After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide GROUNDFLOOR investors with information about our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As 2021 continues, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from June 2021.

You may view activity from previous periods by clicking the links below.

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

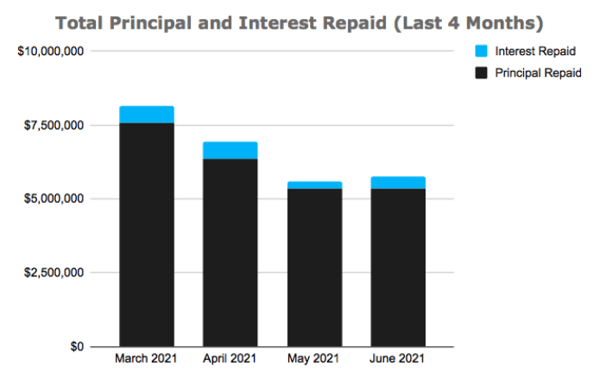

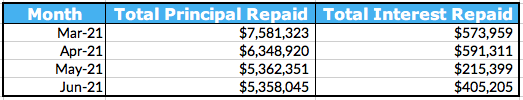

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

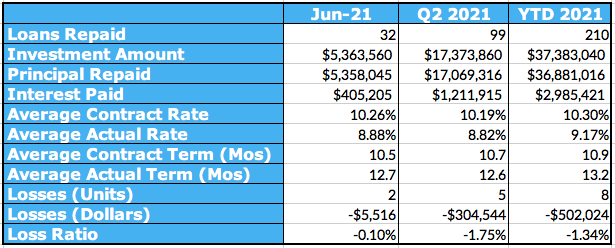

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q2 2020, and loans repaid year-to-date in 2021.

It’s important to underscore that this table showcases the performance of loans that were repaid during the delineated periods, not the performance of loans originated during these timeframes.

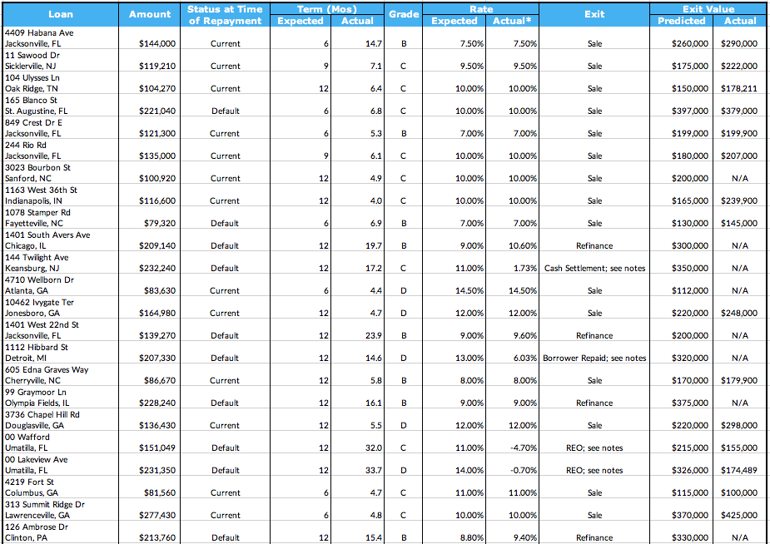

Last Month’s Repayments - June 2021

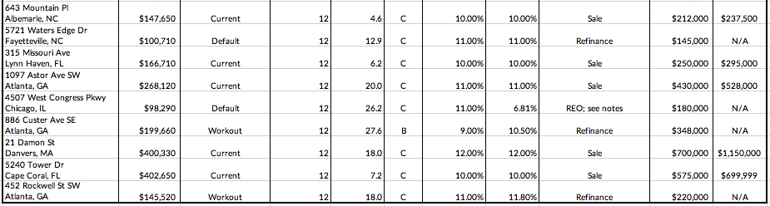

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

**NOTE: The borrower did not disclose the source of repayment proceeds.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Default - loan was resolved while in default

Workout - a workout plan was put into effect and the loan was resolved under the terms of the workout agreement

REO - GROUNDFLOOR assumed title to the property (either through foreclosure or deed in lieu) and sold the property.

Links to the loan detail pages for the above loans:

4409 Habana Ave

11 Sawood Dr

104 Ulysses Ln

165 Blanco St

849 Crest Dr E

244 Rio Rd

3023 Bourbon St

1163 West 36th St

1078 Stamper Rd

1401 South Avers Ave

144 Twilight Ave

4710 Wellborn Dr

10462 Ivygate Ter

1401 West 22nd St

1112 Hibbard St

605 Edna Graves Way

99 Graymoor Ln

3736 Chapel Hill Rd

00 Wafford (LRO #1, LRO #2, LRO #3)

00 Lakeview Ave (LRO #1, LRO #2)

4219 Fort St

313 Summit Ridge Dr

126 Ambrose Dr

643 Mountain Pl (LRO #1, LRO #2)

5721 Waters Edge Dr

315 Missouri Ave

1097 Astor Ave SW (LRO #1, LRO #2)

4507 West Congress Pkwy

886 Custer Ave SE

21 Damon St (LRO #1, LRO #2)

5240 Tower Dr

452 Rockwell St SW

10246 Elmhurst Dr

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

165 Blanco St - Repaid Out Of Default

The project was begun in November 2020 and the loan had an original maturity date in May 2021. The project was completed and the property was listed on the market in February 2021. The property remained on the market through May 2021, at which time the borrower advised that they were in the process of changing realtors. GROUNDFLOOR sent a Notice of Default to the borrower as the maturity date passed. Soon after, the loan was repaid in June 2021.

1078 Stamper Rd - Repaid Out Of Default

The project was begun in November 2020 and the loan had an original maturity date in May 2021. Renovations proceeded as scheduled, but as the maturity date approached, the borrower had not paid off the loan. GROUNDFLOOR sent a Notice of Default to the borrower in May 2021. In June 2021, the loan was repaid.

1401 South Avers Ave - Repaid Out Of Default

The project was begun in October 2019 and the loan had an original maturity date in October 2020. In August 2020, the borrower advised that renovations were nearing completion and that the property was scheduled to be rented out by the maturity date. However, the maturity date passed with no repayment, so in November 2020 GROUNDFLOOR sent the borrower a Notice of Default. In December 2020, the borrower advised that they were in the process of refinancing the loan. In January 2021, GROUNDFLOOR received a payoff request; however, the borrower subsequently advised that the refinance fell through. GROUNDFLOOR connected the borrower to other lenders in March 2021. The borrower then restarted the refinance process, and the loan was repaid in June 2021.

144 Twilight Ave - Repaid Via Cash Settlement

The project was begun in January 2020 and the loan had an original maturity date in January 2021. The borrower advised that they experienced delays in the renovation process due to COVID-19. The maturity date passed with no repayment, so in February 2021 GROUNDFLOOR sent a Notice of Default to the borrower. In March 2021, the borrower advised that they were in the process of refinancing the loan. In April 2021, the borrower advised that the property was under contract; however, it did not go through. To avoid foreclosure proceedings, GROUNDFLOOR was able to negotiate a cash settlement that provided full principal recovery but a partial interest payoff. GROUNDFLOOR accepted this settlement and the loan was repaid in June 2021.

1401 West 22nd St - Repaid Out Of Default

The project was begun in June 2019 and the loan had an original maturity date in June 2020. As the maturity date approached, the borrower advised that they were in the process of renting out the property, but were experiencing delays due to COVID-19. GROUNDFLOOR provided loan leniency in the form of a 90-day extension, giving a new maturity date in September 2020. The borrower advised that they were in the process of securing tenants; however, the maturity date passed with no repayment, so GROUNDFLOOR sent a Notice of Default to the borrower. In March 2021, the borrower advised that they were in the process of refinancing the loan. The refinance process continued through April and May, and the loan was repaid in June 2021.

1112 Hibbard St - Repaid Out Of Default

The project was begun in March 2020 and the loan had an original maturity date in March 2021. As the maturity date approached with no repayment, GROUNDFLOOR sent a Notice of Default to the borrower. The property had outstanding property taxes that needed to be settled. GROUNDFLOOR then learned that the borrower had experienced some severe health crises, so GROUNDFLOOR agreed to a reduced payoff amount. The loan was repaid with partial interest in June 2021.

99 Graymoor Ln - Repaid Out Of Default

The project was begun in February 2020 and the loan had an original maturity date in February 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. However, the maturity date passed with no repayment, so GROUNDFLOOR sent a Notice of Default to the borrower in February 2021. The borrower advised that they were still planning to refinance the loan. The refinance was still ongoing through March and April, and in May 2021 GROUNDFLOOR was in communication with the refinance lender to expedite the process. The loan was repaid in June 2021.

00 Wafford - Repaid Via REO

The project was begun in October 2018 and the loan had an original maturity date in October 2019. In June 2019, the borrower advised that they were in the process of refinancing the loan. In August 2019, the refinance lender advised that the closing was delayed. In September 2019, GROUNDFLOOR met with the borrower and conducted a site visit to determine the status of the project. GROUNDFLOOR and the borrower agreed to a global resolution on the property, which included a full repayment by October 2019. However, the borrower defaulted on the agreement, and GROUNDFLOOR began foreclosure proceedings. Foreclosure proceedings remained ongoing through the end of 2019, and in April 2020 court proceedings were delayed due to COVID-19. The court hearing date was delayed multiple months due to court closures due to the pandemic. A new hearing was scheduled in November 2020. In February 2021, GROUNDFLOOR prepared the property for sale and began marketing it. In March 2021, GROUNDFLOOR accepted a purchase offer; however, the sale did not go through due to the buyer’s health concerns. In June 2021, GROUNDFLOOR accepted another purchase offer, and the loan was repaid with a principal loss.

The property was sold for $155,000. After adding the remaining escrow balance and subtracting legal fees and asset management costs, the net recovery on this property was $133,192.36, which represents an 88.2% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

00 Lakeview Ave - Repaid Via REO

The project was begun in August 2018 and the loan had an original maturity date in August 2019. As the maturity date approached with no repayment, GROUNDFLOOR issued a Notice of Default. In September 2019, GROUNDFLOOR met with the borrower and conducted a site visit to determine the status of the project. GROUNDFLOOR and the borrower agreed to a global resolution on the property, which included a full repayment by December 2019 and proof of permits and tax payments by October 2019. However, the borrower defaulted on the agreement, and GROUNDFLOOR began foreclosure proceedings in October 2019. Foreclosure proceedings continued through the end of 2019 and into 2020. Court proceedings were delayed due to COVID-19. Foreclosure proceedings continued through the end of 2020 and into 2021. In March 2021, GROUNDFLOOR accepted a purchase offer; however, the sale did not go through due to the buyer’s health concerns. In June 2021, GROUNDFLOOR accepted another purchase offer, and the loan was repaid with a principal loss.

The property was sold for $174,489.49. After adding the remaining escrow balance and subtracting legal fees and asset management costs, the net recovery on this property was $155,373.90, which represents a 67.2% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

126 Ambrose Dr - Repaid Out Of Default

The project was begun in March 2020 and the loan had an original maturity date in March 2021. In February 2021, the borrower defaulted on a non-monetary term of the loan’s contract; as such, GROUNDFLOOR sent a Notice of Default to the borrower. In March 2021, the borrower advised that the property was under contract; however, the contract fell through, and at the end of March 2021 GROUNDFLOOR undertook workout discussions with the borrower to avoid foreclosure. A workout agreement was reached in April 2021, giving a new maturity date in May 2021. The borrower subsequently advised that they were in the process of refinancing the GROUNDFLOOR loan, and the loan was repaid in June 2021.

5721 Waters Edge Dr - Repaid Out Of Default

The project was begun in May 2020 and the loan had an original maturity date in May 2021. Renovations were progressing as planned, but the maturity date arrived with no repayment, so GROUNDFLOOR sent a Notice of Default to the borrower. In June 2021, the borrower advised that they were in the process of refinancing the GROUNDFLOOR loan. The loan was repaid in June 2021.

4507 West Congress Pkwy - Repaid Via REO

The project was begun in April 2019 and the loan had an original maturity date in April 2020. The maturity date arrived with no repayment, so GROUNDFLOOR sent a Notice of Default to the borrower in April 2020. The default period expired with no plan for repayment, so in May 2020 GROUNDFLOOR engaged counsel to proceed with foreclosure. Court proceedings were delayed due to COVID-19, and the foreclosure process continued throughout 2020 and into 2021. In May 2021, GROUNDFLOOR received a payoff request from the borrower’s attorney, and in June 2021 GROUNDFLOOR’s attorney advised that the file was going to court to obtain a decision on judgment. The loan was repaid in June 2021.

886 Custer Ave SE - Repaid Via Workout Agreement

The project was begun in March 2019 and the loan had an original maturity date in March 2020. In December 2019, the borrower advised that they were in the process of refinancing the loan; however, the refinance did not go through. The borrower continued pursuing a refinance. In May 2021, GROUNDFLOOR agreed to an extension, giving a new maturity date in November 2020. As the new maturity date approached, GROUNDFLOOR agreed to a second extension at an increased interest rate, giving a new maturity date in February 2021. As 2021 continued, the borrower continued to make progress on the project, which GROUNDFLOOR confirmed. As the maturity date passed, GROUNDFLOOR connected the borrower with refinance lenders to expedite an exit. The borrower began the refinance process, and in June 2021 the loan was repaid.

452 Rockwell St SW - Repaid Via Workout Agreement

The project was begun in December 2019 and the loan had an original maturity date in December 2020. The borrower advised that there were several delays in the renovation process due to COVID-19, and renovations were still ongoing as the maturity date arrived. GROUNDFLOOR agreed to an extension with the borrower, giving a new maturity date in March 2021. The borrower advised that they were in the process of refinancing the GROUNDFLOOR loan, and the loan was repaid in June 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We entered into workout agreements on the following loans last month:

We did not proceed with any foreclosure actions last month.

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

- 4417 Dolly Ridge Rd

- 1122 Oak Knoll Terr SE

- 36 Bowen Ave SE

- 929 East Ramseur St

- 4 Tallant Rd

- 1208 11th St

- 2531 29th Pl

We did not go under contract to sell any properties last month.

We sold the following real estate owned properties last month: