After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As 2021 continues, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from November 2021.

You may view activity from previous periods by clicking the links below.

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

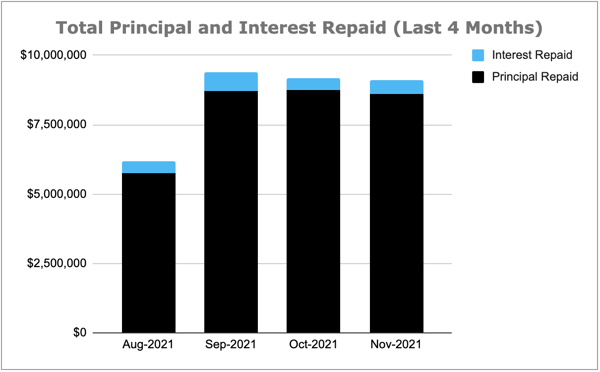

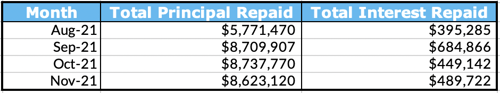

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

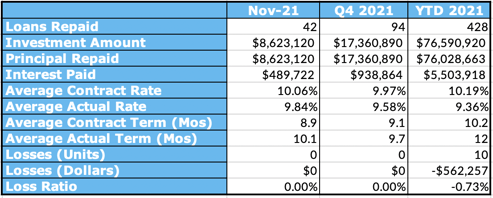

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q4 2021, and loans repaid year-to-date in 2021.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

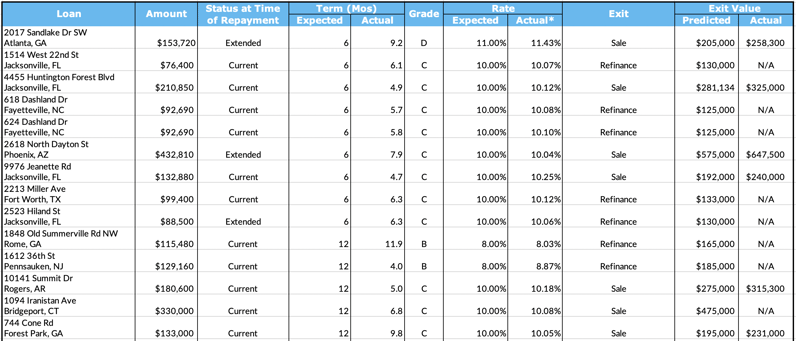

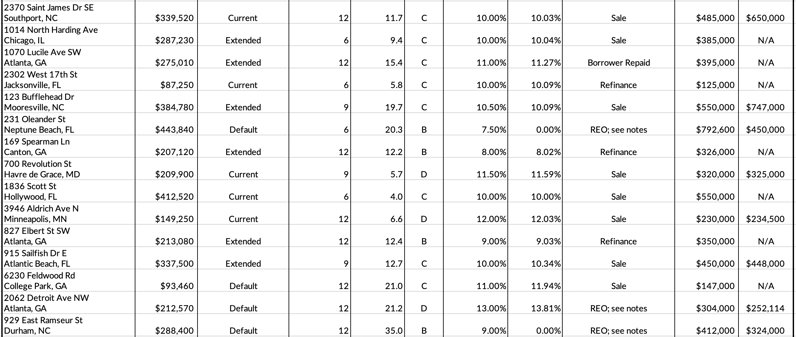

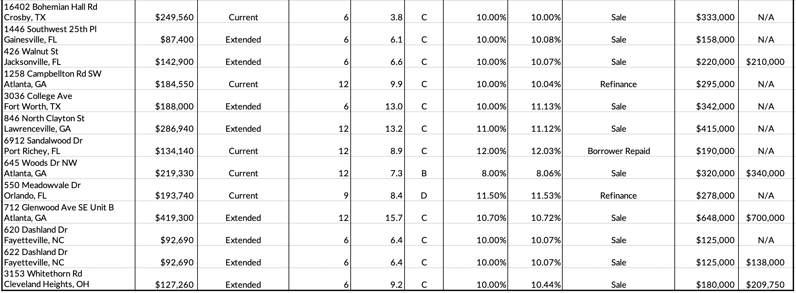

Last Month’s Repayments - November 2021

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

1514 West 22nd St

4455 Huntington Forest Blvd

618 Dashland Dr

624 Dashland Dr

2618 North Dayton St

9976 Jeanette Rd

2213 Miller Ave

2523 Hiland St

1848 Old Summerville Rd NW

1612 36th St

10141 Summit Dr

1094 Iranistan Ave

744 Cone Rd

2370 Saint James Dr SE

1014 North Harding Ave

1070 Lucile Ave SW

2302 West 17th St

123 Bufflehead Dr

231 Oleander St

169 Spearman Ln

700 Revolution St

1836 Scott St

3946 Aldrich Ave N

827 Elbert St SW

915 Sailfish Dr E

6230 Feldwood Rd

2062 Detroit Ave NW

929 East Ramseur St

16402 Bohemian Hall Rd

1446 Southwest 25th Pl

426 Walnut St

1258 Campbellton Rd SW

3036 College Ave

846 North Clayton St

6912 Sandalwood Dr

645 Woods Dr NW

550 Meadowvale Dr

712 Glenwood Ave SE Unit B (LRO #1, LRO #2, LRO #3)

620 Dashland Dr

622 Dashland Dr

3153 Whitethorn Rd

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 42 loans were repaid. 21 of them were current, repaying on time and in full. 21 were special situation loans, the details of which are below.

2017 Sandlake Dr SW - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in July 2021. As the maturity date passed with no repayment from the borrower, in August 2021 Groundfloor sent a Notice of Default to the borrower. The borrower subsequently informed Groundfloor that the property was under contract with an expected closing date in September 2021. As such, Groundfloor granted an extension to give the sale time to go through. The sale continued to process through October 2021, and the loan was repaid in November 2021.

2618 North Dayton St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. In April and May 2021, the borrower advised that they were in the process of receiving permit approval. In June 2021, the borrower advised that permitting was complete and renovations had begun. As the maturity date passed with no repayment, Groundfloor sent a Notice of Default to the borrower. In October 2021, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in December 2021. The borrower subsequently advised that the property was under contract, and in November 2021 the loan was repaid.

2523 Hiland St - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in October 2021. Groundfloor had received a payoff request good through October 2021; however, the maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. Repayment needed a bit more time to complete, and in November 2021 the loan was repaid.

1014 North Harding Ave - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in July 2021. As the maturity date approached, Groundfloor granted a 30-day forbearance to the borrower, giving a new maturity date in August 2021. The borrower subsequently advised that the property was under contract, with an expected closing date in September 2021. As the new maturity date approached, the borrower advised that there were delays in the closing process. Groundfloor granted an additional forbearance until the end of November to allow the closing process to complete, and the loan was repaid in November 2021.

1070 Lucile Ave - Repaid Via Extension

The project began in July 2020 and the loan had an original maturity date in July 2021. As the maturity date approached, the borrower advised that they were experiencing extreme delays with permitting due to city backlogs. Groundfloor granted a 120-day forbearance to the borrower, giving a new maturity date in November 2021. The loan was subsequently repaid in November 2021.

123 Bufflehead Dr - Repaid Via Extension

The project began in March 2020 and the loan had an original maturity date in December 2020. The borrower experienced significant delays in construction materials due to COVID-19. As the maturity date approached, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in April 2021. In February 2021, the borrower advised that final inspections had been scheduled and the property was actively listed on the market. The property went under contract with an expected closing date at the end of March 2021/beginning of April 2021. However, the borrower subsequently advised that they had run into issues with the final phase of the project and the installation of the septic tank, and requested an additional forbearance agreement to give them time to address the issue. In June 2021, the borrower advised that they had obtained septic tank permits and were progressing with addressing the septic tank issues, and the property remained under contract. Groundfloor subsequently granted an additional forbearance due to the septic tank delays, giving a new maturity date in January 2022. The loan was repaid in November 2021.

231 Oleander St - Repaid Via REO

The project began in March 2020 and the loan had an original maturity date in August 2020. The property was a duplex and the borrower’s original plan was to renovate the duplex. While progressing on the project, the borrower received a code violation, which resulted in the municipality taking away the zoning approval for a duplex and the borrower halting work on the project. As such, Groundfloor provided loan leniency in the form of an extension, giving a new maturity date in November 2020. However, the loan was still not repaid and in December 2020 Groundfloor placed the loan in default. In March 2021, Groundfloor obtained the property via a Deed in Lieu agreement with the borrower, and a property assessment was scheduled to determine what work needed to be done to prepare the property for sale. Groundfloor received multiple purchase agreements, but none closed. Because the property had been vacant for a long period of time, completing development required additional capital - especially since due to the zoning issues, the property needed to be renovated and sold as a single-family property. Groundfloor thus listed the property as-is in an effort to recover investors’ principal. The loan was finally repaid (principal only) in November 2021. Impacted investors can view a more detailed breakdown of their repayment in our recent email communication.

169 Spearman Ln - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor provided a forbearance agreement to give the borrower time to complete repayment. The loan was subsequently repaid in November 2021.

827 Elbert St SW - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in November 2021. In October 2021, the borrower advised that they were in the process of refinancing the Groundfloor loan, but were experiencing delays. The borrower subsequently advised that a closing date had been scheduled for November 2021. The refinance process completed and the loan was repaid in November 2021.

915 Sailfish Dr E - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in July 2021. In June 2021, the borrower advised that renovations were complete and the property was actively listed on the market. However, the maturity date passed with no repayment, so in August 2021 Groundfloor sent a Notice of Default to the borrower. The borrower subsequently advised that the contract had fallen through. Groundfloor undertook workout discussions with the borrower in an effort to avoid foreclosure, and provided an extension. The loan was repaid in November 2021.

6230 Feldwood Rd - Repaid Out Of Default

The project began in February 2020 and the loan had an original maturity date in February 2021. In April 2020, the borrower advised that they were experiencing delays in the permitting process due to COVID-19. Work continued on the project through the rest of the year, but the project continued to experience delays due to COVID-19. In addition, as work continued, major structural issues were discovered that required additional time to be addressed. In February 2021, a stop work order was issued due to permitting issues, as the permits were still in progress. As such, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in June 2021. The new maturity date passed with no repayment, with the borrower advising that permitting remained an ongoing issue. Groundfloor continued communicating with the borrower as renovations continued through July and August, but ultimately Groundfloor elected to commence foreclosure proceedings in September 2021. Foreclosure proceedings continued through October 2021. However, before foreclosure could be completed, the loan was repaid in November 2021.

2062 Detroit Ave NW - Repaid Via REO

The project began in December 2019 and the loan had an original maturity date in February 2021. In August 2020, the borrower advised that renovations were progressing ahead of schedule and the project was nearing completion. However, the maturity date approached with no repayment from the borrower, so in February 2021 Groundfloor issued a Notice of Default. In March 2021, the borrower advised that they intended to pay off the loan by the end of April. The borrower subsequently advised that the property was under contract with an expected closing date in June 2021. However, the contract fell through, and the borrower subsequently advised that they were pursuing a refinance, with an expected repayment in August 2021. After multiple calls and emails with the borrower discussing the project, Groundfloor elected to commence foreclosure proceedings on the property in September 2021. A foreclosure date in November 2021 was scheduled. The property was sold to a third party and the loan was subsequently repaid in November 2021.

929 East Ramseur St - Repaid Via REO

The project began in December 2018 and the loan had an original maturity date in December 2019. In December 2019, Groundfloor provided loan leniency in the form of a 90-day extension and a new maturity date was set in March 2020. In February 2020, the borrower advised that the property was actively listed on the market. However, the maturity date passed with no repayment, so in March 2020 Groundfloor engaged legal counsel to proceed with foreclosure. The foreclosure process continued through the next few months, and a foreclosure sale date was set for August 2020. However, in September 2020, our counsel advised that the county courthouse had closed due to an outbreak of COVID-19, and a new sale date in September had been set. On the scheduled date of sale, the borrower filed for bankruptcy, necessitating Groundfloor to engage our bankruptcy attorney. Bankruptcy proceedings remained ongoing through the end of 2020. In February 2021, our attorney advised that a foreclosure sale date was set for March 2021. Groundfloor was the successful bidder at the foreclosure sale. Foreclosure proceedings continued throughout the next few months as Groundfloor waited for the Upset Bid period to expire as per state law. Additionally, as the property was occupied at the time of foreclosure, Groundfloor’s legal team had to pursue legal remedies to order the tenant to vacate. In August 2021, Groundfloor received notice that the property had been secured and lockout was complete. The property was actively listed on the market in September 2021, and in October 2021 the property went under contract, with an expected closing date in November 2021. However, shortly thereafter, Groundfloor received notice that the property had been broken into and all appliances and mechanicals were stolen. In November 2021, Groundfloor accepted an offer to repay the loan with a full principal recovery.

1446 Southwest 25th Pl - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in November 2021. The project was completed and staging for the market was underway as the maturity date arrived. The borrower needed additional time to complete the staging, and the loan was subsequently repaid in November 2021.

426 Walnut St - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market and that renovations had been completed. When the maturity date passed with no repayment, Groundfloor sent a Notice of Default to the borrower. The property subsequently went under contract and the loan was repaid in November 2021.

3036 College Ave - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in April 2021. The maturity date arrived with no repayment, so Groundfloor sent a Notice of Default to the borrower. The borrower advised that the property was nearing completion and was scheduled to be listed on the market. However, the property had not been sold by September 2021, so Groundfloor engaged in workout discussions with the borrower in an attempt to avoid foreclosure. In November 2021, the borrower requested a payoff, and the loan was repaid shortly after.

846 North Clayton St - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in October 2021. In July 2021, the borrower advised that the property was actively listed and had a pending sale. The property went under contract with an expected closing date in September 2021. In October 2021, the borrower advised that they were negotiating an offer. The loan was repaid in November 2021.

712 Glenwood Ave SE Unit B - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. The maturity date passed with no repayment, so Groundfloor sent a Notice of Default to the borrower. The borrower subsequently advised that the property was under contract with an expected closing date in November 2021. The loan was subsequently repaid.

620 Dashland Dr - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. In November 2021, the borrower advised that the property was under contract. The property was sold and the loan was repaid in November 2021.

622 Dashland Dr - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in November 2021. In October 2021, the borrower advised that the property was under contract. The closing was delayed slightly due to corrections needed on some paperwork, and the loan was subsequently repaid in November 2021.

3153 Whitethorn Dr - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in August 2021. The maturity date passed with no repayment, so Groundfloor sent a Notice of Default to the borrower. In September 2021, the borrower advised that renovations were nearing completion and the property was scheduled to be listed on the market. In October 2021, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in November 2021. The loan was subsequently repaid in November 2021.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 191 Katherine Dr

- 154 Clay St SE

- 1136 Oak Knoll Ter SE

- 3130 Lavista Rd

- 785 Thurmond St NW

- 3812 Donaldson Dr

- 782 Dixie Ave NE

- 758 Charlotte Pl NW

- 2557 Glenwood Ave SE

- 1504 Beecher St SW

- 768 East 3rd St

- 127 Hunts Mill Cir

- 129 Hunts Mill Cir

- 1999 Willa Way

- 2000 Willa Dr

- 900 Center Hill Ave NW

- 9343 Corbin Rd

- 5201 Southwest 3rd Ct

- 533 James P Brawley Dr NW

- 1375 Alverado Way

We proceeded with foreclosure actions on the following properties last month:

- 595 Twilley Rd NW

- 879 Sims St SW

- 5111 9th Ave N

- 1795-1797 West Grand Blvd

- 3855 Eloise St

- 3450 Trout River Blvd

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

We sold the following real estate owned properties last month: