Welcome to our Asset Management Monthly Update series, which we began in May 2020 to give Groundfloor investors a monthly snapshot of how our asset management team is managing our outstanding loan portfolio. This report provides details on loans repaid in the previous month, as well as insight into how Groundfloor acted to manage troubled loans.

This latest installment looks at activity from May 2022. You may view activity from previous periods by clicking the links below.

April 2022

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

December 13-19, 2020

December 6-12, 2020

November 29 - December 5, 2020

November 22-28, 2020

November 15-21, 2020

November 8-14, 2020

November 1-7, 2020

October 25-31, 2020

October 18-24, 2020

October 11-17, 2020

October 4-10, 2020

September 27 - October 3, 2020

September 20-26, 2020

September 13-19, 2020

September 6-12, 2020

August 30 - September 5, 2020

August 23-29, 2020

August 16-22, 2020

August 9-15, 2020

August 2-8, 2020

July 26 - August 1, 2020

July 19-25, 2020

July 12-18, 2020

July 5-11, 2020

June 28 - July 4, 2020

June 21-27, 2020

June 14-20, 2020

June 7-13, 2020

May 31-June 6, 2020

May 24-30, 2020

May 17-23, 2020

May 10-16, 2020

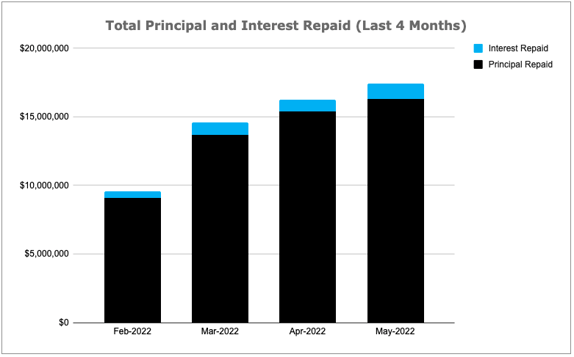

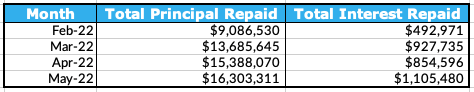

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

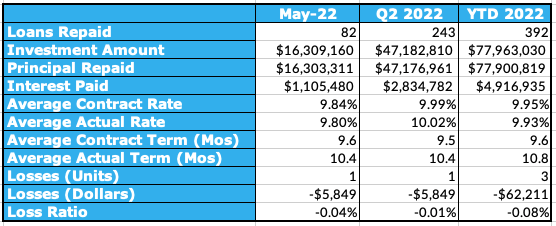

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q2 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

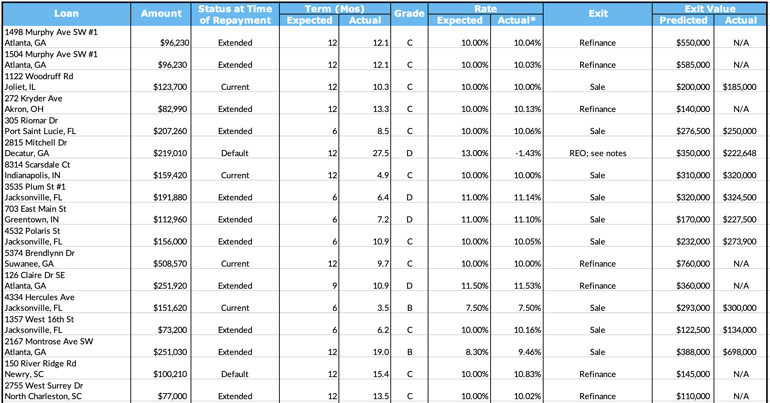

Last Month’s Repayments - May 2022

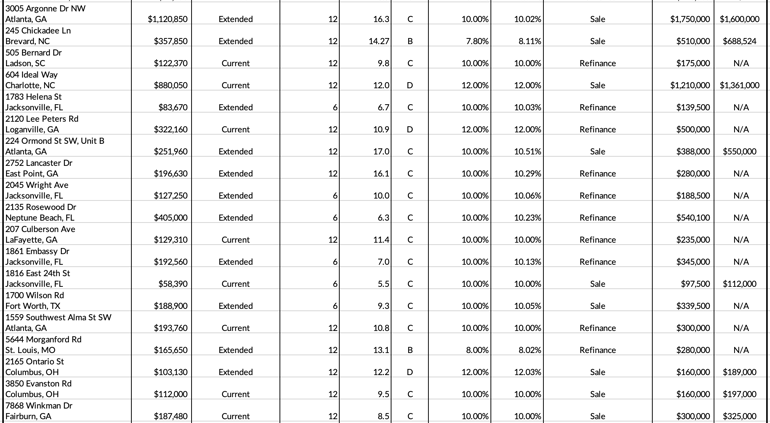

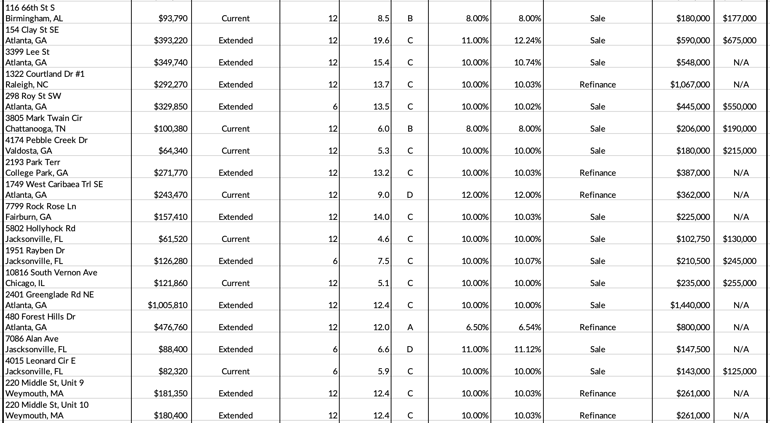

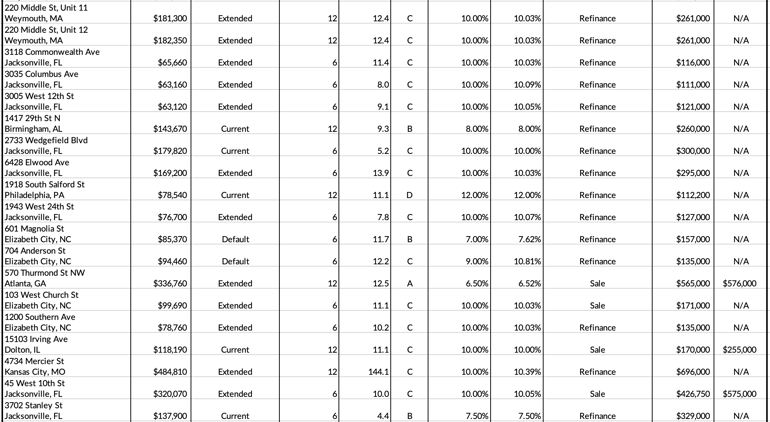

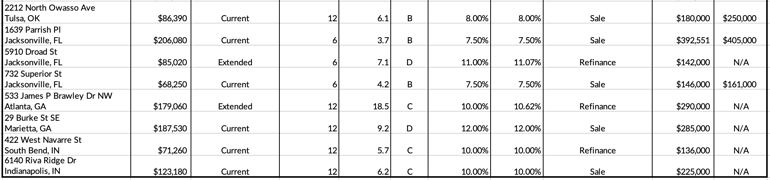

This table presents loans that were repaid within the previous month, with details on the status, actual vs. expected term, actual vs. expected rate, and the exit valuation (sales price or appraised value at time of refinancing, if available):

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Key To Loan Status Column:

Current - loan remained current throughout the term and repaid with full principal (plus interest)

Extended - loan was past maturity and Groundfloor granted contract extension or forbearance agreement

Default - loan was past maturity and Groundfloor took some legal action (e.g., pursuing foreclosure or filing an insurance claim) to resolve the loan

REO - Groundfloor assumed title to the property (either through foreclosure or deed in lieu) and sold the property

Links to the loan detail pages for the above loans:

1498 Murphy Ave SW #1

1504 Murphy Ave SW #1

1122 Woodruff Rd

272 Kryder Ave

305 Riomar Dr

2815 Mitchell Dr

8314 Scarsdale Ct

3535 Plum St #1

703 East Main St

4532 Polaris St

5374 Brendlynn Dr (LRO #1, LRO #2)

126 Claire Dr SE

4334 Hercules Ave

1357 West 16th St

2167 Montrose Ave SW

150 River Ridge Rd

2755 West Surrey Dr

3005 Argonne Dr NW (LRO #1, LRO #2, LRO #3)

245 Chickadee Ln

505 Bernard Dr

604 Ideal Way (LRO #1, LRO #2, LRO #3, LRO #4, LRO #5)

1783 Helena St #1

2120 Lee Peters Rd

224 Ormond St SW, Unit B

2752 Lancaster Dr

2045 Wright Ave

2135 Rosewood Dr (LRO #1, LRO #2)

207 Culberson Ave

1861 Embassy Dr #1

1816 East 24th St #1

1700 Wilson Rd

1559 Southwest Alma St SW

5644 Morganford Rd

2165 Ontario St

3850 Evanston Rd

7868 Winkman Dr

116 66th St S

154 Clay St SE

3399 Lee St

1322 Courtland Dr #1

298 Roy St SW

3805 Mark Twain Cir

4174 Pebble Creek Dr

2193 Park Terr

1749 West Caribaea Trl SE

7799 Rock Rose Ln

5802 Hollyhock Rd

1951 Rayben Dr

10816 South Vernon Ave

2401 Greenglade Rd NE (LRO #1, LRO #2, LRO #3, LRO #4)

480 Forest Hills Dr (LRO #1, LRO #2)

7086 Alan Ave

4015 Leonard Cir E

220 Middle St, Unit 9

220 Middle St, Unit 10

220 Middle St, Unit 11

220 Middle St, Unit 12

3118 Commonwealth Ave

3035 Columbus Ave

3005 West 12th St

1417 29th St N

2733 Wedgefield Blvd

6428 Elwood Ave

1918 South Salford St

1943 West 24th St

601 Magnolia St

704 Anderson St

570 Thurmond St NW

103 West Church St

1200 Southern Ave

15103 Irving Ave

4734 Mercier St (LRO #1, LRO #2)

45 West 10th St

3702 Stanley St

2212 North Owasso Ave

1639 Parrish Pl

5910 Droad St

732 Superior St

533 James P Brawley Dr NW

29 Burke St SE

422 West Navarre St

6140 Riva Ridge Dr

Special Situations Repaid Last Month

Next, we provide a monthly overview of special situation loans we resolved in the prior month.

Last month, a total of 82 loans were repaid. 30 of them were current, repaying on time and in full. 48 loans were granted an extension last month and were repaid after the stated maturity date. 4 were special situation loans, the details of which are below:

2815 Mitchell Dr - Repaid Via REO

The project began in January 2020 and the loan had an original maturity date in January 2021. The maturity date passed and the loan had not yet been repaid, so Groundfloor sent a Notice of Default to the borrower. The default period expired and in March 2021 Groundfloor began foreclosure proceedings. Foreclosure proceedings continued over the next several months. In August 2021, our attorney advised that a foreclosure sale date was scheduled for September. Groundfloor was the successful bidder at the foreclosure sale, and in October 2021 the property was secured and preservation work began. By December 2021, the property was prepped for sale and was actively listed on the market. After some initial offers, the property went under contract in February 2022. Due to delays with the buyer’s lender, the closing date was delayed until April 2022. The sale completed and the loan was repaid with a principal loss in May 2022.

The property was sold for $222,647.69. After adding the remaining escrow balance and subtracting foreclosure costs and legal fees, the net recovery on this property was $213,161.84, which represents a 96% recovery of principal. Impacted investors may view a more detailed breakdown of the recovery in our recent email communication.

150 River Ridge Rd - Repaid Out Of Default

The project began in March 2021 and the loan had an original maturity date in January 2022. As the maturity date passed, Groundfloor began workout discussions in an attempt to avoid foreclosure. The borrower advised they were in the process of refinancing the loan, and Groundfloor prepared necessary documentation to grant an extension. In March 2022, the borrower advised that the property had been rented. In April 2022, Groundfloor began foreclosure proceedings. Separately, the borrower continued to work to refinance the loan. After initial delays with the appraisal, the refinance process was completed and the loan was repaid in full in May 2022.

601 Magnolia St - Repaid Out Of Default

The project began in June 2021 and the loan had an original maturity date in December 2021. As the maturity date approached, the borrower advised that the property was currently under contract and requested an extension. Groundfloor executed a forbearance agreement, giving a new maturity date in February 2022. As the new maturity date approached, the borrower advised they were still working to repay the loan and were now pursuing a refinance. In April 2022, Groundfloor began foreclosure proceedings as the loan was still outstanding. After some initial difficulties in the refinance process, the refinance was completed and the loan was repaid in full in May 2022.

704 Anderson St - Repaid Out Of Default

The project began in May 2021 and the loan had an original maturity date in November 2021. As the maturity date passed with no recourse in place, Groundfloor sent a Notice of Default to the borrower. The borrower subsequently advised they were waiting on an appraisal before closing could occur, but anticipated closing by the end of December 2021. Groundfloor began workout discussions with the borrower and a forbearance agreement was granted, giving a new maturity date in February 2022. As the new maturity date arrived, the borrower advised they were still working to close. In April 2022, Groundfloor began foreclosure proceedings as the loan was still outstanding. After some initial difficulties in the refinance process, the refinance was completed and the loan was repaid in full in May 2022.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month (see link to each individual loan page for detailed history of updates). As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on the following loans last month:

- 746 Bonnie Brae Ave SW

- 2951 Tejas Trail SW

- 962 Welch St SW

- 143 Hickory St

- 288 Wynnwood Dr SW

- 1905 Windemere Dr

- 1328 Gus Thornhill Jr Dr

- 7803 Rock Rose Ln

- 7805 Rock Rose Ln

- 7807 Rock Rose Ln

- 7809 Rock Rose Ln

- 2049 McAfee Rd

- 830 2nd Ave

- 2780 7th St SW

- 901 Ardmore Dr

- 1611 Indian Trail

- 2171 West 81st St

- 697 Garibaldi St SW

- 701 West 36th St

We proceeded with foreclosure actions on the following properties last month:

- 533 James P Brawley Dr NW

- 3673 Turret Ct NE

- 4720 Wellborn Dr

- 2752 Lancaster Dr

- 741 Brookline St SW

- 487 Ridgecrest Dr

- 2304 Herring Rd SW

- 3458 Rockhaven Cir NE

Real Estate Owned (REO) Activity:

We took possession of the following new properties last month:

We went under contract to sell the following properties last month:

- 356 Osage St

- 5221 Court J

We did not sell any real estate owned properties last month.