In this May edition of our continuing Asset Management blog series, we continue to focus on our loan portfolio, similarly to the newly fashioned layout we unveiled last month in our April edition.

As always, the monthly Groundfloor Asset Management series focuses on the key performance metrics and other relevant data managed by our Asset Management team in order to provide you with a comprehensive understanding of the monthly performance of our loan portfolio.

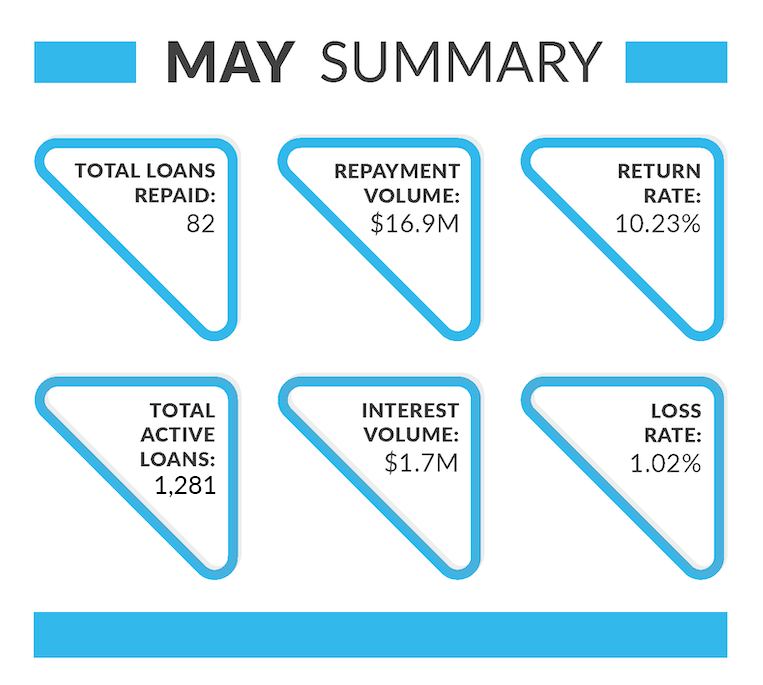

By the Numbers

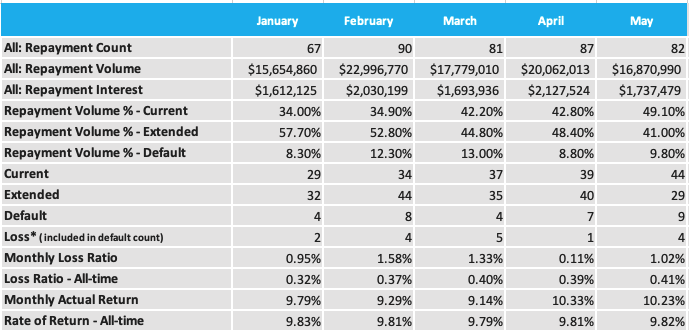

Within this segment, we present insights into the crucial performance metrics relating to the loan portfolio performance for the month of May. Our assessment will encompass loan payoffs, repayment and interest volume, rate of return, and loss ratios. Additionally, we have included comprehensive views of our loan performance states and a detailed overview of the data from the beginning of the year for enhanced clarity.

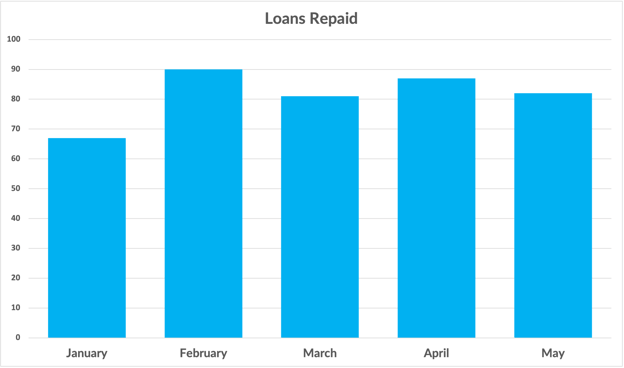

Loan Payoffs

During the month of May, Groundfloor saw 82 loans repaid, signifying just a slight decrease from last month's total of 87. This brings the total number of repaid loans for the year to 407.

Despite ongoing economic headwinds, loan repayments have remained stable. Notably, the past four months have demonstrated robust performance rates, which is an encouraging trend as we progress deeper into the year and finish out the first half of 2023.

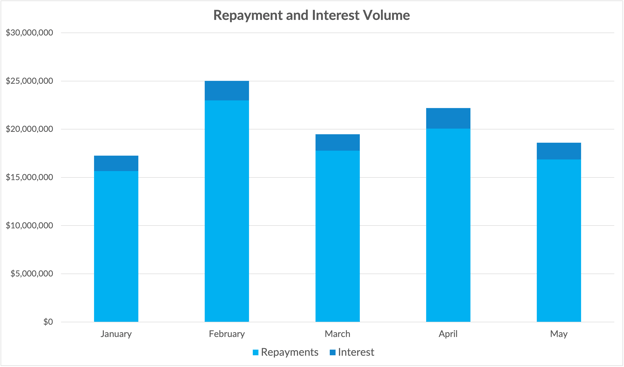

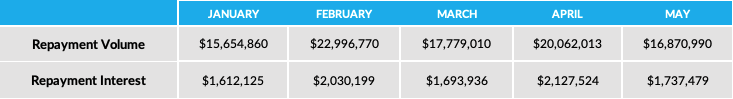

Below is a monthly breakdown of the loans repaid and repayment volume to date in 2023:

Repayment & Interest Volume

The repayment and volume interest for the month of May saw a moderate decline in comparison to April, although numbers have remained consistent after peaking in February. The total repayment volume amounted to $16.9 million, while the interest volume was $1.7 million. The performance over the past few months remains consistent and we foresee that continuing through the summer months.

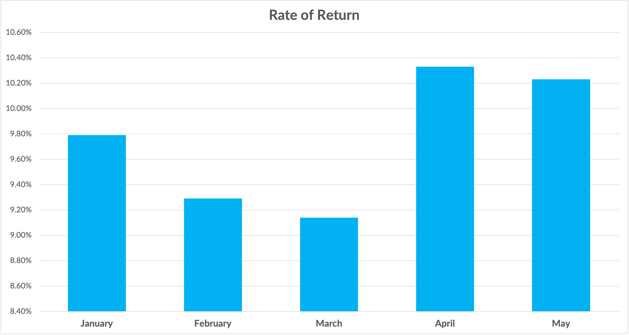

Rate of Return

In May, the rate of return reached a yearly high of 10.86, surpassing last month's high of 10.72%, thanks to the exceptional performance of our Asset Management team. Observing the average over the past several months, it is evident that Groundfloor has maintained a cumulative all-time rate-of-return at 9.82%, as previously emphasized.

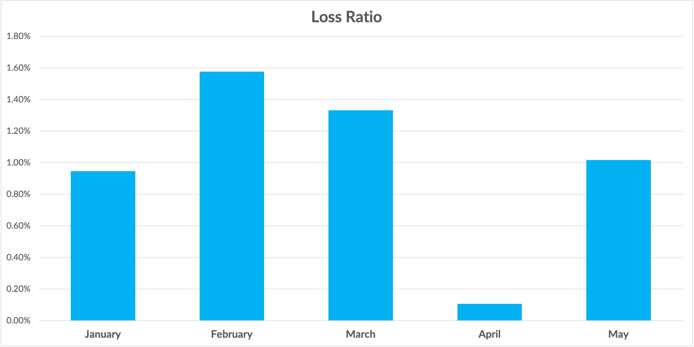

Loss Ratio

In May, Groundfloor had four losses. This year, we have had 16 losses, averaging just 3 per month, which gives us a year-to-date loss ratio of 1%. May’s loss ratio was 1.02% with an overall historical loss rate of 0.41%.

In line with the preceding remarks on our rate of return, Groundfloor maintains an exceptionally low historical loss rate of 0.41%. This data is particularly significant, given current market conditions and the result of older loans from the COVID pandemic coming off the books.

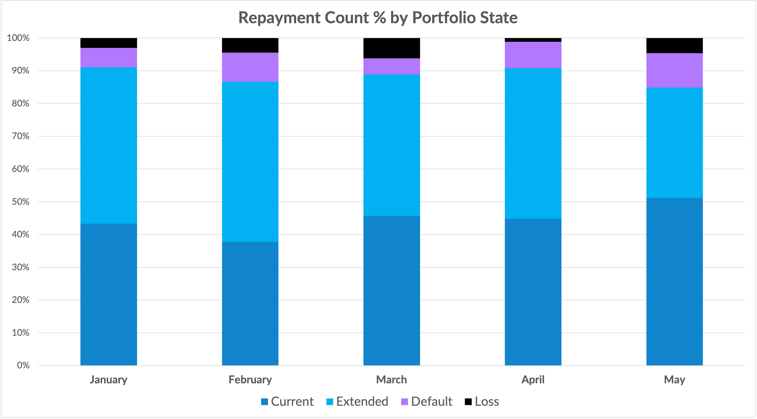

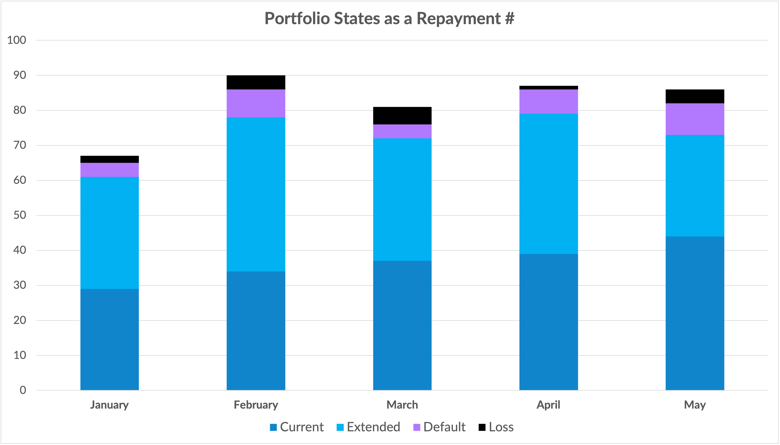

Further Detail

Groundfloor monitors four distinct states within our loan portfolio, which include current, extended, default, and losses. The following charts provide a month-over-month representation of repayments from all four loan portfolio states for 2023.

Lastly, we present a full view into our overall loan portfolio, broken out into expanded detail for your review.

What We’re Seeing

The Groundfloor Asset Management team is working with borrowers to keep their projects moving in the right direction. The below highlights some team adjustments as well as some observations we are seeing in the marketplace:

- Groundfloor has expanded our asset management resources, which enables us to enhance borrower services and communication, resolve issues earlier in the loan lifecycle, and improve overall efficiency.

- To tackle permit delay challenges for new construction loans, we have implemented a new policy requiring permits in hand prior to loan closing.

- We acknowledge that macroeconomic factors, such as supply chain disruptions and labor shortages, continue to cause delays impacting builders and borrowers. However, we are committed to working closely with affected clients and providing appropriate extensions. It is important to note that loans in an "extended" portfolio state are not necessarily negative or a warning sign for that specific loan.

- Groundfloor actively collaborates with borrowers to understand the underlying reasons why a loan may require more time than initially contracted. Our team is also making steady progress in resolving older loans in the portfolio, including listing some real estate owned properties (REOs).

- We have noticed an increase in draw requests on escrow balances, indicating positive progress in the field.

Highlights from the Month

Here are some of the notable loan achievements from last month:

1304 Iranistan Avenue, Bridgeport, CT:

- The loan matured in April 2022.

- Asset Management worked closely with the borrower for almost a year to complete repayment.

- Borrower successfully refinanced and repaid Groundfloor and investors in full, including default interest.

1874 Williams Avenue, Atlanta, GA:

- The loan matured in July 2022.

- Extension granted by Asset Management, ongoing communication with the borrower.

- Continuous delays prevented the completion of the project and loan repayment during the extension period.

- The file was referred to the Default Services team in April 2023.

- Despite facing foreclosure, the borrower completed refinance and repaid the loan with contract and default interest to investors.

1410 Hawkins Street, Atlanta, GA:

- The loan matured in May of 2022.

- The borrower failed to initiate work on the project and attempted to refinance to avoid foreclosure.

- Continued delays and lack of repayment led to Groundfloor initiating foreclosure in November 2022.

- Foreclosed property and completed initial preservation and securing services.

- Property listed on the market for over 100 days with 15 offers received.

- Groundfloor accepted the highest and best offer with a sales price of $90,000, resulting in a 94% principal recovery for investors.

May Project Spotlights

Below we highlight some of the properties that were repaid last month and showcase the before-and-after outcomes.

753 Martin Street, Atlanta, GA

(New Construction)

Property Purchased For: $185,000

Total Loan Amount: $415,260

Term: 12 months

Repaid Date: May 26, 2023

Sold for: $720,000

3109 Albion Street, Nashville, TN

(Purchase & Renovation)

Property Purchased For: $343,000

Total Loan Amount: $311,950

Term: 12 months

Repaid Date: May 22, 2023

Sold for: $437,000

15101 Redgate Drive, Silver Spring, MD

(Purchase & Renovation)

Property Purchased For: $495,500

Total Loan Amount: $503,570

Term: 12 months

Repaid Date: May 10, 2023

Sold for: $760,000

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here.

Further Reading:

- Read our recently published Asset Management Supplement

- Check out our June Monthly Market Trends blog

- Stay in the loop with our weekly 5-minute newsletter: On the Groundfloor