After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

We are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from February 2022.

You may view activity from previous periods by clicking the links below.

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

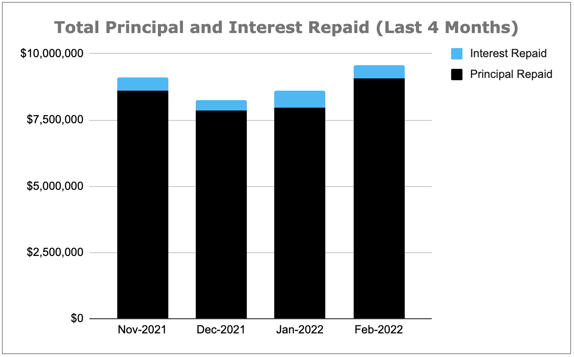

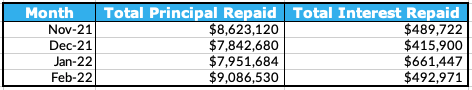

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

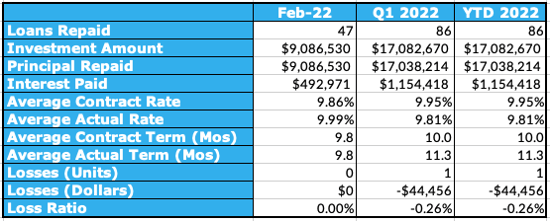

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q1 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

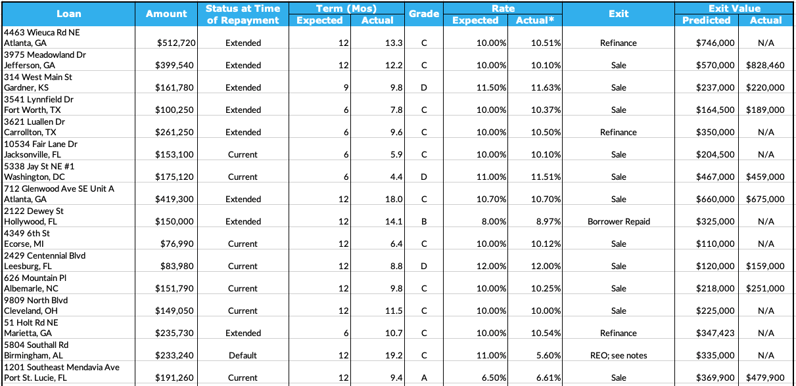

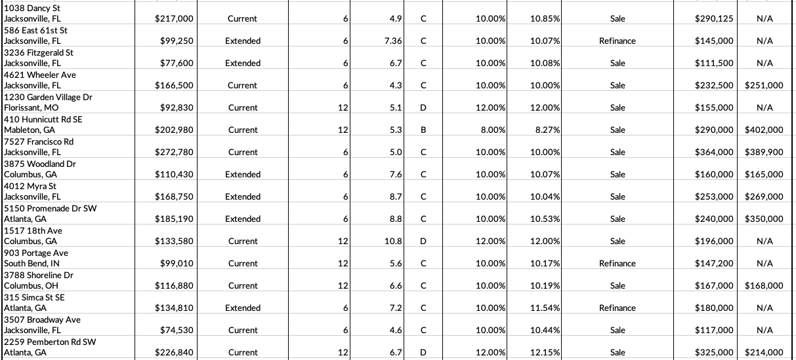

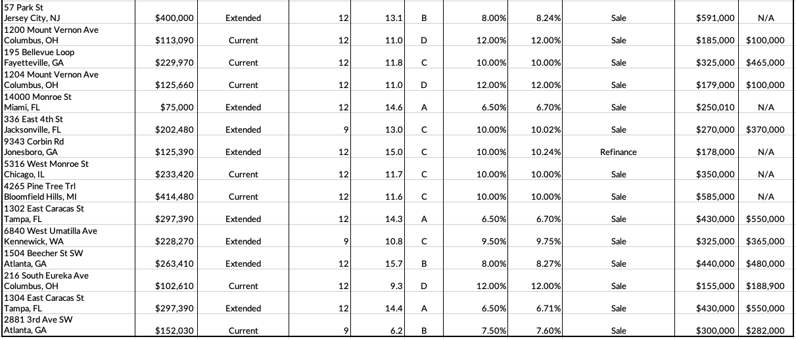

Last Month’s Repayments - February 2022

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

4463 Wieuca Rd NE (LRO #1, LRO #2)

3975 Meadowland Dr (LRO #1, LRO #2, LRO #3, LRO #4)

314 West Main St

3541 Lynnfield Dr

3621 Luallen Dr

10534 Fair Lane Dr

5338 Jay St NE #1

712 Glenwood Ave SE Unit A (LRO #1, LRO #2, LRO #3)

2122 Dewey St

4349 6th St

2429 Centennial Blvd

626 Mountain Pl (LRO #1, LRO #2)

9809 North Blvd

51 Holt Rd NE

5804 Southall Rd

1201 Southeast Mendavia Ave (LRO #1, LRO #2)

1038 Dancy St

586 East 61st St

3236 Fitzgerald St

4621 Wheeler Ave

1230 Garden Village Dr

410 Hunnicutt Rd SE

7527 Francisco Rd

3875 Woodland Dr

4012 Myra St

5150 Promenade Dr SW

1517 18th Ave

903 Portage Ave

3788 Shoreline Dr

315 Simca St SE

3507 Broadway Ave

2259 Pemberton Rd SW

57 Park St

1200 Mount Vernon Ave

195 Bellevue Loop

1204 Mount Vernon Ave

14000 Monroe St

336 East 4th St

9343 Corbin Rd

5316 West Monroe St

4265 Pine Tree Trl (LRO #1, LRO #2)

1302 East Caracas St

6840 West Umatilla Ave

1504 Beecher St SW

216 South Eureka Ave

1304 East Caracas St

2881 3rd Ave SW

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 47 loans were repaid. 25 of them were current, repaying on time and in full. 22 were special situation loans, the details of which are below.

4463 Wieuca Rd NE - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that permitting was still in progress. Groundfloor helped connect the borrower with a refinance lender in order to expedite an exit. In January 2022, the borrower advised that the refinance process was ongoing. The loan was subsequently repaid in February 2022.

3975 Meadowland Dr - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that the property was under contract and the renovations were nearing completion. The project was completed and the loan was repaid in February 2022.

314 West Main St - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in late January. The property was sold and the loan was repaid in February 2022.

3541 Lynnfield Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was currently actively listed on the market and had received several offers. Negotiations continued through December 2021. The property was sold and the loan was repaid in February 2022.

3621 Luallen Dr - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, the borrower advised that renovations were nearing completion. In December 2021, the borrower advised that they were in the process of refinancing the loan, with an expected closing date in January 2022. The refinance was completed and the loan was repaid in February 2022.

712 Glenwood Ave SE Unit A - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in August 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in November 2021. As this maturity date approached, Groundfloor again reached a workout settlement with the borrower, giving a new maturity date in March 2022. The project was completed and the loan was repaid in February 2022.

2122 Dewey St - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date passed, the borrower advised that they were in the process of refinancing the loan, with an expected closing date in January 2022. However, the refinance did not go through, so in January 2022 the borrower advised they had listed the property on the market. The property was sold and the loan was repaid in February 2022.

51 Holt Rd NE - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in September 2021. As the maturity date passed, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in December 2021. As that new maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance continued through January 2022, and the loan was repaid in February 2022.

5804 Southall Rd - Repaid Via REO

The project began in July 2020 and the loan had an original maturity date in July 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor began workout discussions with the borrower; however, a workout agreement was not reached, so after the maturity date passed with no repayment, Groundfloor commenced foreclosure proceedings. Foreclosure proceedings were ongoing through September and October, and in November 2021 Groundfloor was the successful bidder at the foreclosure auction. Groundfloor secured the property and prepared it for sale through November and December. In December 2021, Groundfloor received an off-market offer, with an expected closing date in January 2022. The property was sold and the loan was repaid with full principal and partial interest in February 2022.

586 East 61st St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that renovations were completed. Groundfloor received a payoff request in mid December 2021. The loan was repaid in February 2022.

3236 Fitzgerald St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the project was completed, and the loan was repaid in February 2022.

3875 Woodland Dr - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was under contract. The loan was repaid in February 2022.

4012 Myra St - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that renovations were nearing completion. The project was completed and the loan was repaid in February 2022.

315 Simca St SE - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process was successful and the loan was repaid in February 2022.

57 Park St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, Groundfloor began workout discussions with the borrower. The loan was subsequently repaid in February 2022.

14000 Monroe St - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in January 2022. The borrower subsequently advised that the property was under contract, with an expected closing date in February 2022. The loan was repaid in February 2022.

336 East 4th St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. The property remained on the market through November and December. The loan was repaid in February 2022.

9343 Corbin Rd - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. Groundfloor reached a workout settlement with the borrower, giving a new maturity date in February 2022. The loan was subsequently repaid in February 2022.

1302 East Caracas St - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. In January 2022, the borrower advised that the property was under contract. The loan was repaid in February 2022.

6840 West Umatilla Ave - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in January 2022. Groundfloor subsequently agreed to an additional extension, giving a new maturity date in February 2022. The loan was then repaid in February 2022.

1504 Beecher St SW - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in February 2022. The loan subsequently was repaid in February 2022.

1304 East Caracas St - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that renovations were nearing completion. Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. In January 2022, the borrower advised that the property was under contract. The loan was repaid in February 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 1803 Vinton St

- 1807 Vinton St

- 139 Tonawanda Dr

- 2887 Grand Ave SW

- 150 Edwards St NW

- 5417 Cannas Dr

- 2752 Lancaster Dr

- 2119 Penelope St NW

- 367 Andrew Hairston Pl NW

- 3350 Lawrence St

- 1002 Hiawatha Dr

- 127 Hunts Mill Circle

- 129 Hunts Mill Circle

- 1906 Maywood Pl NW

- 1154 Tecumseh St

- 0 Roy St SW

- 5015 West Wabanasia Ave

- 120 Waldor Ave

- 176 Vanira Ave SE

- 176 Vanira Ave SE - B

We did not proceed with any foreclosure actions last month.

Real Estate Owned (REO) Activity:

We did not take possession of any new properties last month.

We went under contract to sell the following properties last month:

We sold the following real estate owned properties last month: