After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with information about our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As 2021 continues, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from August 2021.

You may view activity from previous periods by clicking the links below.

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

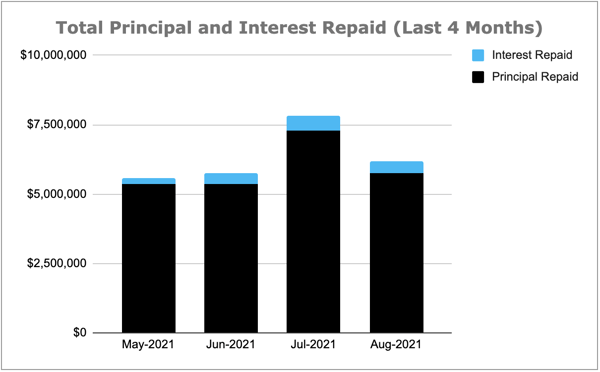

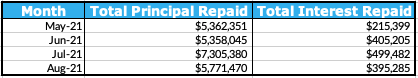

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

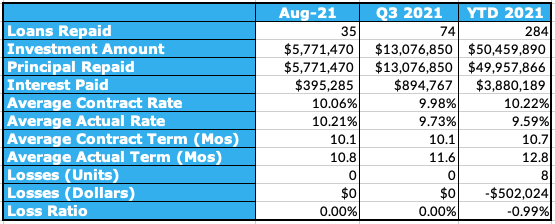

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q3 2021, and loans repaid year-to-date in 2021.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

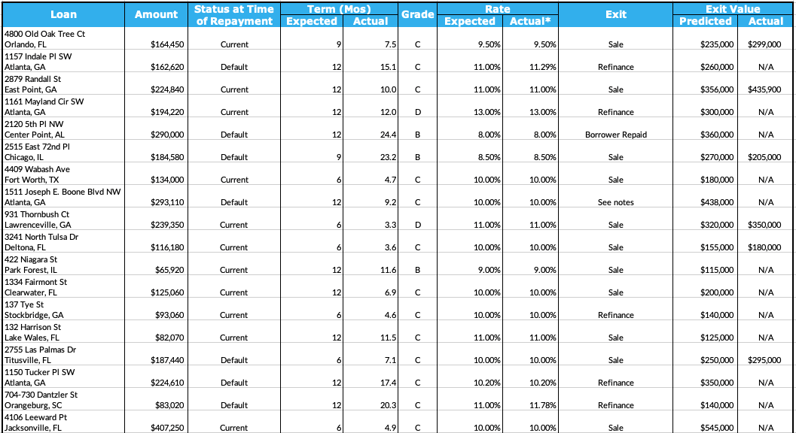

Last Month’s Repayments - August 2021

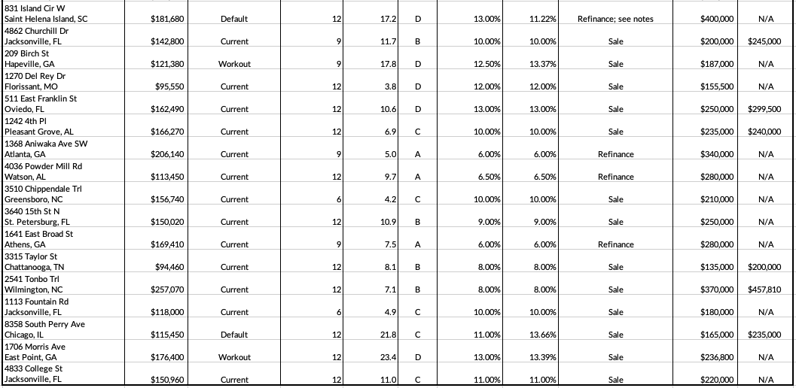

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Default - loan was resolved while in default

Workout - a workout plan was put into effect and the loan was resolved under the terms of the workout agreement

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property.

Links to the loan detail pages for the above loans:

4800 Old Oak Tree Ct

1157 Indale Pl SW

2879 Randall St (LRO #1, LRO #2, LRO #3)

1161 Mayland Cir SW

2120 5th Pl NW

2515 East 72nd Pl

4409 Wabash Ave

1511 Joseph E. Boone Blvd NW

931 Thornbush Ct

3241 North Tulsa Dr

422 Niagara St

1334 Fairmont St

137 Tye St

132 Harrison St

2755 Las Palmas Dr

1150 Tucker Pl SW

704-730 Dantzler St

4106 Leeward Pt

831 Island Cir W

4862 Churchill Dr

209 Birch St

1270 Del Rey Dr

511 East Franklin St

1242 4th Pl

1368 Aniwaka Ave SW

4036 Powder Mill Rd

3510 Chippendale Trl

3640 15th St N

1641 East Broad St (LRO #1, LRO #2)

3315 Taylor St

2541 Tonbo Trl (LRO #1, LRO #2, LRO #3, LRO #4)

1113 Fountain Rd

8358 South Perry Ave

1706 Morris Ave (LRO #1, LRO #2)

4833 College St

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 35 loans were repaid. 24 of them were current, repaying on time and in full. 11 were special situation loans, the details of which are below:

1157 Indale Pl SW - Repaid Out Of Default

The project began in April 2020 and the loan had an original maturity date in April 2021. As the maturity date approached, the borrower advised that renovations were complete and the house was actively listed on the market. However, the maturity date passed with no repayment, in May 2021 Groundfloor sent a Notice of Default to the borrower. The borrower subsequently advised that they were in the process of refinancing the loan, and the loan was repaid in August 2021.

2120 5th Pl NW - Repaid Out Of Default

The project began in July 2019 and the loan had an original maturity date in July 2020. In March 2020, Groundfloor received a payoff request from the borrower. However, repayment did not occur. In September 2020, Groundfloor again received a payoff request from the borrower, but once again repayment did not occur. In October 2020, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in December 2020. The new maturity date arrived with no repayment from the borrower, so in February 2021 Groundfloor sent a Notice of Default. In March 2020, after the default period expired, Groundfloor reached out to the borrower for an update and began preparing to foreclose. The borrower advised that the property was under contract. In May 2021, Groundfloor reached out to the borrower again to confirm closing details. In June 2021, Groundfloor received a payoff request from the borrower. The loan was repaid in August 2021.

2515 East 72nd Pl - Repaid Out Of Default

The project began in August 2019 and the loan had an original maturity date in May 2020. In September 2019, the borrower advised that renovations had been completed, and in October 2019 the property was actively listed on the market. The borrower advised that they had shown the property multiple times with no luck, and the home remained on the market month after month. In January 2020, the borrower advised they had reduced the asking price in order to attract potential buyers. In February 2020, the borrower advised that they were planning to re-market the property and potentially reduce the price again. In May 2020, the borrower advised that they were currently in negotiations with a buyer; as such, Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in August 2020. However, the sale did not complete, and the property remained actively listed on the market as the maturity date passed. In December 2020, Groundfloor reached a new workout agreement with the borrower, giving a new maturity date in January 2021. The borrower advised that they had an interested buyer, but in March 2021 they advised that the buyer had backed out due to financing issues. Groundfloor connected the borrower with some refinance lenders as they continued to pursue a sale strategy. In May 2021, the borrower advised that they had further reduced the sale price of the home as they had had two offers fall through. In June 2021, the borrower advised that the property was under contract, and the loan was repaid in August 2021.

1511 Joseph E. Boone Blvd NW - Repaid Out Of Default

The project began in November 2020 and the loan had an original maturity date in November 2021. In May 2021, Groundfloor submitted a title insurance claim on the property. The claim was successful and the loan was repaid in full through the title claim insurance proceeds in August 2021.

2755 Las Palmas Dr - Repaid Out Of Default

The project began in December 2020 and the loan had an original maturity date in July 2021. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in August. The maturity date passed with no repayment, so Groundfloor sent a Notice of Default to the borrower. The loan was subsequently repaid in August 2021.

1150 Tucker Pl SW - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. The project experienced heavy delays due to COVID-19, with the permitting process alone taking over 9 months to complete. As such, the project was still in the early stages of renovation by the time the maturity date arrived. Groundfloor sent a Notice of Default to the borrower and began workout discussions in order to avoid foreclosure. Groundfloor connected the borrower with several refinance lenders in order to expedite an exit, and in July 2021 the borrower advised that they were in the process of refinancing. The loan was repaid in August 2021.

704-730 Dantzler St - Repaid Out Of Default

The project began in November 2019 and the loan had an original maturity date in December 2020. In November 2020, renovations were completed, and the borrower advised that the property was under contract with an expected closing date in January 2021. However, the buyer’s financing fell through, so in February 2021 the borrower advised they were in the process of refinancing the loan. Groundfloor agreed to a workout settlement, giving a new maturity date in June 2021. The refinance process continued through the new maturity date (triggering a Notice of Default to be sent to the borrower). The refinance process completed in July 2021 and the loan was repaid in August 2021.

831 Island Cir W - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. Renovations were initially delayed due to COVID-19, but the project then proceeded with no issues. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. Groundfloor then connected the borrower with some refinance lenders to expedite an exit, and in May 2021 the borrower advised that they were in the process of refinancing. The refinance process proved more challenging than expected and took several months. In August 2021, the refinance princess finally completed and the loan was repaid.

209 Birch St - Repaid Via Workout Agreement

The project began in February 2020 and the loan had an original maturity date in November 2020. The project experienced some delays due to COVID-19 but renovations were progressing, so Groundfloor provided loan leniency in the form of a 90-day extension, giving a new maturity date in February 2021. The borrower asked for additional time to finish up the renovation work, so Groundfloor agreed to extend the forbearance agreement to April 2021 while increasing the interest rate to 13.5%. The project was completed and the property was actively listed on the market and generating a lot of interest/activity, so as the maturity date approached Groundfloor agreed to grant the borrower additional time to sell the property, giving a new maturity date in August 2021. The borrower advised that they were under contract on the property, and the loan was repaid in August 2021.

8358 South Perry Ave - Repaid Out Of Default

The project began in September 2019 and the loan had an original maturity date in November 2020. In May 2020, the borrower advised that the property had experienced a fire and they were filing an insurance claim. As a result, the project was unfinished by the time the maturity date arrived, so Groundfloor sent a Notice of Default and began workout discussions in an effort to avoid foreclosure. In January 2021, the borrower advised that they were in the process of refinancing the loan; however, the refinance fell through. In March 2021 the borrower advised that they had secured a buyer for the property, with an expected closing date in April 2021. Unfortunately, the contract fell through, in part because closing was delayed due to a water meter box repair. The borrower reduced the asking price to encourage interest in June 2021. Groundfloor subsequently began foreclosure proceedings.

1706 Morris Ave - Repaid Via Workout Agreement

The project began in September 2019 and the loan had an original maturity date in September 2020. In August 2020, the borrower advised that renovations were nearing completion, but they were experiencing delays in installations and property inspections due to COVID-19. As such, Groundfloor agreed to an extension until December 2020. In September 2020, the borrower advised that final inspections were in progress and the property was scheduled to be listed. In December 2020, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in March 2021. The borrower advised that they were in the process of refinancing the loan and gave an expected closing date in April 2021. However, the refinance process took longer than expected. As the refinance continued, in June 2021 the borrower advised that the property was under contract, with an expected closing date in July 2021. The loan was repaid in August 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We entered into workout agreements on the following loans last month:

- 3601 7th Ave

- 629 Windsor St SW

- 631 Windsor St SW

- 3222 Chapel St

- 17527 Stoepel St

- 137 Hay St

- 2824 Dodson Dr

- 18075 Roselawn St

- 815 Welch St SW

- 5201 Southwest 3rd Crt

- 2097 Dellwood Pl

- 4527 Westhampton Woods Dr

We proceeded with foreclosure actions on the following properties last month:

- 293 Ormond St SE (1st position, 2nd position)

- 825 Danmead Ave

- 2938 Waters Rd SW

- 5804 Southall Rd

- 1617 North Davidson St

- 2062 Detroit Ave NW

- 1405 Chicago Blvd

- 305 153rd St

- 6230 Feldwood Rd

- 824 Delaware St

- 1564 Cadillac Blvd

- 7436 Oakland Ave

- 8043 Cornell St

- 14134 Prevost St

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

We did not sell any real estate owned properties last month.