After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

We are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from December 2021.

You may view activity from previous periods by clicking the links below.

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

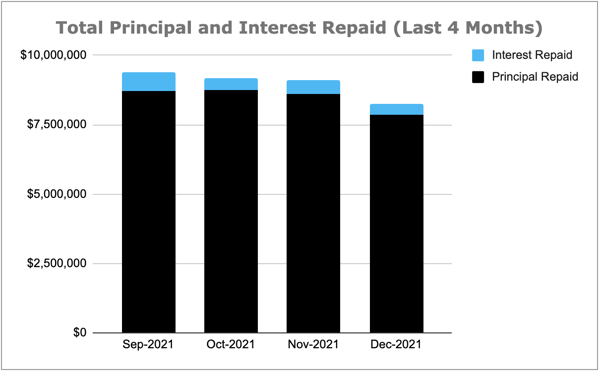

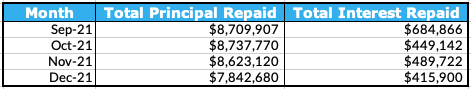

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

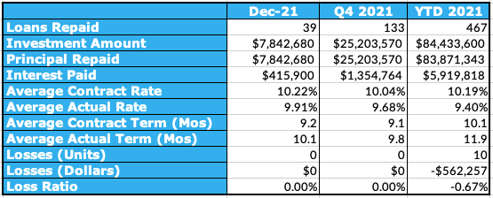

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q4 2021, and loans repaid year-to-date in 2021.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

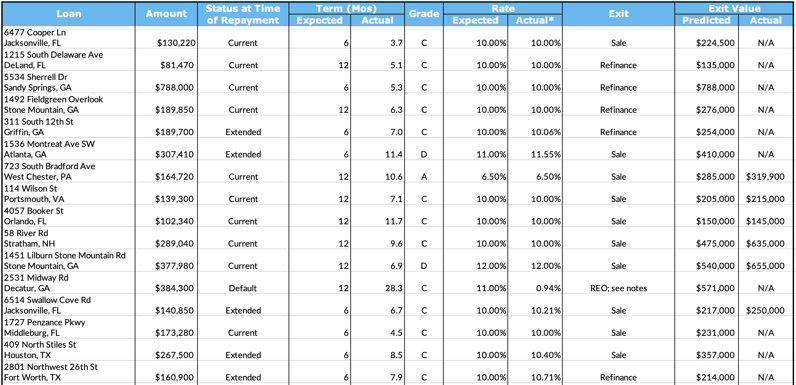

Last Month’s Repayments - December 2021

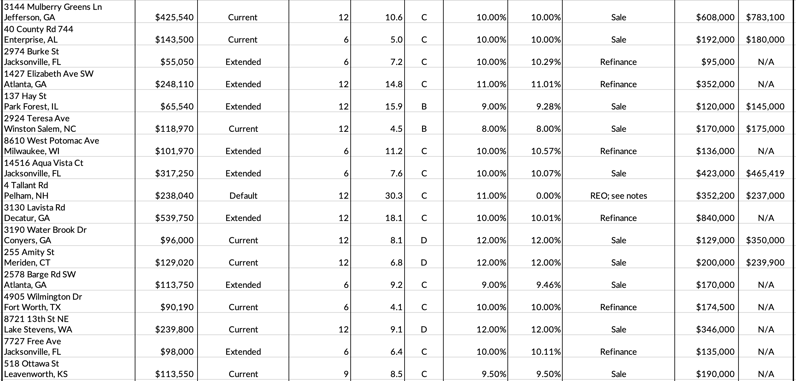

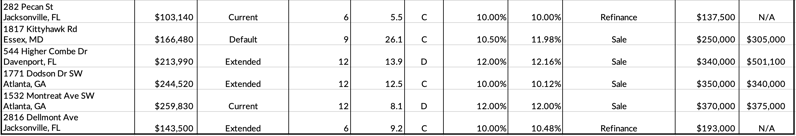

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

6477 Cooper Ln

1215 South Delaware Ave

5534 Sherrell Dr (LRO #1, LRO #2)

1492 Fieldgreen Overlook

311 South 12th St

1536 Montreat Ave SW

723 South Bradford Ave

114 Wilson St

4057 Booker St

58 River Rd

1451 Lilburn Stone Mountain Rd

2531 Midway Rd (LRO #1, LRO #2)

6514 Swallow Cove Rd

1727 Penzance Pkwy

409 North Stiles St

2801 Northwest 26th St (LRO #1, LRO #2)

3144 Mulberry Greens Ln (LRO #1, LRO #2, LRO #3, LRO #4, LRO #5)

40 County Rd 744

2974 Burke St

1427 Elizabeth Ave SW

137 Hay St

2924 Teresa Ave (LRO #1, LRO #2)

8610 West Potomac Ave

14516 Aqua Vista Ct

4 Tallant Rd

3130 Lavista Rd (LRO #1, LRO #2, LRO #3)

3190 Water Brook Dr

255 Amity St

2578 Barge Rd SW

4905 Wilmington Dr

8721 13th St NE

7727 Free Ave

518 Ottawa St

282 Pecan St

1817 Kittyhawk Rd

544 Higher Combe Dr

1771 Dodson Dr SW

1532 Montreat Ave SW

2816 Dellmont Ave

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 39 loans were repaid. 20 of them were current, repaying on time and in full. 19 were special situation loans, the details of which are below.

311 South 12th St - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. In November 2021, the borrower advised that they expected to pay off the loan by the end of December. The loan was repaid in December 2021.

1536 Montreat Ave SW - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in June 2021. In July 2021, the borrower advised that the project was scheduled to be listed, and Groundfloor agreed to a workout settlement, giving a new maturity date in September 2021. The project continued to progress, and as the new maturity date arrived Groundfloor agreed to an additional workout settlement, giving a new maturity date in November 2021. The loan was subsequently repaid in November 2021.

2531 Midway Rd - Repaid Via REO

The project began in August 2019 and the loan had an original maturity date in July 2020. During the course of demolition, the borrower discovered significant foundational issues that required more work than anticipated. So, in August 2020 Groundfloor granted loan leniency in the form of a 90-day extension, giving a new maturity date in October 2020. As the new maturity date arrived, Groundfloor agreed to a second extension, giving a new maturity date in February 2021. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in April 2021. However, the property failed to close, so Groundfloor began workout discussions with the borrower in an effort to avoid foreclosure. In September 2021, Groundfloor obtained the property via a Deed in Lieu agreement. In November 2021, the property went under contract, and it sold as-is in December 2021, enabling us to recover full principal and some interest.

6514 Swallow Cove Rd - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was under contract. The sale was completed and the loan was repaid in December 2021.

409 North Stiles St - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that the property was scheduled to be listed. In November 2021, the borrower advised that the property was actively listed. The property was sold and the loan was repaid in December 2021.

2801 Northwest 26th St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The loan was repaid in December 2021.

2974 Burke St - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor received a payoff request good through early December. The loan was repaid shortly thereafter.

1427 Elizabeth Ave SW - Repaid Via Extension

The project began in September 2020 and the loan had an original maturity date in September 2021. In October 2021, the borrower informed that they were planning to sell the property as-is and had a buyer lined up, with the sale expected to close in November. Unfortunately, the buyer backed out at the last minute. Groundfloor began foreclosure proceedings, but did not proceed further as the borrower advised they had found another buyer. The loan was repaid in December 2021.

137 Hay St - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. In September 2021, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in November 2021. As the new maturity date arrived, the borrower advised that the property was under contract to be sold, with a closing date in December. The sale was successful and the loan was repaid in December 2021.

8610 West Potomac Ave - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in July 2021. In June 2021, the borrower advised that the property was under contract with an expected closing date in August 2021. In September 2021, the borrower advised that closing was delayed. Groundfloor undertook workout discussions in an effort to avoid foreclosure and provided an extension. The loan was repaid in December 2021.

14516 Aqua Vista Ct - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was under contract. The loan was repaid in December 2021.

4 Tallant Rd - Repaid Via REO

The project began in June 2019 and the loan had an original maturity date in June 2020. The borrower had not made sufficient progress on the project, so in June 2020 Groundfloor issued a Notice of Default, with the intention of proceeding with foreclosure if the loan was not repaid by July 2020. The loan was not repaid, so Groundfloor proceeded with foreclosure in July 2021. However, a state moratorium on foreclosure proceedings was in effect through December 2021. Groundfloor resumed foreclosure proceedings once the moratorium was lifted in January 2021. Foreclosure proceedings continued through the next months. In April 2021, our attorney advised that title had cleared and a foreclosure sale was being scheduled for June 2021. Groundfloor was the successful bidder at the foreclosure sale, and in August 2021 we received the foreclosure Deed of Sale and were inspecting the property to prepare it for sale. In October 2021, the property was listed for sale. The property remained for sale for the next couple of months, and our realtor advised that the property was not in great condition and would most likely be a tear down. In December 2021, Groundfloor received an offer for sale, the proceeds of which allowed us to recover full principal.

3130 Lavista Rd - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in June 2021. As the maturity date arrived, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in October 2021. As the new maturity date arrived, Groundfloor again reached a workout settlement, giving a new maturity date in November 2021. The borrower subsequently advised they were pursuing a refinance. The loan was subsequently repaid in December 2021.

2578 Barge Rd SW - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. The maturity date arrived with no repayment, so Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in December 2021. The loan was repaid in December 2021.

7727 Free Ave - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. The maturity date arrived as the loan was in the process of being paid off. The loan was repaid about a week after the maturity date.

1817 Kittyhawk Rd - Repaid Out Of Default

The project began in October 2019 and the loan had an original maturity date in July 2020. The maturity date approached as renovations were nearing completion, so Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in October 2020. The project continued to progress well. As the new maturity date approached, Groundfloor agreed to a second workout settlement with the borrower, giving a new maturity date in April 2021. The borrower subsequently advised that a potential buyer was interested in the property but needed additional adjustments made to make the property more handicap accessible. These adjustments were made through May and June, and in June 2021 the borrower advised that the property was under contract with an expected closing date in July 2021. However, the sale did not go through. Groundfloor then undertook workout discussions with the borrower in an effort to avoid foreclosure, and reached a settlement agreement that gave a new maturity date in October 2021. Groundfloor then informed the borrower that the file would be referred to counsel for foreclosure by November 2021 if the loan was not repaid. The maturity date arrived with no repayment, so the file was referred for foreclosure in November 2021. However, Groundfloor received a payoff request good through December 2021 and paused foreclosure proceedings. The loan was repaid in December 2021.

544 Higher Combe Dr - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in October 2021. The maturity date arrived as renovations were finishing up so Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in January 2022. Renovations were completed and the loan was repaid in December 2021.

1771 Dodson Dr SW - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. In November 2021, the borrower advised that they had received an offer and were negotiating with a potential buyer. Groundfloor provided a forbearance agreement to allow the sale to go through. The loan was repaid at the end of December 2021, a couple of weeks after the maturity date.

2816 Dellmont Ave - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. The project was completed and rented out by October 2021, with the borrower in the process of refinancing the Groundfloor loan. The refinance process took several weeks to complete. The loan was repaid in December 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 3421 Old Tennessee Rd SW

- 224 Ormond St SW Unit A

- 224 Ormond St SW Unit B

- 854 Thurmond St NW

- 1063 Mayson Turner Rd NW

- 346 Mount Vernon Ave

- 2897 Santa Monica Dr

- 2522 Loghaven Dr NW

- 2061 Austin Dr

- 314 Fortune St NE Unit A

- 314 Fortune St NE Unit B

- 1302 East Caracas St

- 1304 East Caracas St

- 629 Windsor St SW

- 631 Windsor St SW

- 1559 Frazier Rd

- 166 Vanira Ave SE - A

- 166 Vanira Ave SE - B

- 595 Twilley Rd NW

- 533 James P Brawley Dr NW

- 1507 Frazier Rd

- 4201 Brookview Dr SE

- 25 26th St NW

- 6840 West Umatilla Ave

We proceeded with foreclosure actions on the following properties last month:

- 3421 Old Tennessee Rd SW

- 2122 Dewey St

- 2638-2640 & 2630-2632 East 122nd St

- 4527 Westhampton Woods Dr

- 1180 Holly St NW

- 5201 Southwest 3rd Ct

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

We sold the following real estate owned properties last month: