After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

We are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from January 2022.

You may view activity from previous periods by clicking the links below.

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

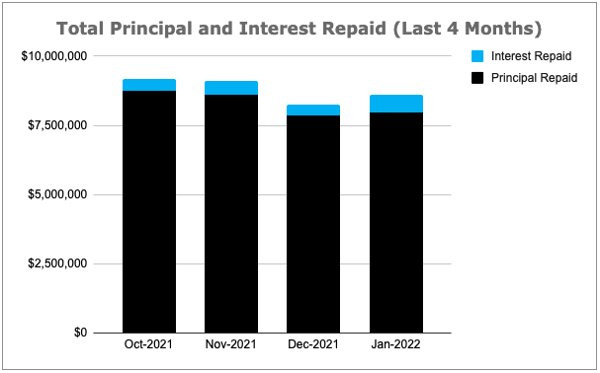

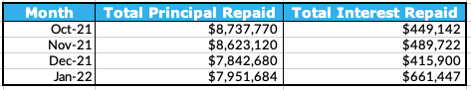

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

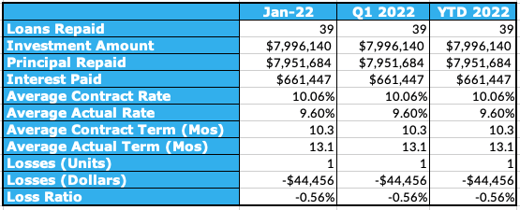

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q1 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

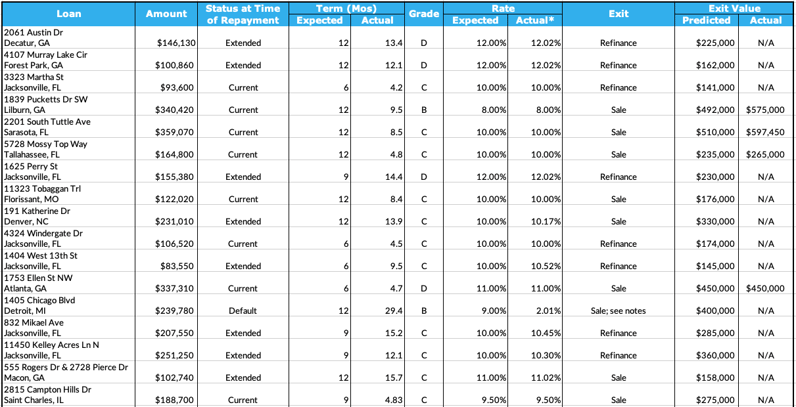

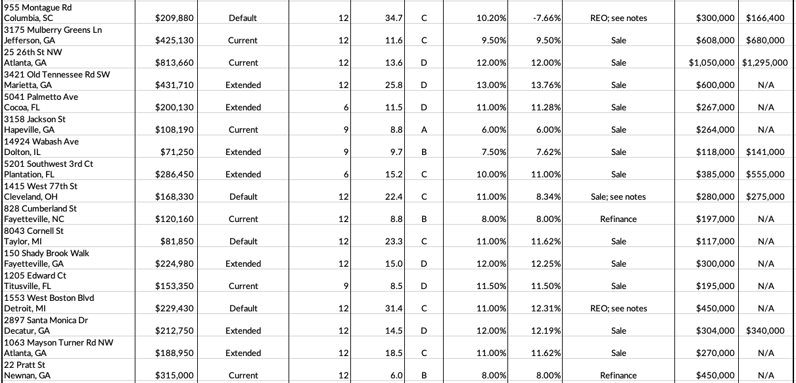

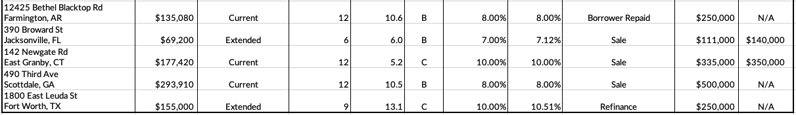

Last Month’s Repayments - January 2022

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

2061 Austin Dr

4107 Murray Lake Cir

3323 Martha St

1839 Pucketts Dr SW

2201 South Tuttle Ave (LRO #1, LRO #2)

5728 Mossy Top Way

1625 Perry St

11323 Tobaggan Trl

191 Katherine Dr

4324 Windergate Dr

1404 West 13th St

1753 Ellen St NW

1405 Chicago Blvd

832 Mikael Ave

11450 Kelley Acres Ln N

555 Rogers Dr & 2728 Pierce Dr

2815 Campton Hills Dr

955 Montague Rd

3175 Mulberry Greens Ln (LRO #1, LRO #2, LRO #3, LRO #4)

25 26th St NW (LRO #1, LRO #2, LRO #3)

3421 Old Tennessee Rd SW (LRO #1, LRO #2, LRO #3)

5041 Palmetto Ave

3158 Jackson St

14924 Wabash Ave

5201 Southwest 3rd Ct

1415 West 77th St

828 Cumberland St

8043 Cornell St

150 Shady Brook Walk

1205 Edward Ct

1553 West Boston Blvd

2897 Santa Monica Dr

1063 Mayson Turner Rd NW

22 Pratt St

12425 Bethel Blacktop Rd

390 Broward St

142 Newgate Rd

490 Third Ave

1800 East Leuda St

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 39 loans were repaid. 17 of them were current, repaying on time and in full. 22 were special situation loans, the details of which are below.

2061 Austin Dr - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. Groundfloor then reached a workout settlement with the borrower, giving a new maturity date in December 2021. The borrower advised that the refinance process would be finished by the end of the month. The loan was repaid in January 2022.

4107 Murray Lake Cir - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. The project was progressing as planned and Groundfloor had received a payoff request good through December 2021. The loan was subsequently repaid in January 2022.

1625 Perry St - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in August 2021. As the maturity date approached, the borrower advised that the property was under contract, with an expected closing date in October 2021. However, the contract did not go through. After several other sales did not go through, the borrower advised that they were instead pursuing a refinance. The refinance process continued through the end of the year, and the loan was then repaid in January 2022.

191 Katherine Dr - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was under contract. Groundfloor then reached a workout settlement with the borrower, giving a new maturity date in January 2022. The loan was subsequently repaid in January 2022.

1404 West 13th St - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in late September 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan, with an expected closing date in late October 2021. However, the refinancing process took longer than anticipated as the borrower was still waiting on the appraisal in November 2021. In December, the borrower and loan processor advised that the refinance would be completed by the end of the month. The loan was subsequently repaid in January 2022.

1405 Chicago Blvd - Repaid Out Of Default

The project began in June 2019 and the loan had an original maturity date in August 2020. In August 2020, Groundfloor provided loan leniency in the form of an extension, giving a new maturity date in October 2020. The property was in need of a lot of work; however, Groundfloor was unable to initiate foreclosure proceedings because the county was not holding foreclosure sales. Instead, Groundfloor focused on connecting the borrower with a refinance lender, while also granting an extension so the borrower could continue working on the project. The extension gave a new maturity date in March 2021. Unfortunately, the refinance fell through; the borrower then advised that they were going to list the house for sale as-is. Selling the property proved unsuccessful. Finally, once the foreclosure moratorium was lifted, in September 2021 Groundfloor initiated foreclosure proceedings. Foreclosure proceedings continued through the following months. In November 2021, Groundfloor accepted a short sale offer to avoid foreclosure, with an expected closing date in January 2022. The loan was subsequently repaid with a 2% interest rate in January 2022.

832 Mikael Ave - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in July 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. As the borrower was in good standing, Groundfloor provided a forbearance agreement so the renovations could be completed and so the refinance could go through. The refinancing process continued through the following months, and the loan was finally repaid in January 2022.

11450 Kelley Acres Ln N - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in October 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The borrower subsequently advised that they were experiencing delays with the property appraisal; the appraisal was completed in November 2021 and the refinance process was able to continue. The refinance completed and the loan was repaid in January 2022.

555 Rogers Dr & 2728 Pierce Dr - Repaid Via Extension

The project began in September 2020 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that the properties were actively listed on the market. The properties were cross-collateralized with each other; 555 Rogers sold first, and the borrower was able to use those funds to partially pay off the loan. 2728 Pierce took longer to sell. The borrower needed more time to finish up construction and sell the property, so Groundfloor granted an extension. The borrower was finally able to sell 2728 Pierce and pay off the rest of the loan in January 2022.

955 Montague Rd - Repaid Via REO

The project began in February 2019 and the loan had an original maturity date in February 2020. As the maturity date approached, the borrower advised that they were in the process of refinancing their loan. As the maturity date passed with no repayment, Groundfloor sent a Notice of Default to the borrower and notified them that if the loan was not repaid by March 2020, they would be foreclosed on. The loan was not repaid, so in March 2020 Groundfloor initiated foreclosure proceedings. Foreclosure proceedings continued through the next several months.The foreclosure date was scheduled in October 2020; Groundfloor was the successful bidder at the sale and after taking time to prepare the property, Groundfloor began actively marketing the property in January 2021. The property remained on the market for several months. In July 2021, Groundfloor advised that the property was under contract; however, the sale fell through. In September 2021, the property was relisted on the market at a lower price to attract buyers. The property remained on the market through the end of 2021. In January 2022, the property was finally sold and the loan was repaid.

The property was sold for $166,400. After adding the remaining escrow balance and subtracting foreclosure costs and fees, the net recovery on this property was $165,380.58, which represents a 79% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

3421 Old Tennessee Rd SW - Repaid Via Extension

The project began in December 2019 and the loan had an original maturity date in November 2020. The borrower advised that the permitting process was very delayed due to COVID-19, which delayed the start of the project for several months. As such, Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in May 2021. As the new maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance process continued through the next few months; as such, Groundfloor agreed to another workout settlement, giving a new maturity date in December 2021. The loan was repaid in January 2022.

5041 Palmetto Ave - Repaid Via Extension

The project began in February 20221 and the loan had an original maturity date in July 2021. As the maturity date approached, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in October 2021. The borrower subsequently advised that the property was under contract, with an expected closing date in November 2021. The closing was delayed until January, and the loan was finally repaid in January 2022.

14924 Wabash Ave - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was under contract. The loan was subsequently repaid in January 2022.

5201 Southwest 3rd Ct - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in April 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in July 2021. Groundfloor reached a second workout agreement with the borrower, extending the maturity date to September 2021. The borrower subsequently advised that the property was under contract with an expected closing date in November 2021. The closing was delayed. The loan was finally repaid in January 2022.

1415 West 77th St - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in March 2021. As the maturity date approached, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in June 2021. The property was listed on the market but was not receiving offers. The borrower decided to reduce the price to encourage sales, and Groundfloor agreed to an additional workout settlement, giving a new maturity date in August 2021. The loan was not repaid by this date, so Groundfloor commenced foreclosure proceedings in November 2021. Groundfloor subsequently repaid the loan in January 2022.

8043 Cornell St - Repaid Out Of Default

The project began in January 2020 and the loan had an original maturity date in February 2021. As the maturity date arrived with no repayment by the borrower, Groundfloor began workout discussions as an alternative to foreclosure. Workout discussions were unsuccessful; however, Groundfloor was unable to pursue foreclosure because there was a foreclosure moratorium in place. In july 2021, foreclosure moratoriums were lifted and Groundfloor began foreclosure proceedings. At the same time, the borrower was continuing to work on the property, and in September 2021 the borrower advised that they were in the process of refinancing the loan. Foreclosure proceedings continued through the next few months. In November 2021, the borrower advised that the property was under contract. The sale went through and the loan was repaid in January 2022.

150 Shady Brook Walk - Repaid Via Extension

The project began in October 2020 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor reached a workout agreement with the borrower, giving a new maturity date in January 2022. The loan was subsequently repaid in January 2022.

1553 West Boston Blvd - Repaid Via REO

The project began in June 2019 and the loan had an original maturity date in June 2020. As the maturity date approached, Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in October 2020. As that maturity date approached, Groundfloor reached an additional workout settlement with the borrower, giving a new maturity date in March 2021. The project still remained unfinished as March 2021 arrived; however, Groundfloor was unable to proceed with foreclosure as there was a foreclosure moratorium in place. In August 2021, Groundfloor was able to proceed with foreclosure proceedings. The foreclosure sale was set for November 2021. Groundfloor was the successful bidder at the foreclosure sale, and the loan was subsequently repaid in January 2022.

2897 Santa Monica Dr - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date arrived, Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in January 2022. The property subsequently went under contract and the loan was repaid in January 2022.

1063 Mayson Turner Rd NW - Repaid Via Extension

The project began in July 2020 and the loan had an original maturity date in July 2021. As the maturity date arrived, Groundfloor agreed to a workout settlement with the borrower, giving a new maturity date in November 2021. The borrower subsequently advised that the property was under contract with an expected closing date in December 2021. The closing was delayed until January 2022. The loan was then repaid in January 2022.

390 Broward St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. The loan was repaid several days after the maturity date passed.

1800 East Leuda St - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in September 2021. As the maturity date approached, the borrower advised that the property was under contract. Unfortunately, the sale fell through, so in December 2021 the borrower advised that they were in the process of refinancing the loan. The refinance went through and the loan was repaid in January 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 1086 West Ave SW

- 712 Glenwood Ave SE - Unit A

- 1396 Beatie Ave SW

- 73 Rockyford Rd NE

- 3860 Outer Dr

- 2167 Montrose Ave SW

- 2002 Fargo Pl SE

- 0 Fontaine Rd

- 1328 Gus Thornhill Jr Dr

- 123 Leathers Cir

- 2897 Santa Monica Dr

- 8620 Canal Dr

- 9343 Corbin Rd

- 1033 Allene Ave SW

- 128 Nathan Rd SW

- 707 Essex Court

- 507 Dona Dr

- 6840 West Umatilla Ave

We proceeded with foreclosure actions on the following properties last month:

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

- 356 Osage St

- 5221 Court J

We sold the following real estate owned properties last month: