Repaid Via Extension

The project began in March 2022 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that renovations remained ongoing. A workout settlement was agreed to, giving a new maturity date in May 2022. The loan was subsequently repaid under the terms of that workout agreement.

5612 Bree Rd - Repaid Via Extension

The project began in October 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that repayment via a refinance would occur within the next few weeks. The loan was subsequently repaid in April 2022.

1445 North Laura St - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing their loan. Groundfloor granted a forbearance agreement on the loan to allow the refinance process to complete. In February 2022, the borrower requested a payoff letter good through March. The loan was subsequently repaid in April 2022.

507 Dona Dr - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. As that maturity date approached, the borrower advised they were awaiting the final valuation from their appraiser. The loan was subsequently repaid in April 2022.

477 West 63rd St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing their loan. The refinance process took longer than expected, but finally went through in late March 2022. The loan was repaid in April 2022.

3036 West 9th St - Repaid Via Extension

The project began in October 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower requested a payoff letter good through March. The loan was subsequently repaid in April 2022.

1077 Huron St - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. Construction and material delays required the loan to be extended. A garage was transitioned into an additional bedroom and bathroom in the house. The project was completed and repaid in April 2022.

1002 Hiawatha Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that the property was currently under contract. The loan was subsequently repaid in April 2022.

369 Joseph E Lowery Blvd NW - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor undertook workout discussions with the borrower in order to avoid foreclosure. A forbearance agreement was reached, giving a new maturity date in February 2022. The borrower subsequently advised that the property had gone under contract, and the loan was repaid at the beginning of April 2022.

224 Ormond St SW, Unit A - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The borrower subsequently advised that the property had been actively listed on the market. Groundfloor agreed to a new workout settlement to give the property time to sell, giving a new maturity date in May 2022. The property was sold and the loan was repaid in April 2022.

1003 West 15th St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor provided the borrower with a payoff letter good through March 2022. The loan was subsequently repaid in April 2022.

1883 Brewer Blvd SW - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in May 2022. In February 2022, the borrower advised that the property was being listed on the market. The property was sold and the loan was repaid in April 2022.

1620 Saddleridge Way - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor granted an extension for 90 days. In January 2022, the borrower stated they expected to close in February. This was delayed for several weeks. The loan was finally repaid in April 2022.

6938 Exline Rd - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor granted loan leniency in the form of an extension. The property was sold and the loan was repaid in April 2022.

1917 North Central St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process took a few weeks to go through, and the loan was repaid in April 2022.

2121 Broadway Ave - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor granted loan leniency in the form of an extension. The property was sold and the loan was repaid in April 2022.

1795-1797 West Grand Blvd - Repaid Via REO

The project began in August 2019 and the loan had an original maturity date in August 2020. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in November 2020. The borrower continued to make progress on the property; however, as the project was still not completed by that maturity date, Groundfloor sent a Notice of Default to the borrower in November 2020. Foreclosure proceedings could not begin, however, because the state had a temporary foreclosure moratorium in place due to COVID-19. Groundfloor continued working with the borrower to get the project completed and the loan paid off during the moratorium. The borrower advised that they were continuing to work on the project through the first half of 2021 in an effort to obtain a good refinance deal. In July 2021, the borrower reported that they were in the process of refinancing the Groundfloor loan and requested an extension. However, an extension was not granted and in November 2021 Groundfloor was able to begin foreclosure proceedings. The foreclosure sale was scheduled for March 2022. The loan was repaid in April 2022.

2519 Wylene St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor agreed to a 30-day extension. The loan was subsequently repaid in April 2022.

907 Beecher St SW - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that they had experienced delays due to permitting; Groundfloor then began workout discussions with the borrower. The borrower subsequently advised that they were in the process of refinancing the loan. The refinance completed and the loan was repaid in April 2022.

1448 Southwest 25th Pl - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in February 2022. The borrower subsequently advised that the property was being actively listed on the market. The loan was repaid in April 2022.

707 Essex Ct #1 - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in April 2022. The loan was subsequently repaid in April 2022.

1264 Emerald Ave SE - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor granted loan leniency in the form of several extensions. The property went under contract and sold, and the loan was repaid in April 2022.

912 Alabama Ave SE - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that the property was under contract. The sale was completed and the loan was repaid in April 2022.

2887 Lenox Ave - Repaid Via Extension

The project began in October 2021 and the loan had an original maturity date in April 2022. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in March 2022. The closing was delayed. The sale was completed and the loan was repaid in April 2022.

878 Bluejay St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor began workout discussions with the borrower, eventually agreeing to an extension to the end of April 2022. The loan was repaid in April 2022.

3232 Lucoma Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that they had run into multiple delays due to permitting issues and that they would be needing an extension. Groundfloor began workout discussions with the borrower. Workout discussions continued while the borrower also continued work on the property, eventually advising that closing was anticipated in March 2022. The loan was repaid in April 2022.

6320 Norwood Ave - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process took multiple weeks. The loan was repaid in April 2022.

10622 Akers Dr N - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in August 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan, with an expected closing date in October 2021. However, the refinance did not go through, so Groundfloor sent a Notice of Default. The borrower subsequently advised they were again in the process of refinancing the loan. In March 2022, the borrower advised that they had obtained the funds needed to repay the loan. The loan was repaid in April 2022.

0 Fontaine Rd - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in February 2022. As the maturity date arrived the borrower advised that they were in the process of refinancing the loan. The refinance process completed and the loan was repaid in April 2022.

6632 Bloxham Ave - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. Ongoing construction and material delays led to an extension period for the project. Work was completed and the loan was repaid in April 2022.

1280 West Peachtree St NW - Repaid Via REO

The project began in March 2019 and the loan had an original maturity date in December 2019. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process was delayed for several weeks. In January 2020, the loan still had not been refinanced, so Groundfloor engaged counsel to begin foreclosure proceedings. The foreclosure sale date was scheduled for May 2020. Eviction and foreclosure proceedings remained ongoing through the next few months. In November 2020, the borrower’s attorney requested a settlement; however, Groundfloor did not reach a settlement agreement with the borrower, and proceeded with eviction and foreclosure actions on the borrower. Legal actions remained ongoing and made progress through the court system through much of 2021. In January 2022, a mediation was scheduled with the borrower, which was ultimately successful. Groundfloor received the payoff funds and repaid the loan with a full principal recovery in April 2022.

412 Henry St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in July 2022. The loan was subsequently repaid in April 2022.

6622 Avenue C - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in May 2022. The loan was subsequently repaid in April 2022.

1999 Willa Way - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in July 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in October 2021. As that maturity date approached, Groundfloor reached a new workout settlement, giving a new maturity date in January 2022. The borrower subsequently advised that the property was actively listed on the market. The property subsequently went under contract and the loan was repaid in April 2022.

1500 Murphy Ave SW - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in April 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The loan was repaid in April 2022.

2630 Jewel St - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in April 2022. The property was sold and the loan was repaid in April 2022.

1312 Chartiers Ave - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. Groundfloor continued to track performance due to delays in construction. The borrower remained in communication and the property went under contract in March 2022. The loan was repaid in April 2022.

4220 Silver Spring Rd - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in August 2022. The loan was subsequently repaid in April 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 566 Coldstream Ct NW

- 132 J Y Carmichael Rd

- 1400 Barna Ave

- 31 Screven St NE

- 2301 N Decatur Rd

- 626 Hunter St

- 584 Kelton Ave

- 450 West Beidler Rd

- 1995 Shalimar Dr NE

- 20529 Melrose St

- 2091 Barberrie Ln

We proceeded with foreclosure actions on the following properties last month:

- 533 James P Brawley Dr NW

- 3673 Turret Ct NE

- 1711 Floyd Rd

- 4720 Wellborn Dr

- 2752 Lancaster Dr

- 741 Brookline St SW

- 487 Ridgecrest Dr

- 2304 Herring Rd SW

- 3458 Rockhaven Cir NE

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We did not go under contract to sell any properties last month.

We sold the following real estate owned properties last month: