As the financial and real estate markets continue to experience upheaval due to the COVID-19 pandemic, we understand that some Groundfloor investors may become more concerned than usual with the status of their investments.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As we move into a new year, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from March 2021.

You may view activity from previous periods by clicking the links below.

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

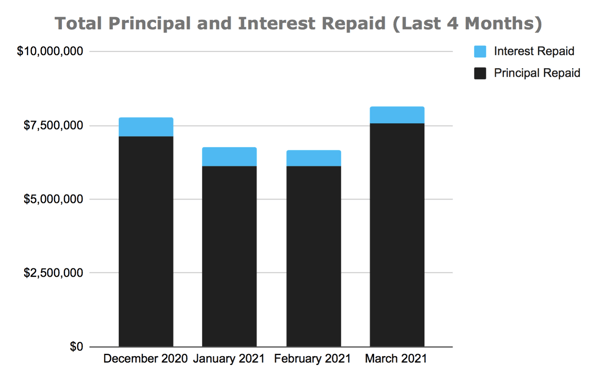

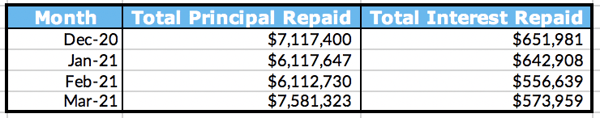

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

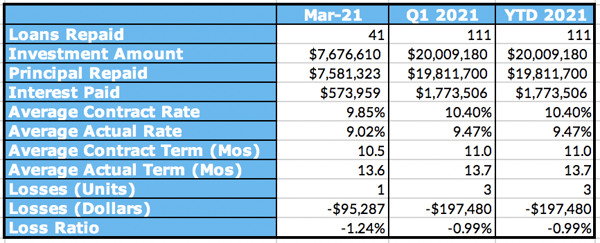

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q1 2020, and loans repaid year-to-date in 2021.

It’s important to underscore that this table showcases the performance of loans that were repaid during the delineated periods, not the performance of loans originated during these timeframes.

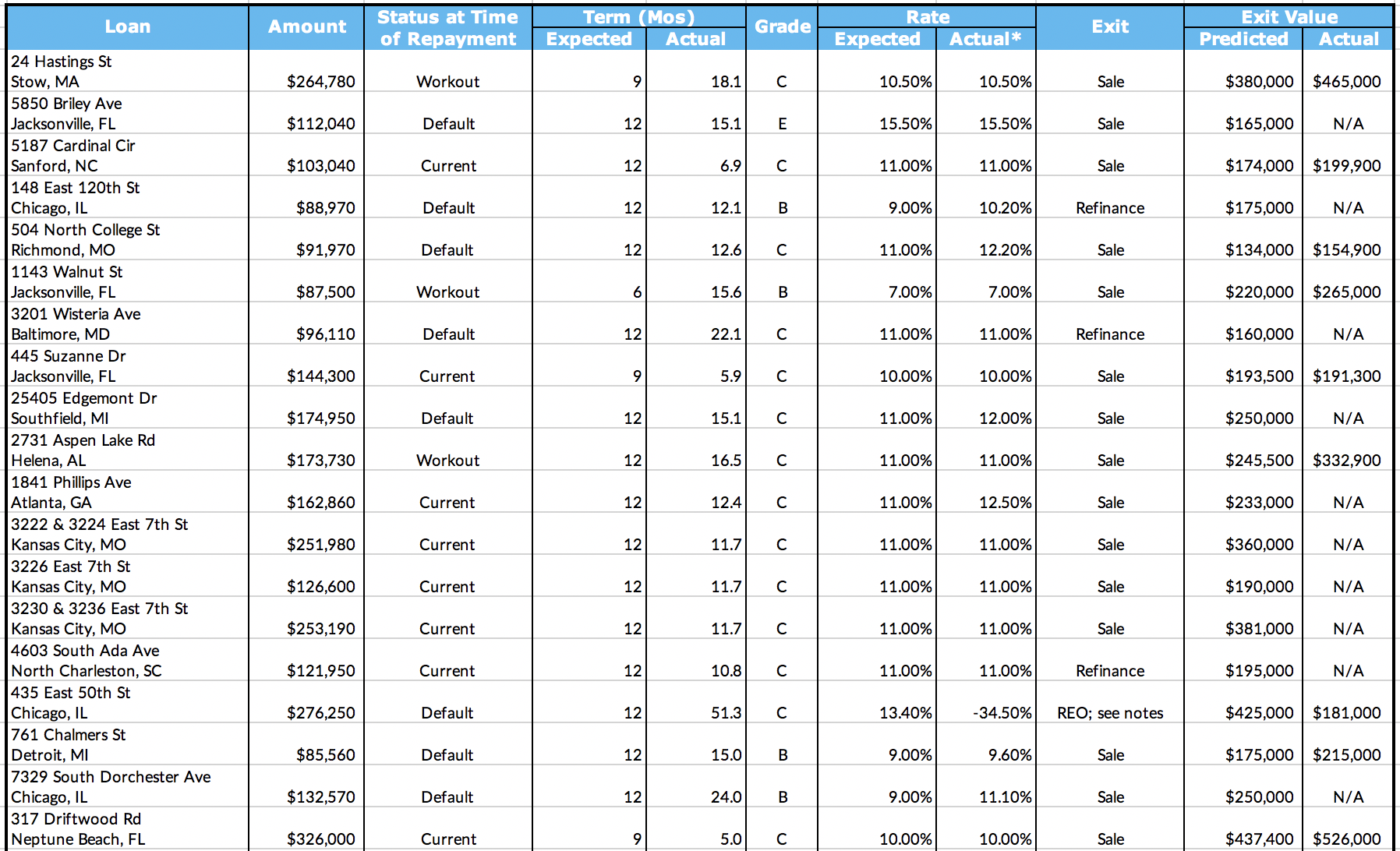

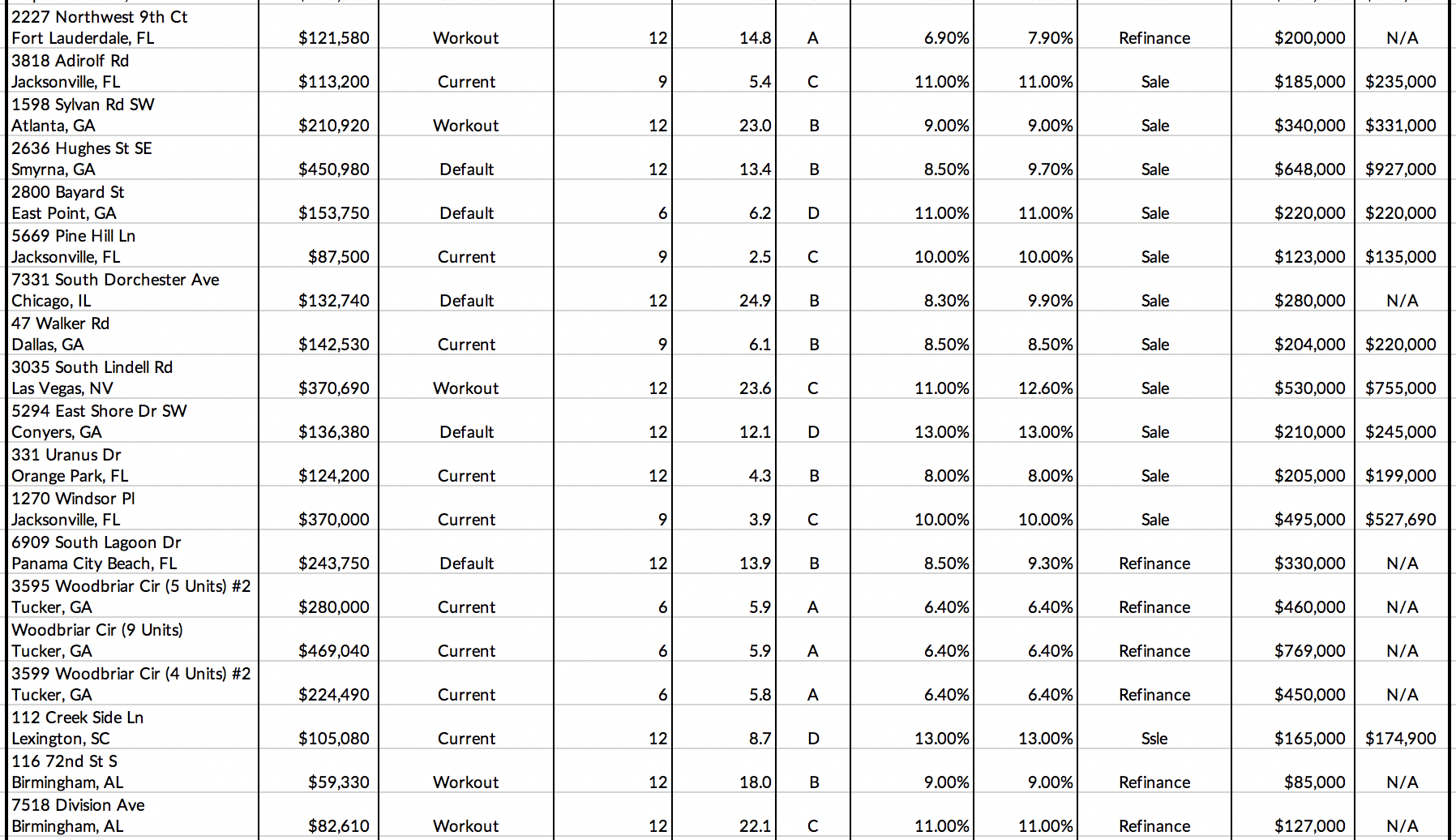

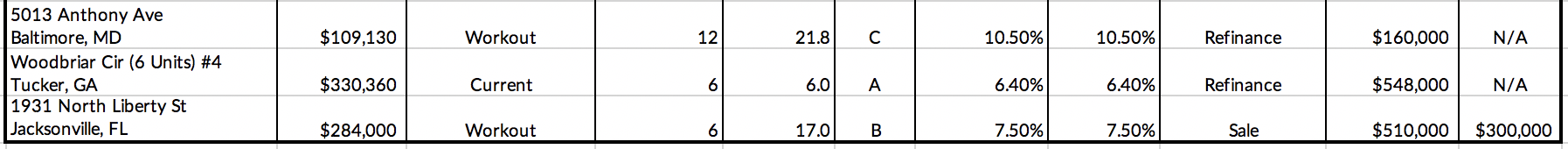

Last Month’s Repayments - March 2021

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

**NOTE: The borrower did not disclose the source of repayment proceeds.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Default - loan was resolved while in default

Workout - a workout plan was put into effect and the loan was resolved under the terms of the workout agreement

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property.

Links to the loan detail pages for the above loans:

24 Hastings St (LRO #1 and LRO #2)

5850 Briley Ave

5187 Cardinal Cir

148 East 120th St

504 North College St

1143 Walnut St

3201 Wisteria Ave

445 Suzanne Dr

25405 Edgemont Dr

2731 Aspen Lake Rd

1841 Phillips Ave

3222 & 3224 East 7th St

3226 East 7th St

3230 & 3236 East 7th St

4603 South Ada Ave

435 East 50th St

761 Chalmers St

7329 South Dorchester Ave

317 Driftwood Rd

2227 Northwest 9th Ct

3818 Adirolf Rd

1598 Sylvan Rd SW

2636 Hughes St SE (LRO #1, LRO #2, LRO #3, LRO #4, LRO #5)

2800 Bayard St

5669 Pine Hill Ln

7331 South Dorchester Ave

47 Walker Rd

3035 South Lindell Rd

3834 Galicia Rd

5294 East Shore Dr SW

331 Uranus Dr

1270 Windsor Pl

6909 South Lagoon Dr

3595 Woodbriar Cir (5 Units) #2

Woodbriar Cir (9 Units)

3599 Woodbriar Cir (4 Units) #2

112 Creek Side Ln

116 72nd St S

7518 Division Ave

5013 Anthony Ave

Woodbriar Cir (6 Units) #4

1931 North Liberty St

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 41 loans were repaid. 18 of them were current, repaying on time and in full. 23 were special situation loans, the details of which are below.

24 Hastings St - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in late 2019 and the original maturity date was May 29, 2020. The borrower experienced multiple delays, including permitting and construction, due to COVID-19. Groundfloor provided a 90-day extension due to the pandemic, with a new maturity date of August 27, 2020. The project was progressing well, but the pandemic still caused delays. Groundfloor provided additional loan leniency in the form of another 90-day extension, with a new maturity date of November 25, 2020. The borrower advised that the property was under contract, with an expected closing date of December 12, 2020; however, the buyer backed out due to funding. The property then went under contract again, with an expected closing date on February 5, 2021. After a slight delay that pushed the closing date back several days, the loan was repaid in full on March 1, 2021.

5850 Briley Ave - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in late 2019 and the original maturity date was in December 2020. Due to the pandemic, work on the project was delayed. As the maturity date arrived, Groundfloor entered into workout discussions with the borrower to avoid foreclosure, but no agreement was reached. However, Groundfloor received a payoff request at the end of January 2021, and the loan was repaid in full on March 1, 2021.

148 East 120th St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in February 2020 and the original maturity date was in February 2021. The borrower experienced delays due to COVID-19. Work on the project was progressing well, and Groundfloor initially received a payoff request before the loan was to reach maturity. However, repayment did not occur. The borrower then advised they were in the process of refinancing the loan. The refinance was not completed before the maturity date, so Groundfloor sent a Notice of Default to the borrower. The loan was then repaid in full on March 3, 2021.

504 North College St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in February 2020 and the original maturity date was in February 2021. The borrower experienced multiple delays due to COVID-19. The borrower advised that renovations were completed in January 2021 and the property was slated to be listed on the market shortly thereafter. The property then went under contract, with an expected closing date of February 18, 2021. The maturity date arrived with no repayment of the loan, so Groundfloor sent a Notice of Default to the borrower. The loan was then repaid in full on March 3, 2021.

1143 Walnut St - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in November 2019 and the original maturity date was in May 2020. Because the property was located in a historic district, the borrower had to wait on approval from the local preservation/homeowner’s association regarding the exterior paint and appearance of the home, which delayed the completion of the property. The borrower initially elected to refinance the loan to pay it off by the maturity date, but then decided to list the property instead. Approval from the preservation association took longer than expected, so Groundfloor provided loan leniency in the form of a 90-day extension, with a new maturity date in October 2020. The property was completed and listed on the market, and received several offers. The borrower entered into negotiations with the potential buyers to obtain the best offer, and the property was scheduled to close in December 2020. Closing was delayed by several months. The loan was repaid in full on March 3, 2021.

3201 Wisteria Ave - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in May 2019 and the original maturity date was in April 2020. The property was completed and listed on the market in February 2020; the property remained actively listed as the maturity date approached. Due to the onset of the coronavirus, Groundfloor provided loan leniency in the form of a 90-day extension, with a new maturity date of July 29, 2020. The property went under contract, with an expected close date of August 7, 2020; however, the property ultimately failed to sell. A Notice of Default was then sent to the borrower. Groundfloor entered into workout discussions with the borrower to avoid foreclosure; the borrower then advised they were in the process of refinancing the loan. The refinance was successful, and the loan was repaid in full on March 3, 2021.

25405 Edgemont Dr - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in November 2019 and the original maturity date was in December 2020. The borrower advised that the project was completed in early December 2020 and they were in the process of negotiating with a potential buyer. However, the maturity date arrived without repayment of the loan, so Groundfloor sent a Notice of Default to the borrower. The borrower then advised that the property was under contract and was expected to close in March 2021. The loan was repaid in full on March 10, 2021.

2731 Aspen Lake Rd - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in October 2019 and the original maturity date was in October 2020. The borrower advised that after some delays due to COVID-19, the project was completed and actively listed on the market, and went under contract in November 2020. The property did not sell, so Groundfloor entered into a workout agreement with the borrower, with a new loan maturity date in late January 2021. The property went under contract and sold, and the loan was repaid on March 10, 2021.

435 East 50th St - Repaid Via REO

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in December 2016 and the original maturity date was in December 2017. The borrower initially advised that he was pursuing a refinance in order to pay off the loan, but after he failed to provide a commitment letter from the refinance lender, Groundfloor issued a Notice of Default. The default period expired without repayment of the loan, so Groundfloor moved forward with foreclosure. As Illinois is a judicial foreclosure state, the foreclosure proceedings wound their way through the state court system through 2018 and 2019. The foreclosure proceedings experienced multiple delays and extensions in the court system. In December 2019, the borrower indicated he was open to negotiating with Groundfloor, and in January 2020 Groundfloor's Asset Management team began exploring alternative settlement options. Negotiations with the borrower continued through much of the year and experienced delays due to COVID-19. In September 2020, Groundfloor agreed to a short sale of the property to avoid continuing delays in the foreclosure process. The borrower requested additional time to close, moving the closing date to late November 2020. Negotiations for the short sale of the property continued, and the property was eventually sold at a principal loss in March 2021.

The property was sold for $181,000. After adding the remaining escrow balance and subtracting legal fees and asset management costs, the net recovery on this property was $180,963.09, which represents a 65.5% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

761 Chalmers St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in December 2019 and the original maturity date was in December 2020. The project was listed on the market in December 2020. Groundfloor entered into a workout agreement with the borrower to give the property more time on the market to sell, with a new maturity date in February 2021. The new maturity date passed without repayment of the loan, so Groundfloor sent a Notice of Default to the borrower. The property then went under contract with an expected closing date in March 2021, and the loan was repaid on March 11, 2021.

7329 South Dorchester Ave - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in March 2019 and the original maturity date was in March 2020. Despite some aspects of construction that took longer than anticipated, the project was progressing as planned, and in December 2019 the borrower advised that he was continuing to talk with potential buyers. Shortly thereafter, the property went under contract and Groundfloor received a payoff request for March 2020. However, the maturity date arrived with no repayment of the loan, so Groundfloor sent a Notice of Default to the borrower. The borrower advised that due to COVID-19, the courts were closed, and they would not be able to close on the sale until May 2020. In May 2020, the borrower advised that the courts were still closed, but the buyer remained in place and the sale would close when the courts reopened. Unfortunately, due to the pandemic and the ongoing delays, the sale did not complete, and the property was relisted on the market. Groundfloor sent another Notice of Default to the borrower in October 2020, and shortly thereafter began foreclosure proceedings. In January 2021, the borrower advised that they had another contract in place, with a closing scheduled in March 2021. The loan was repaid on March 11, 2021.

2227 Northwest 9th Ct - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in December 2019 and the original maturity date was in December 2020. The borrower advised that there were delays in construction and in obtaining permitting due to COVID-19. Groundfloor provided loan leniency in the form of a 90-day extension, giving a new maturity date in March 2021. The borrower successfully refinanced the loan, and the loan was repaid on March 16, 2021.

1598 Sylvan Rd SW - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in April 2019 and the original maturity date was in April 2020. Renovations were progressing as planned and the borrower advised that he planned to list the property on the market in March 2020. Due to the onset of the coronavirus, Groundfloor provided loan leniency in the form of a 90-day extension, giving a new maturity date in July 2020. The property remained on the market with no offers, and when the maturity date arrived with no repayment, Groundfloor issued a Notice of Default. The borrower advised that he had hired a new brokerage to stage and relist the property, so Groundfloor provided loan leniency in the form of another 90-day extension, giving a new maturity date in October 2020. The property was getting some interest on the market, but unfortunately in late October a tree fell on the property, causing damage. The borrower was working to get the tree removed and the property repaired in December 2020, so Groundfloor provided an additional loan leniency in the form of a 90-day extension, giving a new maturity date in March 2021. The property then went under contract, and the loan was repaid on March 16, 2021.

2636 Hughes St SE - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in February 2020 and the original maturity date was in February 2021. The project was completed and listed on the market by the maturity date, but had not yet sold. The property then went under contract, with an expected closing date of March 12, 2021. The loan was repaid on March 16, 2021.

2800 Bayard St - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in September 2020 and the original maturity date was on March 7, 2021. The property was completed in November 2020 and was actively listed on the market in December 2020. In February 2021, the borrower advised that the property was under contract, with an expected closing date in March 2021; however, the loan did not repay before the maturity date, so Groundfloor sent a Notice of Default to the borrower. The loan was repaid on March 16, 2021.

7331 South Dorchester Ave - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in February 2019 and the original maturity date was in February 2020. The property was completed and listed on the market in November 2019. The borrower continued to talk with potential buyers throughout the next couple of months with no luck. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. The property then went under contract, with an expected closing date in March 2020. However, due to the onset of COVID-19, the courts in Chicago closed and the closing was not able to occur. The courts remained closed through August 2020. The property went back on the market, and in October 2020 Groundfloor sent another Notice of Default to the borrower. After the default period expired, Groundfloor engaged counsel to begin foreclosure proceedings. As foreclosure proceedings were ongoing, the borrower advised that he had a fully executed purchase and sale agreement in place in February 2021. The property was sold and the loan was repaid on March 16, 2021.

3035 South Lindell Rd - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in April 2019 and the original maturity date was in April 2020. The borrower was experiencing delays in completing and listing the project due to COVID-19. Groundfloor provided loan leniency in the form of a 90-day extension so the borrower could complete and list the property, with a new maturity date in July 2020. The borrower advised that COVID-19 was continuing to cause delays. Groundfloor issued a Notice of Default to the borrower in late July 2020. The borrower advised that the project was nearing completion, and Groundfloor entered into a workout agreement with the borrower in October 2020 to allow time to refinance the property. The new maturity date was in November 2020. The borrower advised that they were working to resolve tax liens on the property in order to complete refinance, and Groundfloor received a payoff request good through January 2021. However, the loan was not repaid, so Groundfloor commenced foreclosure proceedings in March 2021. The loan was subsequently repaid on March 24, 2021.

5294 East Shore Dr SW - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in March 2020 and the original maturity date was in March 2021. The project was completed and listed on the market in January 2021. The borrower advised that the project was under contract in February 2021, and the loan was repaid on March 22, 2021, several days after the loan maturity date.

6909 South Lagoon Dr - Repaid Out Of Default

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in January 2020 and the original maturity date was in January 2021. As the maturity date approached, the borrower advised that they were in the final stages of refinancing the loan. However, the maturity date arrived with no repayment. The borrower advised they were experiencing delays with their current refinance lender and were exploring other refinance lender options. The loan was repaid on March 29, 2021.

116 72nd St S - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in September 2019 and the original maturity date was in September 2020. Work was completed and the property was listed on the market in March 2020. The property was still on the market in May 2020; the borrower then advised they were pursuing a refinance as a backup measure to repay the loan. In August 2020, the borrower advised that the property was under contract. However, the sale did not go through. In November 2020, Groundfloor entered into workout discussions as an alternative to foreclosure. The borrower then provided sufficient evidence that a lender was ready to refinance the property in January 2021, so Groundfloor reached a workout agreement and provided a new maturity date in March 2021. The refinance was successful and the loan was repaid on March 30, 2021.

7518 Division Ave - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in May 2019 and the original maturity date was in May 2020. The project was nearing completion in January 2020, but a subsequent storm damaged the roof of the home, causing a leak. As the borrower worked to repair the storm damage, they advised they were going to pursue a refinance of the Groundfloor loan. In May 2020, Groundfloor provided loan leniency due to COVID-19 in the form of a 90-day extension. In August 2020, the borrower advised that they were still in the process of refinancing the loan; however, as it had still not completed by November 2020, Groundfloor began workout discussions with the borrower as an alternative to foreclosure. The borrower provided satisfactory evidence that a lender was ready to refinance the property in December 2020. The refinance was still in progress in January 2021; Groundfloor reached a workout settlement with the borrower to allow the refinance time to complete. The loan was repaid on March 30, 2021.

5013 Anthony Ave - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in June 2019 and the original maturity date was in June 2020. Work was completed in late 2019 and the property was actively listed by January 2020. After two months on the market with no success, the price was reduced; however, the property still needed more time to sell. In June 2020, Groundfloor provided loan leniency due to COVID-19 in the form of a 90-day extension. The new maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower in October 2020. When the default was not cured by the end of the cure period, Groundfloor entered into workout discussions with the borrower to avoid foreclosure. Groundfloor connected the borrower to a refinance lender, and in March 2021 the borrower advised that the refinance was nearing completion. The loan was repaid on March 31, 2021.

1931 North Liberty St - Repaid Via Workout Agreement

The loan was in maturity default because the borrower failed to repay the loan by the maturity date. The project was begun in October 2019 and the original maturity date was in April 2020. In February 2020, the borrower advised that the property was actively listed on the market, and in March 2020 the property went under contract. However, the sales contract fell through, and the property went back on the market in April 2020. In May 2020, the borrower advised they were pursuing a refinance to pay off the loan. Initially, the refinance was set to close in August 2020; however, delays in the refinance process pushed the closing date back to November 2020. Groundfloor entered into workout discussions with the borrower to allow for more time to repay the loan. Ultimately, Groundfloor took the property via a deed in lieu and negotiated a sale of the property, which ultimately netted a repayment of full principal to investors. The loan was repaid on March 30, 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We entered into workout agreements on the following loans last month:

- 1415 West 77th St

- 825 Danmead Ave

- 2096 Kipling Cir SE

- 21 Damon St

- 1401 South Avers Ave

- 629 Salem Dr

- 1484 Norman Berry Dr

- 126 Ambrose Dr

- 8023 4th Ave S

- 1315 Eastridge Rd SW

- 6230 Feldwood Rd

- 704-730 Dantzler St

- 1097 Astor Ave SW

- 1074 Astor Ave SW

We proceeded with foreclosure actions on the following properties last month:

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We did not go under contract to sell any properties last month.

We sold the following real estate owned properties last month: