After the COVID-19 pandemic’s onset in Q2 2020 triggered upheaval and uncertainty in financial and real estate markets, we wanted to provide Groundfloor investors with more insight into our asset management team’s activities.

On the heels of our extensive stress test analysis, which looked at the potential effects a coronavirus-related recession could have on our investors’ portfolios, starting in May 2020 our team began publishing weekly updates on loan repayments and asset management activities to provide a transparent look at how our loans were actually performing in real time.

We are pleased to continue providing transparent updates of our asset management team’s activities on a monthly basis. This latest installment looks at activity from March 2022.

You may view activity from previous periods by clicking the links below.

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

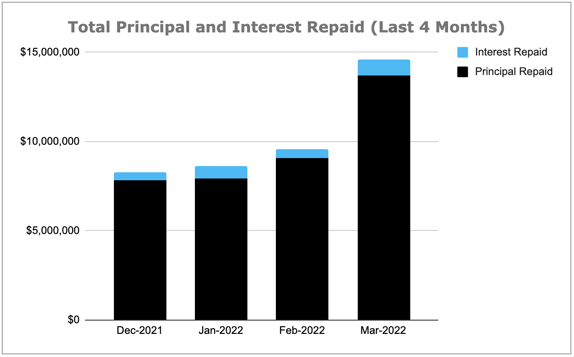

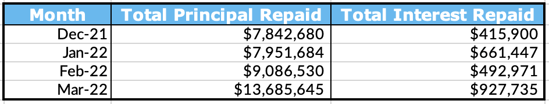

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

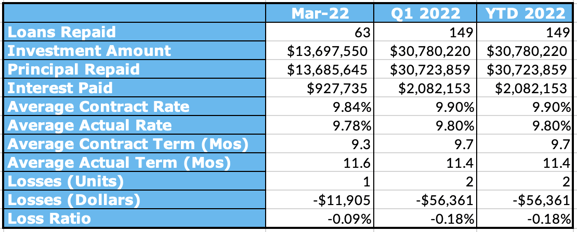

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q1 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

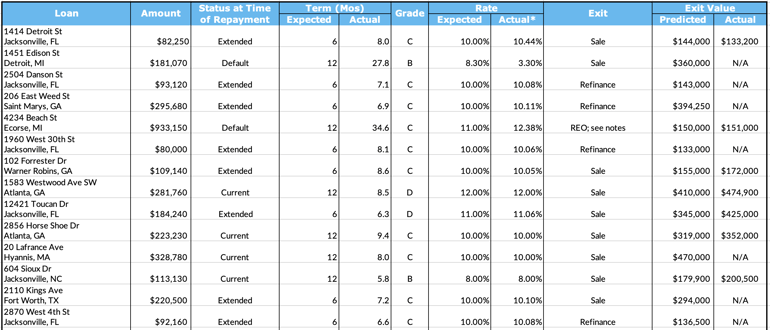

Last Month’s Repayments - March 2022

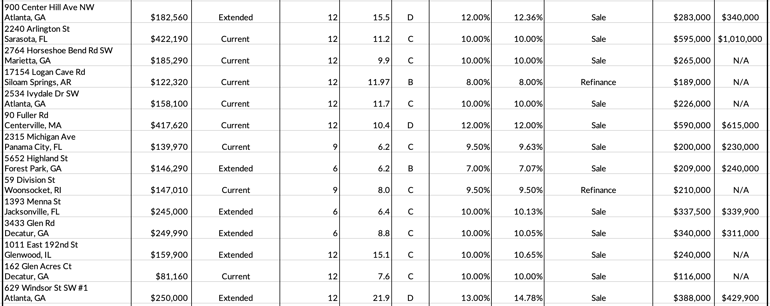

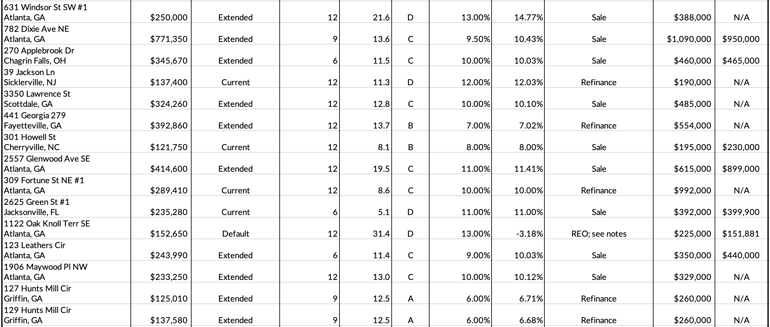

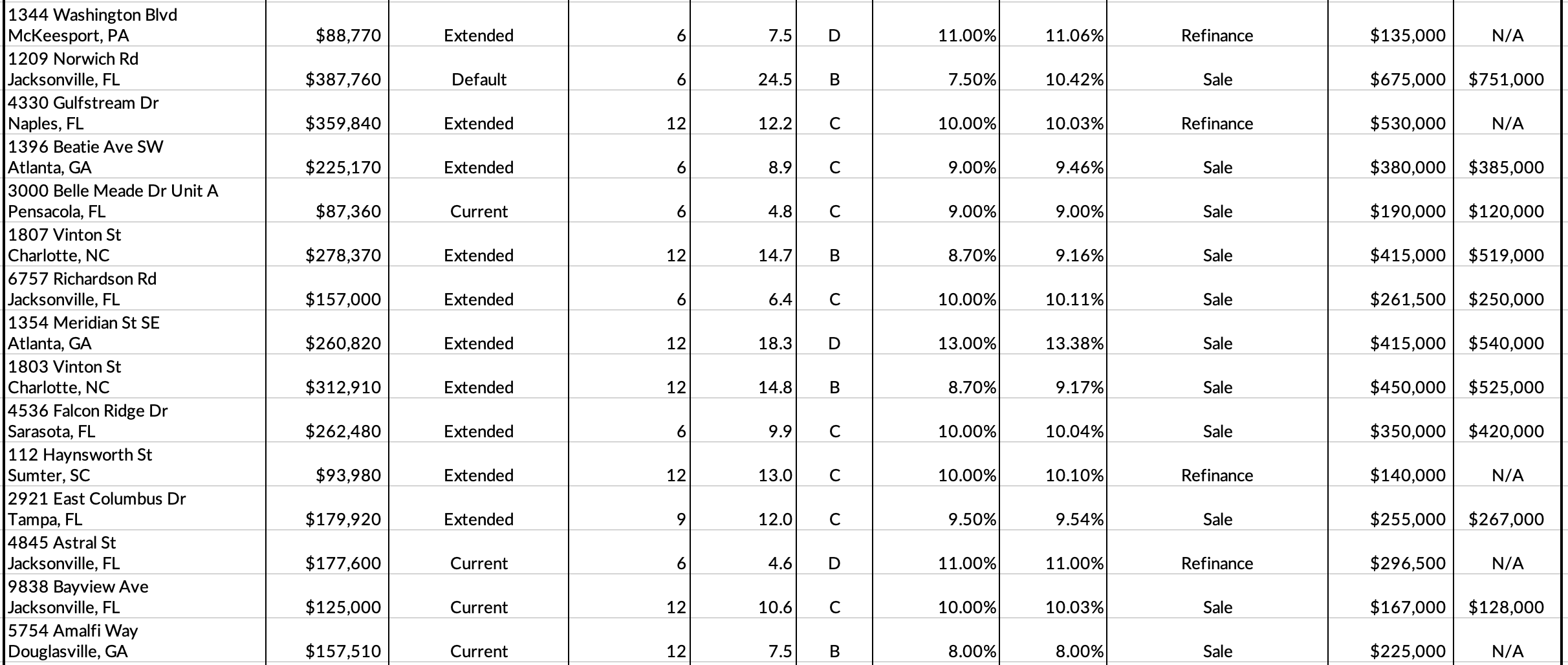

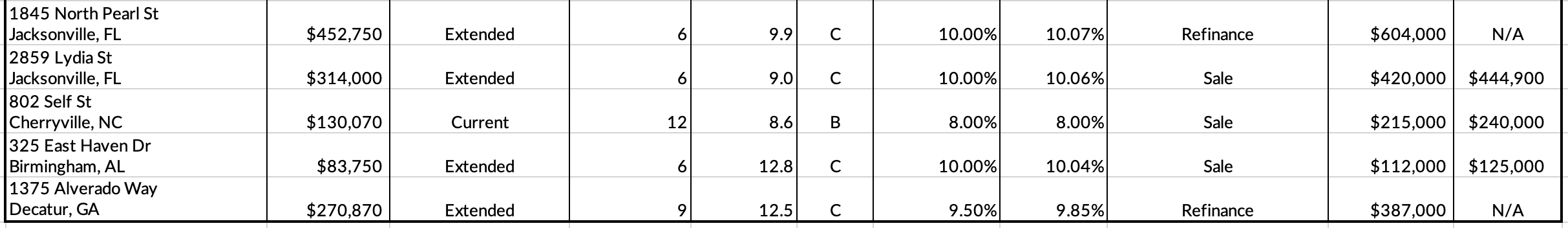

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

Please note that we have recently updated the terminology we use to categorize loan performance. Going forward, we are reserving the label “default” for those loans past maturity in which some legal action is being taken. All loans that reach maturity but are otherwise in good standing or have a contract extension in place will now be labeled “extended.” You can read more about this terminology change in our Portfolio Analysis: Q3 2021.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

1414 Detroit St

1451 Edison St

2504 Danson St

206 East Weed St

4234 Beach St

1960 West 30th St

102 Forrester Dr

1583 Westwood Ave SW

12421 Toucan Dr

2856 Horse Shoe Dr

20 Lafrance Ave

604 Sioux Dr

2110 Kings Ave

2870 West 4th St

900 Center Hill Ave NW

2240 Arlington St (LRO #1, LRO #2)

2764 Horseshoe Bend Rd SW

17154 Logan Cave Rd

2534 Ivydale Dr SW

90 Fuller Rd (LRO #1, LRO #2)

2315 Michigan Ave

5652 Highland St

59 Division St

1393 Menna St

3433 Glen Rd

1011 East 192nd St

162 Glen Acres Ct

629 Windsor St SW #1

631 Windsor St SW #1

782 Dixie Ave NE (LRO #1, LRO #2, LRO #3, LRO #4)

270 Applebrook Dr

39 Jackson Ln

3350 Lawrence St

441 Georgia 279

301 Howell St

2557 Glenwood Ave SE (LRO #1, LRO #2)

309 Fortune St NE #1

2625 Green St #1

1122 Oak Knoll Terr SE

123 Leathers Cir

1906 Maywood Pl NW

127 Hunts Mill Cir

129 Hunts Mill Cir

1344 Washington Blvd

1209 Norwich Rd

4330 Gulfstream Dr (LRO #1, LRO #2)

1396 Beatie Ave SW

3000 Belle Meade Dr Unit A

1807 Vinton St (LRO #1, LRO #2, LRO #3)

6757 Richardson Rd

1354 Meridian St SE

1803 Vinton St (LRO #1, LRO #2, LRO #3)

4536 Falcon Ridge Dr

112 Haynsworth St

2921 East Columbus Dr

4845 Astral St

9838 Bayview Ave

5754 Amalfi Way

1845 North Pearl St (LRO #1, LRO #2)

2859 Lydia St

802 Self St

325 East Haven Dr

1375 Alverado Way

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 63 loans were repaid. 22 of them were current, repaying on time and in full. 41 were special situation loans, the details of which are below.

1414 Detroit St - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in January 2022. In November 2021, the borrower advised that the property was actively listed on the market, and shortly thereafter went under contract. However, in January 2022 the borrower informed that the contract had fallen through and the property was back on the market. In February 2022 the borrower advised that the property was again under contract. This time, the sale went through, and the loan was repaid in March 2022.

1451 Edison St - Repaid Out Of Default

The project began in October 2019 and the loan had an original maturity date in November 2020. In April 2020, the borrower reported delays due to city shutdowns because of COVID-19. The project stalled as city offices remained closed for months, which delayed approval processes. In November 2020, Groundfloor began workout discussions with the borrower in an effort to avoid foreclosure. Workout discussions remained ongoing through December 2020 and January 2021. Ultimately, workout discussions were unsuccessful, and in February 2021 Groundfloor commenced foreclosure proceedings on the property. However, due to a county foreclosure moratorium, foreclosure proceedings were not able to continue. Groundfloor thus began searching for a Receiver to appoint to sell the property. In the meantime, in May 2021 the borrower advised they had a potential cash offer; however, the deal fell through. The borrower subsequently advised they were in the process of refinancing the loan in June 2021. In August 2021, Groundfloor was able to proceed with foreclosure actions on the property. Foreclosure proceedings remained ongoing through the rest of 2021. In February 2022, the borrower advised that the property was sold. The loan was repaid with full principal and partial interest in March 2022.

2504 Danson St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance completed and the loan was repaid in March 2022.

206 East Weed St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance completed and the loan was repaid in March 2022.

4234 Beach St - Repaid Via REO

The project began in April 2019 and the loan had an original maturity date in April 2020. As the maturity date approached, Groundfloor provided loan leniency in the form of a 90-day extension due to COVID-19, giving a new maturity date in July 2020. This maturity date passed with no repayment plan from the borrower, so Groundfloor issued a Notice of Default. Once the default period expired in September 2020, Groundfloor began foreclosure proceedings. Foreclosure proceedings continued throughout the remainder of 2020 and into 2021 as the courts placed a temporary moratorium on foreclosures. The foreclosure sale was finally held in September 2021 and Groundfloor was the successful bidder. Groundfloor worked to get the property preserved and set up for sale through September and October 2021. In tandem with this process, the borrower advised that they were still hoping to achieve an exit before the redemption period expired and were pursuing a refinance. In February 2022, Groundfloor received a payoff request from the borrower, and the loan was repaid in March 2022.

1960 West 30th St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the project was nearing completion. A payoff request was sent to Groundfloor in February 2022 and the loan was repaid in March 2022.

102 Forrester Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that renovations had been completed and the property was listed on the market. In February 2022, the borrower advised that the property was under contract. The sale went through and the loan was repaid in March 2022.

12421 Toucan Dr - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that renovations had been completed and they were expecting to repay the loan on time. The property was sold and the loan was repaid in March 2022.

2110 Kings Ave - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in January 2022. As the maturity date approached, the borrower advised that the property was under contract. To provide extra time for the sale to complete, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in July 2022. The property was sold and the loan was repaid in March 2022.

2870 West 4th St - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that renovations were complete and requested a payoff statement good through the end of February. The loan was subsequently repaid in March 2022.

900 Center Hill Ave NW - Repaid Via Extension

The project began in November 2020 and the loan had an original maturity date in November 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The property was sold and the loan was repaid in March 2022.

5652 Highland St - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in March 2022. In January 2022, the borrower advised that the property was under contract with an expected closing date in February 2022. Closing took longer than expected, but the property was sold and the loan was repaid in March 2022.

1393 Menna St - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower requested a payoff letter good through the end of March. The loan was subsequently repaid in March 2022.

3433 Glen Rd - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. The property remained listed through January 2022, and in February 2022 the borrower advised that the property was under contract. The sale went through and the loan was repaid in March 2022.

1011 East 192nd St - Repaid Via Extension

The project began in December 2020 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the Groundfloor loan and requested a payoff letter good through December. However, the loan did not repay by the maturity date, so Groundfloor began workout discussions with the borrower in an effort to avoid foreclosure. The Groundfloor team confirmed there was a contract to sell the property. The borrower expected to close at the end of December; however, the buyer had difficulty securing financing and the deal ultimately fell through. The property went back under contract shortly thereafter. The property was sold and the loan was repaid in March 2022.

629 Windsor St SW #1 - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in May 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in August 2021. As that maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor reached a new workout agreement with the borrower, giving a new maturity date in December 2021. As this maturity date arrived, the borrower advised that an issue with the property’s retaining wall prevented closing. Groundfloor subsequently granted an additional forbearance to give the borrower time to fix the issue. The issue was remedied and the loan was subsequently repaid in March 2022.

631 Windsor St SW #1 - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in May 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in August 2021. As that maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor reached a new workout agreement with the borrower, giving a new maturity date in December 2021. As this maturity date arrived, the borrower advised that an issue with the property’s retaining wall prevented closing. Groundfloor subsequently granted an additional forbearance to give the borrower time to fix the issue. The issue was remedied and the loan was subsequently repaid in March 2022.

782 Dixie Ave NE - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in January 2022. As that maturity date approached, the borrower advised that they were negotiating with a buyer. The property subsequently went under contract, with an expected closing date in March 2022. The loan was then repaid in March 2022.

270 Applebrook Dr - Repaid Via Extension

The project began in April 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, the borrower expressed concerns about repaying on time due to many delays in the renovation process. Groundfloor granted a forbearance for 90 days to allow the borrower time to finish and list the property. In January 2022, the borrower advised that the property was actively listed on the market. The property went under contract in February 2022 and the loan was repaid in March 2022.

3350 Lawrence St - Repaid Via Extension

The project began in January 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that the property was under contract with an expected closing date in March. The property was sold and the loan was repaid in March 2022.

441 Georgia 279 - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in January 2022. The borrower requested a payoff letter good through March 2022 as the maturity date approached. The loan was subsequently repaid in March 2022.

2557 Glenwood Ave SE - Repaid Via Extension

The project began in August 2020 and the loan had an original maturity date in July 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in December 2021. The borrower subsequently advised that the property was actively listed on the market and the price had been lowered to attract interest. The property was sold and the loan was repaid in March 2022.

1122 Oak Knoll Terr SE - Repaid Via REO

The project began in July 2019 and the loan had an original maturity date in August 2020. As the maturity date approached, Groundfloor granted a forbearance agreement, giving the loan a new maturity date in November 2020. This maturity date passed with no repayment from the borrower, so in January 2021 Groundfloor issued a Notice of Default. In March 2021, Groundfloor began foreclosure proceedings. The foreclosure sale was scheduled for June 2021; Groundfloor was the successful bidder at the sale and began preparing the property to be listed. Unfortunately, during this process the property was vandalized, necessitating an insurance claim. The property was finally listed on the market in December 2021. In February 2022, the property went under contract, and in March 2022 the loan was repaid.

The property was sold for $151,881.37. After adding the remaining escrow balance and subtracting foreclosure costs and fees, the net recovery on this property was $140,745.36, which represents a 92% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

123 Leathers Cir - Repaid Via Extension

The project began in May 2021 and the loan had an original maturity date in October 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in January 2022. As this maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor granted an additional forbearance, giving a new maturity date in March 2022. The property was sold and the loan was repaid in March 2022.

1906 Maywood Pl NW - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The property was sold and the loan was repaid in March 2022.

127 Hunts Mill Cir - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in May 2022. The property was sold and the loan was repaid in March 2022.

129 Hunts Mill Cir - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in May 2022. The property was sold and the loan was repaid in March 2022.

1344 Washington Blvd - Repaid Via Extension

The project began in August 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The refinance completed and the loan was repaid in March 2022.

1209 Norwich Rd - Repaid Out Of Default

The project began in March 2020 and the loan had an original maturity date in August 2020. As the maturity date approached, the borrower reported that the project was experiencing delays due to contractor issues, but the project was on track to be completed and listed by December 2020. After the property sat for several months on the market with no movement, Groundfloor issued a Notice of Default, and after the default period expired, Groundfloor began foreclosure proceedings. These proceedings put pressure on the borrower to make price reductions to the listing price. This ultimately led to a sale of the property, and the loan was finally repaid in March 2022.

1396 Beatie Ave SW - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The property was sold and the loan was repaid in March 2022.

1807 Vinton St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in April 2022. In February 2022, the property was actively listed on the market. The property was sold and the loan was repaid in March 2022.

6757 Richardson Rd - Repaid Via Extension

The project began in September 2021 and the loan had an original maturity date in March 2022. As the maturity date approached, the borrower advised that the property had been listed on the market. The property was sold and the loan was repaid in March 2022.

1354 Meridian St SE - Repaid Via Extension

The project began in September 2020 and the loan had an original maturity date in September 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in January 2022. As that maturity date passed, the borrower advised that the property was actively listed on the market. The property was sold and the loan was repaid in March 2022.

1803 Vinton St - Repaid Via Extension

The project began in February 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in April 2022. In February 2022, the borrower advised that the property was under contract. The sale went through and the loan was repaid in March 2022.

4536 Falcon Ridge Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that the property was actively listed on the market. The property then went under contract, with an expected closing date in February 2022. The sale went through and the loan was repaid in March 2022.

112 Haynsworth St - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in February 2022. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan. The loan was repaid in March 2022.

2921 East Columbus Dr - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was under contract. The closing process took several months to complete. The property was sold and the loan was repaid in March 2022.

1845 North Pearl St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in November 2021. As the maturity date approached, the borrower advised that they were in the process of refinancing the loan, with an expected closing date in January 2022. The refinance process took several months to complete. The loan was finally repaid in March 2022.

2859 Lydia St - Repaid Via Extension

The project began in July 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was listed on the market. The property went under contract, and the loan was repaid in March 2022.

325 East Haven Dr - Repaid Via Extension

The project began in June 2021 and the loan had an original maturity date in September 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The borrower subsequently advised they were in the process of refinancing the loan as well as listing the property on the market. The refinance went through and the loan was repaid in March 2022.

1375 Alverado Way - Repaid Via Extension

The project began in March 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, Groundfloor reached a workout settlement with the borrower, giving a new maturity date in March 2022. The borrower subsequently advised they were in the process of refinancing the loan. The refinance was completed and the loan was repaid in March 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 411 Morgan Pl SE

- 1906 Maywood Pl NW

- 2119 Penelope St NW

- 5775 Meadow Park Ct

- 635 Robert St NW

- 1507 Frazier Rd

- 4201 Brookview Dr

- 224 Ormond St SW Unit A

- 224 Ormond St SW Unit B

- 73 Rockyford Rd NE

- 1136 Oak Knoll Terrace SE

We proceeded with foreclosure actions on the following properties last month:

- 5512 Carville Ave

- 150 River Ridge Rd

- 2300 West Knoxville St

- 2518 Godfrey Dr NW

- 2524 South 61st St

- 2355 North Cleveland St

- 2001 Vine St

- 758 Charlotte Pl NW

- 369 Joseph E Lowery Blvd

- 27600 Imperial River Rd

- 704 Anderson St

- 601 Magnolia St

- 413 Lakeview Cir

- 8620 Canal Dr

- 1409 Lorenzo Dr

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

We sold the following real estate owned properties last month: