After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As 2021 continues, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from September 2021.

You may view activity from previous periods by clicking the links below.

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

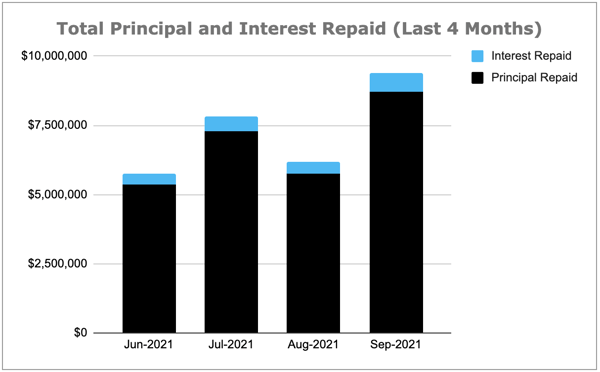

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

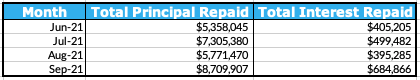

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q3 2021, and loans repaid year-to-date in 2021.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

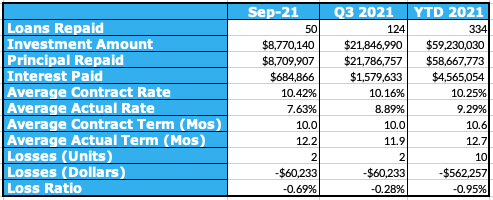

Last Month’s Repayments - September 2021

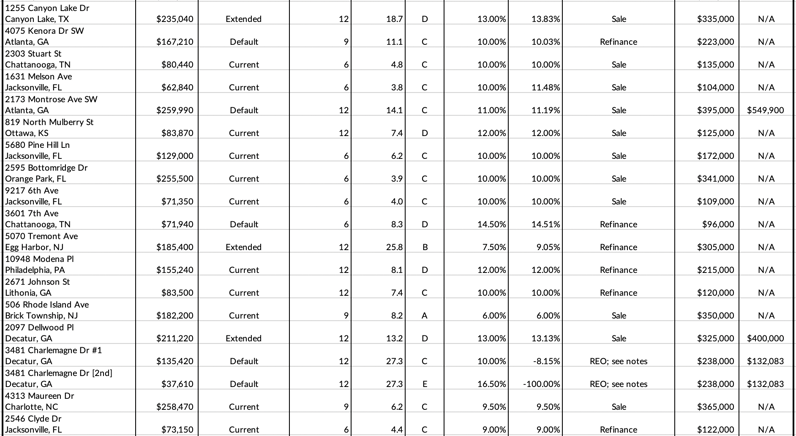

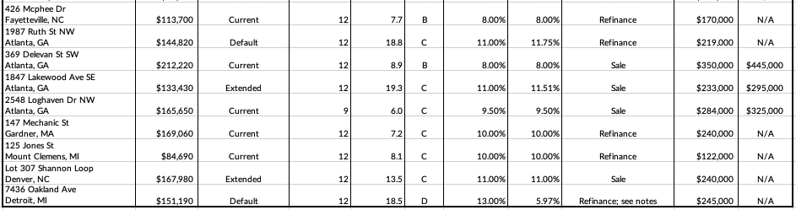

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

2623 & 2621 Watauga Rd

3330 Claremont Rd

1448 Westridge Rd SW

3328 Santa Fe Trl

692 Ira St SW

878 North Grand Ave NW

5100 Riverwest Rd

1567 West 19th St

883 North Grand Ave NW

965 Whitfield Ct

3126 Garden Lane Dr (LRO #1, LRO #2, LRO #3)

817 Ontario St

1208 11th St

1121 Gateshead Ln (LRO #1, LRO #2, LRO #3, LRO #4)

2600 West Harold St

244 Delevan St SW

800 Fayetteville Rd SE

743 Kennolia Dr SW (LRO #1, LRO #2)

2911 Mount Holly St

2125 Hollywood Dr NW - Unit A

2125 Hollywood Dr NW - Unit B

762 Lee Andrews Ave SE

1255 Canyon Lake Dr

4075 Kenora Dr SW

2303 Stuart St

1631 Melson Ave

2173 Montrose Ave SW

819 North Mulberry St

5680 Pine Hill Ln

2595 Bottomridge Dr

9217 6th Ave

3601 7th Ave

5070 Tremont Ave

10948 Modena Pl

2671 Johnson St

506 Rhode Island Ave

2097 Dellwood Pl

3481 Charlemagne Dr #1

3481 Charlemagne Dr [2nd]

4313 Maureen Dr

2546 Clyde Dr

426 Mcphee Dr

1987 Ruth St NW

369 Delevan St SW

1847 Lakewood Ave SE

2548 Loghaven Dr NW

147 Mechanic St

125 Jones St

Lot 307 Shannon Loop

7436 Oakland Ave

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 50 loans were repaid. 26 of them were current, repaying on time and in full. 24 were special situation loans, the details of which are below:

2623 & 2621 Watauga Rd - Repaid Via Extension

The project began in November 2019 and the loan had an original maturity date in November 2020. The maturity date arrived with no repayment, so Groundfloor undertook workout discussions with the borrower as an alternative to foreclosure. A workout settlement was reached, giving a new maturity date in February 2021. The borrower advised that they were in the process of refinancing the loan. In March 2021, the borrower advised that the refinance process was delayed due to COVID-19. Groundfloor subsequently connected the borrower to another refinance lender to expedite resolution. The refinance process continued to experience delays due to an outbreak of COVID-19. In July 2021, the borrower advised that the refinance process was almost complete with an expected closing date in August 2021. The loan was subsequently repaid in September 2021.

3328 Santa Fe Trl - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. In February 2021, the borrower advised that they were in the process of refinancing the Groundfloor loan; however, the maturity date passed with no repayment, so Groundfloor sent a Notice of Default to the borrower. The borrower advised they were continuing to pursue a refinance, with an expected closing date in May 2021. However, the refinance process experienced delays over the next few months. In September 2021, the borrower advised that the property was under contract, and the loan was repaid shortly thereafter.

692 Ira St SW - Repaid Out Of Default

The project began in August 2020 and the loan had an original maturity date in August 2021. Renovations were progressing well, but the maturity date passed with no repayment, so Groundfloor issued a Notice of Default to the borrower. The loan was subsequently repaid in September 2021.

883 North Grand Ave NW - Repaid Out Of Default

The project began in January 2020 and the loan had an original maturity date in January 2021. As the maturity date approached, the borrower advised that renovations were nearing completion; however, the maturity date arrived with no repayment. In January 2021, Groundfloor undertook workout discussions with the borrower in an effort to avoid foreclosure. Workout discussions continued through March 2021, and in April 2021 Groundfloor connected the borrower with some refinance lenders in order to expedite repayment. The borrower advised that they were in the process of refinancing the loan in May 2021. In tandem with the refinance process, in June 2021 Groundfloor began foreclosure proceedings on the property. The refinance process continued through the next few months, and in September 2021 the process was completed and the loan was repaid.

965 Whitfield Ct - Repaid Via Extension

The project began in October 2019 and the loan had an original maturity date in October 2020. The maturity date arrived with no repayment from the borrower, so Groundfloor sent a Notice of Default to the borrower. In November 2020, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2021. Renovations continued throughout the first half of 2021, and in May 2021 the borrower advised the property was under contract. The sale process continued with an expected closing date in August 2021. After a delay in closing, the loan was repaid in September 2021.

1208 11th St - Repaid Via REO

The project began in April 2018 and the loan had an original maturity date in April 2019. In March 2019, the borrower advised they were in the process of refinancing the Groundfloor loan. As the maturity date arrived with no repayment from the borrower, Groundfloor issued a Notice of Default. The default period expired with no repayment, so in May 2019 Groundfloor engaged legal counsel to begin the foreclosure process. In July 2019, our attorney advised that they were working on title and tax issues in order for foreclosure proceedings to continue. In September 2019, our attorney advised that a tax issue had arisen and that to correct it, a judge needed to look over the issue. Our attorney filed a case for review with the local Probate Court. After some delays, in November 2019 the tax issue was resolved and the foreclosure was able to proceed. The foreclosure sale date was set for January 2020. Groundfloor subsequently took possession of the property. It was discovered that tenants were living in the home, so in February 2020 Groundfloor began the process of evicting them. The eviction process took several months to wind through the courts, and in July 2020 our attorney advised that a sheriff eviction was scheduled for the next month. However, due to a state eviction moratorium in place due to COVID-19, the eviction was significantly delayed. Finally, in May 2021 our attorney advised that the sheriff was performing the sheriff eviction. In July 2021, the property went under contract and sold “as-is.” The loan was then repaid in September 2021.

2600 West Harold St - Repaid Via Extension

The project began in February 2020 and the loan had an original maturity date in February 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor sent a Notice of Default. Groundfloor subsequently reached a workout settlement with the borrower, giving a new maturity date in April 2021. The borrower advised that they were in the process of refinancing the Groundfloor loan. The refinance process took several months to complete. Finally, the refinance went through and the loan was repaid in September 2021.

244 Delevan St SW - Repaid Via Extension

The project began in November 2019 and the loan had an original maturity date in December 2020. The borrower reported multiple delays due to COVID-19. As the maturity date approached, Groundfloor began workout discussions with the borrower as an alternative to foreclosure. A workout agreement was reached, giving a new maturity date in April 2021. The borrower advised that they were in the process of refinancing the Groundfloor loan and were anticipating a June 2021 closing date as they wrapped up renovations on the home. The borrower subsequently advised that the property was under contract, with an expected closing date in August 2021. After a slight delay in closing, the loan was repaid in September 2021.

800 Fayetteville Rd SE - Repaid Out Of Default

The project began in July 2019 and the loan had an original maturity date in July 2020. The borrower reported that renovations were progressing well and that the property was scheduled to be listed in August 2020; however, the property failed to sell. In November 2020, the borrower advised that they were in the process of refinancing the loan. The refinance process continued throughout the next several months as the borrower had to switch refinance lenders several times. The refinance process finally completed and the loan was repaid in September 2021.

2125 Hollywood Dr NW - Unit A - Repaid Out of Default

The project began in June 2021 and the loan had an original maturity date in September 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default; however, the loan was repaid shortly thereafter.

2125 Hollywood Dr NW - Unit B - Repaid Out Of Default

The project began in June 2021 and the loan had an original maturity date in September 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default; however, the loan was repaid shortly thereafter.

762 Lee Andrews Ave SE - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in June 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default. Groundfloor subsequently reached a workout agreement with the borrower, giving a new maturity date in September 2021. The loan was then repaid in September 2021.

1255 Canyon Lake Dr - Repaid Via Extension

The project began in February 2020 and the loan had an original maturity date in February 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default. Groundfloor subsequently reached a workout agreement with the borrower, giving a new maturity date in May 2021. As the maturity date approached, the borrower advised that they were receiving multiple offers on the home even as renovations were still wrapping up. Groundfloor reached another workout agreement with the borrower, giving a new maturity date in August 2021. As that maturity date passed, Groundfloor again initiated workout discussions as an alternative to foreclosure; however, the loan was subsequently repaid in September 2021.

4075 Kenora Dr SW - Repaid Out Of Default

The project began in October 2020 and the loan had an original maturity date in July 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default. The borrower subsequently advised that they were pursuing a refinance, with an expected close in August 2021. The refinance went through and the loan was repaid in September 2021.

2173 Montrose Ave SW - Repaid Out Of Default

The project began in July 2020 and the loan had an original maturity date in July 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default. The borrower subsequently advised that the property was under contract but the deal fell through. They re-listed the property on the market at a competitive price in August 2021. The property was subsequently sold and the loan was repaid in September 2021.

3601 7th Ave - Repaid Out Of Default

The project began in January 2021 and the loan had an original maturity date in July 2021. In May 2021, the borrower advised that they were in the process of refinancing the Groundfloor loan; however, the maturity date arrived with no repayment, so Groundfloor issued a Notice of Default. The borrower then advised that the refinance process was still ongoing. The refinance went through and the loan was repaid in September 2021.

5070 Tremont Ave - Repaid Via Extension

The project began in July 2019 and the loan had an original maturity date in July 2020. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. After the default period expired, Groundfloor began foreclosure proceedings. Simultaneously, Groundfloor began workout discussions with the borrower as an alternative to foreclosure. In January 2021, a workout agreement was reached, giving a new maturity date in September 2021. The borrower then advised that they were in the process of refinancing the loan. The refinance process was delayed several months due to a COVID-19 outbreak. The refinance finally went through and the loan was repaid in September 2021.

2097 Dellwood Pl - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. As the maturity date arrived, renovations remained ongoing, so Groundfloor reached a workout agreement with the borrower, giving a new maturity date in October 2021. In September 2021, the borrower advised that renovations were complete and the property was under contract. The loan was subsequently repaid.

3481 Charlemagne Dr - Repaid Via REO

This loan was split into two LROs, each holding a different payment position (for more information about how that works, see this blog post). The project began in June 2019 and the loan had an original maturity date in June 2020. The maturity date arrived with no repayment, so Groundfloor issued a Notice of Default to the borrower. After the default period expired, Groundfloor engaged counsel to proceed with foreclosure. A foreclosure sale was scheduled, and in January 2021 Groundfloor obtained the property. However, after the foreclosure sale, one of the borrowers named Groundfloor in a civil suit for wrongful foreclosure. The suit was dismissed, but the litigation delayed the resolution of the loan. To avoid a continued costly and lengthy listing process, Groundfloor accepted an all-cash offer on the property in September 2021.

The property was sold for $132,082.86. After adding the remaining escrow balance and subtracting relevant fees and asset management costs, our net recovery was $112,796.45. As this loan was a split loan, principal was repaid first to investors in the first payment position, and any remaining principal is then paid to the higher risk second payment position. Investors in the first payment position for 3481 Charlemagne received 83% principal recovery, while no recovery remained to fulfill the principal for investors in the second payment position. Impacted investors may view a more detailed breakdown of our recovery for this project in our recent email communication.

1987 Ruth St NW - Repaid Out Of Default

The project was begun in March 2020 and the loan had an original maturity date in March 2021. The maturity date arrived with no repayment from the borrower, so Groundfloor issued a Notice of Default. Groundfloor subsequently entered into workout discussions with the borrower as an alternative to foreclosure. In July 2021, the borrower advised that they were in the process of refinancing the loan. The refinance process took a couple of months, and the loan was repaid in September 2021.

1847 Lakewood Ave SE - Repaid Via Extension

The project began in January 2020 and the loan had an original maturity date in February 2021. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. Groundfloor subsequently reached a workout agreement with the borrower, giving a new maturity date in May 2021. The borrower advised that they were pursuing a refinance. Groundfloor subsequently provided an additional forbearance through August 2021. The borrower then advised that the previous contract fell through, but a new contract was pending. The loan was repaid in September 2021.

Lot 307 Shannon Loop - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. Shortly thereafter, the borrower advised that the property was under contract. The loan was repaid in September 2021.

7436 Oakland Ave - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. The borrower subsequently advised that they were in the process of refinancing their loan. The refinance process continued through the next several months, and the loan was repaid in September 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We entered into workout agreements on the following loans last month:

- 2578 Barge Rd SW

- 2618 North Dayton St

- 18075 Roselawn St

- 150 Shady Brook Walk

- 815 Welch St SW

- 3673 Turret Ct NE

- 51 Holt Rd NE

- 1986 Memorial Dr SE

- 1536 Montreat Ave SW

- 3153 Whitethorn Rd

- 3421 Old Tennessee Rd SW

- 1063 Mayson Turner Rd NW

- 298 Roy St SW

- 1817 Kittyhawk Rd

- 2824 Dodson Dr

- 1354 Meridian St SE

We proceeded with foreclosure actions on the following properties last month:

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We did not go under contract to sell any properties last month.

We did not sell any real estate owned properties last month.