After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

As 2021 continues, we are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from September 2021.

You may view activity from previous periods by clicking the links below.

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

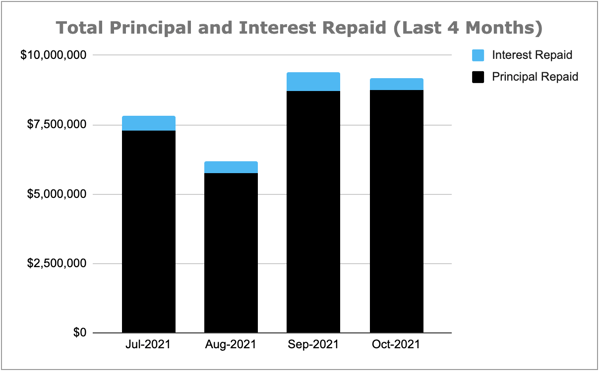

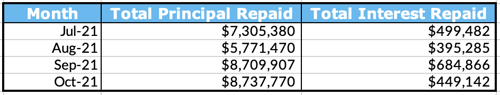

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

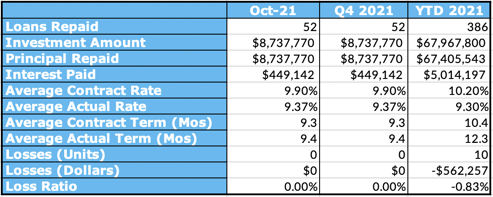

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q4 2021, and loans repaid year-to-date in 2021.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

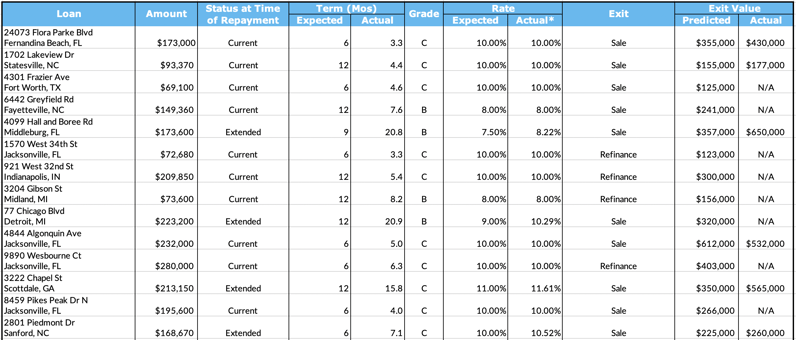

Last Month’s Repayments - October 2021

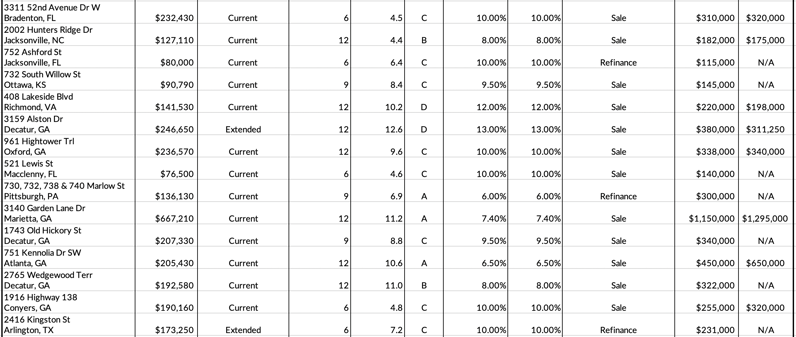

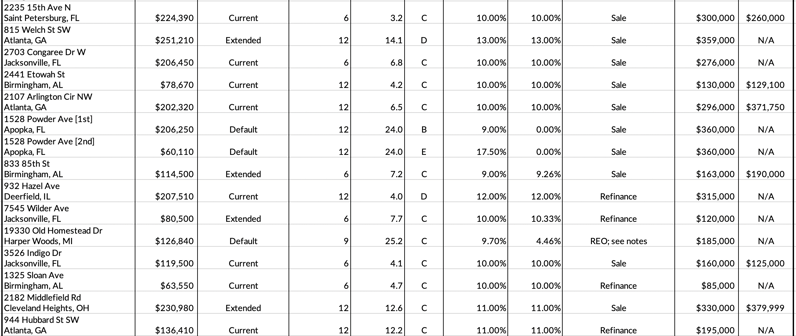

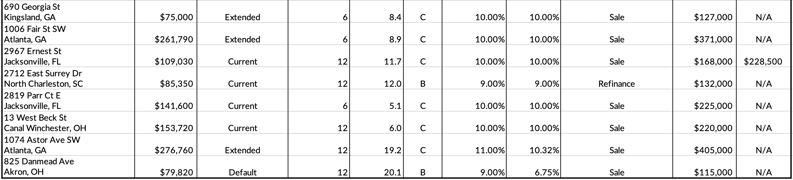

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

24073 Flora Parke Blvd

1702 Lakeview Dr

4301 Frazier Ave

6442 Greyfield Rd

4099 Hall and Boree Rd

1570 West 34th St

921 West 32nd St

3204 Gibson St

77 Chicago Blvd

4844 Algonquin Ave

9890 Wesbourne Ct

3222 Chapel St

8459 Pikes Peak Dr N

2801 Piedmont Dr

3311 52nd Avenue Dr W

2002 Hunters Ridge Dr

752 Ashford St

732 South Willow St

408 Lakeside Blvd

3159 Alston Dr

961 Hightower Trl

521 Lewis St

730, 732, 738 & 740 Marlow St

3140 Garden Lane Dr (LRO #1, LRO #2, LRO #3)

1743 Old Hickory St

751 Kennolia Dr SW (LRO #1, LRO #2)

2765 Wedgewood Terr

1916 Highway 138

2416 Kingston St

2235 15th Ave N

815 Welch St SW

2703 Congaree Dr W

2441 Etowah St

2107 Arlington Cir NW

1528 Powder Ave (1st payment position, 2nd payment position)

833 85th St

932 Hazel Ave

7545 Wilder Ave

19330 Old Homestead Dr

3526 Indigo Dr

1325 Sloan Ave

2182 Middlefield Rd

944 Hubbard St SW

690 Georgia St

1006 Fair St SW

2967 Ernest St

2712 East Surrey Dr

2819 Parr Ct E

13 West Beck St

1074 Astor Ave SW

825 Danmead Ave

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 52 loans were repaid. 35 of them were current, repaying on time and in full. 17 were special situation loans, the details of which are below.

4099 Hall and Boree Rd - Repaid Via Extension

The project began in January 2020 and the loan had an original maturity date in October 2020. After experiencing some delays due to COVID-19, the project progressed and renovations were largely complete as the maturity date approached. Groundfloor reached a workout settlement to allow the borrower more time to finish up the renovation work. The borrower advised that the property was actively listed on the market in early 2021. After some time on the market, in May 2021 the property’s list price was reduced and the borrower changed agents to help expedite a sale. The property remained on the market for the next few months. Finally, in September 2021, the borrower advised that the property was under contract. The loan was subsequently repaid in October 2021.

77 Chicago Blvd - Repaid Via Extension

The project began in January 2020 and the loan had an original maturity date in January 2021. In January 2021, the borrower advised that they anticipated the project being completed and listed by March 2021. In March 2021, the borrower advised that the property was listed on the market; however, in April 2021 they had to delist the property in order to repair a roof leak. The roof was repaired and the property was relisted on the market by July 2021. In September 2021, the property went under contract, and in October 2021 the loan was repaid.

3222 Chapel St - Repaid Via Extension

The project began in June 2020 and the loan had an original maturity date in June 2021. As the maturity date approached, the borrower was still finishing up the final stages of the renovation work. As the maturity date passed, Groundfloor sent a Notice of Default to the borrower because the loan was not repaid by the maturity date. A workout agreement was subsequently reached, giving a new maturity date in September 2021. This date arrived with no repayment, so Groundfloor reached an additional workout agreement with the borrower, giving a new maturity date in December 2021. The loan was subsequently repaid in October 2021.

2801 Piedmont Dr - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. The maturity date arrived with no repayment by the borrower, so Groundfloor sent a Notice of Default to the borrower. The borrower advised they needed just a little more time for the property sale to complete to repay the loan. The loan was then repaid in October 2021.

3159 Alston Dr - Repaid Via Extension

The project began in September 2020 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in September 2021. The closing ended up taking longer than anticipated. The loan was repaid in October 2021.

2416 Kingston St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that they were in the final stages of refinancing the loan. The loan was subsequently repaid in October 2021.

815 Welch St SW - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. In June 2021, the borrower advised that they were experiencing delays in receiving city permits. In September 2021, Groundfloor received a payoff request, and the loan was repaid in October 2021.

1528 Powder Ave [1st] [2nd] - Repaid Out Of Default

The project began in October 2019 and the loan had an original maturity date in October 2020. As renovations continued, the borrower advised Groundfloor that they intended to refinance the loan. In October 2020, the borrower advised that the refinance process remained ongoing. As the maturity date passed with no repayment, in November 2020 Groundfloor sent a Notice of Default to the borrower. The default period expired with no repayment, so in December 2020 Groundfloor engaged legal counsel to begin foreclosure proceedings. In January 2021, the borrower advised that they were still pursuing a refinance. Refinancing continued in tandem with foreclosure proceedings for the next several months. In May 2021, the borrower advised that the property was under contract with an expected closing date in June 2021. The closing date was pushed to September 2021, and the loan was finally repaid in October 2021.

833 85th St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. In August 2021, the borrower advised that the property was actively listed on the market. The property needed a little more time to sell. The loan was repaid in October 2021.

7545 Wilder Ave - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in August 2021. As the maturity date passed, the borrower advised that they were in the process of refinancing the loan. The loan was subsequently repaid in October 2021.

19330 Old Homestead Dr - Repaid Via REO

The project began in September 2019 and the loan had an original maturity date in June 2020. In March 2020, the borrower advised that the property was under contract and scheduled to close at the end of the month. However, in April 2020, the borrower advised that the closing had been delayed due to COVID-19. Later on that same month, Groundfloor issued a Notice of Default to the borrower for a failure to keep current with the monthly interest payments. The default period expired with no payments to bring the loan current, so in May 2020 Groundfloor engaged counsel to proceed with foreclosure. The Foreclosure process continued through the next months into 2021. In January 2021, our attorney advised that foreclosure proceedings were on hold due to a temporary foreclosure moratorium in place due to COVID-19. The foreclosure remained on hold through the spring and summer. In August 2021, our attorney advised that the foreclosure sale was scheduled for September 2021. At the foreclosure sale, Groundfloor was the successful bidder, and our team began preparing the property for sale. The loan was repaid in October 2021.

2182 Middlefield Rd - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in October 2021. In May 2021, the borrower advised that renovations had been completed and the property was in the process of being listed. In September 2021, the borrower advised that they had reduced the asking price to encourage interest. The maturity date arrived with no repayment, but a few weeks later the loan was repaid.

690 Georgia St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in August 2021. In July 2021, the borrower advised that the property was actively listed on the market. In September 2021, the borrower advised that the property was under contract. The closing process took several weeks to complete, and the loan was repaid in October 2021.

1006 Fair St SW - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in July 2021. The borrower needed more time to repay the loan, so Groundfloor reached a workout agreement. The loan was repaid in October 2021.

1074 Astor Ave SW - Repaid Via Extension

The project began in March 2020 and the loan had an original maturity date in March 2021. In February 2021, the borrower advised that the property was under contract. The property remained under contract as the borrower finished up renovations, which experienced delays due to COVID-19. The borrower advised that all work would be completed by August 2021. The borrower worked to pay off the loan over the next months, and the loan was fully repaid in October 2021.

825 Danmead Ave - Repaid Out Of Default

The project began in February 2020 and the loan had an original maturity date in February 2021. As the maturity date passed with no repayment, Groundfloor sent the borrower a Notice of Default in February 2021. In March 2021, Groundfloor engaged in workout discussions with the borrower as an alternative to foreclosure. Groundfloor subsequently agreed to a workout settlement, giving a new maturity date in June 2021. That maturity date passed with no repayment from the borrower, so Groundfloor sent a Notice of Default and began preparing to begin the foreclosure process. In September 2021, Groundfloor again reached a workout agreement, giving a new maturity date in October 2021. The loan was subsequently repaid.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 123 Leather Cir

- 2167 Montrose Ave SW

- 1041 Stonewall Dr SE

- 544 Higher Combe Dr

- 1122 Merrill Ave SW

- 1883 Brewer Blvd

- 3130 Lavista Rd

- 1423 Lanvale Dr SW

- 8610 West Potomac Ave

- 1711 Floyd Rd

We proceeded with foreclosure actions on the following properties last month:

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

We sold the following real estate owned properties last month: