At Groundfloor, we’re committed to doing everything in our power to ensure our borrowers’ projects are successful, which in turn drives value to our investors. One way we do this is through proactive and diligent asset management practices to help us identify or anticipate any potential issues that may arise during the course of a project’s life. Another way is through careful vetting of the details associated with a proposed project. Our underwriting team relies on accurate property, borrower, and market data to analyze and price a project’s risk so we can ensure that our loan is underwritten and graded appropriately. One of the most important of these data points is a property’s estimated after repair value, or ARV.

To examine how accurate our team has been at estimating project ARVs, we analyzed all loans that paid off via a property sale in 2020 to compare our ARV estimates to the actual sale prices of the properties. The results show that Groundfloor's estimated ARVs generally turned out to be more conservative than the eventual sales prices, reflecting our efforts to protect our investors and mitigate risk during last year’s heightened uncertainty caused by the pandemic.

Context

Benefits for Borrowers

The ARV of a property is essentially the projected value of a property after it has been repaired or flipped. Translated, the ARV is roughly the price you’d expect the property to fetch in its new and improved condition. As such, the ARV is a crucial piece of information for flippers to obtain as it helps measure whether or not there is enough margin for the renovation project to become profitable.

The Groundfloor team also uses a property’s ARV to determine how much leverage to loan to the borrower. For instance, Groundfloor typically does not lend above 70% of the ARV. For the Loan100 product, Groundfloor does not exceed 75% of the ARV. Thus, correctly estimating a given property’s ARV is essential, both for the borrower looking to complete the renovation and for the investors who choose to invest in the project.

Benefits for Investors

Accurate ARV estimates are valuable for our investors as well. As noted above, ARV estimates help inform the terms of our loans (specifically, the interest rates, risk factors, and loan grades) which ultimately fund for investment on our platform. Our investors then use this information to make decisions about where to put their money. Additionally, consistently having ARV estimates that match closely to the final selling price reflects that our team is providing accurate risk assessments on the amount of leverage against any particular project, which in turn helps determine whether the final exit will provide enough profit for the borrower to repay the loan.

Process

When a borrower approaches Groundfloor for a loan for their proposed project, they present us with a detailed scope of work along with their estimate of the home’s ARV. This estimate is based on that borrower’s knowledge of the community and the market trends. Once this information is received from the borrower, Groundfloor orders an independent appraisal or feasibility study, which provides a professional opinion on the as-is value and the ARV. This second estimate is backed up by comparable properties in the area, the appraiser’s years of experience and knowledge of the market, and other relevant data. Groundfloor's underwriting team then uses all of this data, plus data from a comprehensive MLS review and other automated valuation models (AVMs), to reach a final ARV estimate that’s known as the reconciled value.

Findings

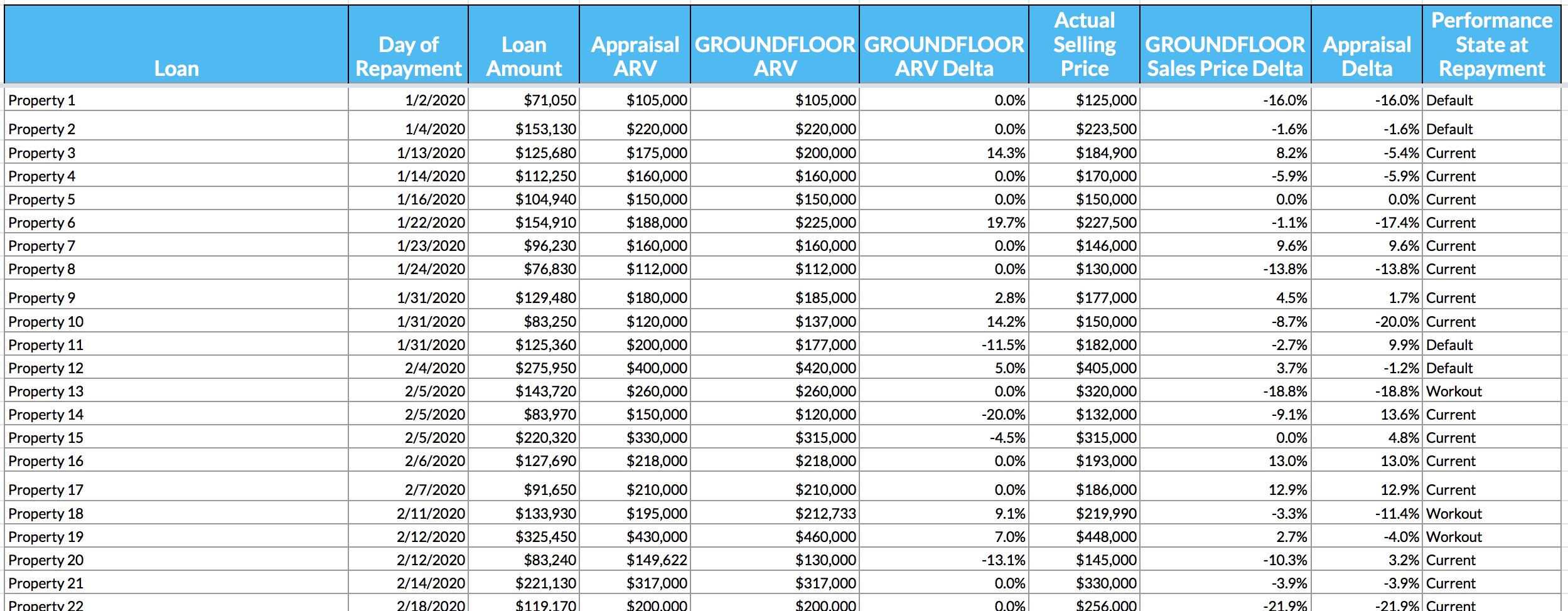

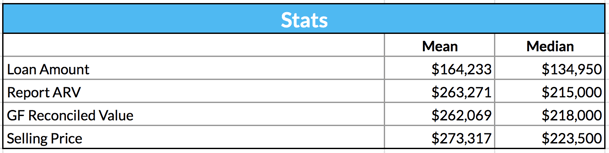

We recently completed an analysis of all 261 loans that paid off in 2020 via a sale of the property to compare our reconciled ARV estimates to the actual sale prices of the property. Here is a snapshot of the data from this analysis - please click here to view the full data set:

Summary findings from the analysis include:

- Relative to the actual sale price, Groundfloor's ARVs were on average 2.61% lower, while the appraisal ARV is on average 1.39% lower.

- Relative to the actual sales price, Groundfloor's median value was 6.1% lower, while the median appraisal value was 5.1% lower.

- Groundfloor's estimated ARVs were on average 0.13% lower than the appraised values, with a median difference of 0%.

- The Groundfloor ARV estimates have a standard deviation of 0.2181, while the appraisal ARV estimates have a standard deviation of 0.2537.

As can be seen above, both the average Groundfloor ARV and the median Groundfloor ARV were more conservative than the average and median appraisal ARVs when compared with the actual sales price. In addition, overall, the Groundfloor reconciled ARV estimates were on average slightly lower (0.13%) than the appraisal ARV estimates, though the median values were equivalent. Finally, Groundfloor's ARV estimates had a lower standard deviation -- meaning they tended to have less variability -- than appraisal ARV estimates.

Overall, relative to the eventual sale prices, the discrepancy between Groundfloor's ARV estimates and the appraisal estimates remained within approximately one percentage point for both the average (2.61% vs. 1.39%) and median values (6.1% vs. 5.1%). Further, the difference between the average Groundfloor ARV estimate and the average appraisal estimate was negligible (0.13%). Thus, while it is true that the appraisal estimates tended to reconcile to a value slightly closer to the property’s true value, it is unlikely that overall loan parameters were significantly affected by the use of the Groundfloor ARV estimates.

Conclusions

The data above indicates that relative to the eventual sales price of the properties, Groundfloor's reconciled ARV estimates turned out to be generally more conservative than the appraisal ARVs, reflecting our efforts to protect our investors during last year’s heightened uncertainty caused by the pandemic. Being more conservative in our property evaluations ensured our loans were not in danger of becoming over-leveraged -- and our investors thus put at more risk -- as the market continued shifting.

As we observed last year, the onset of the COVID-19 pandemic had a significant impact on financial markets. Most loans that were repaid in 2020 were generally originated pre-pandemic and accordingly had not accounted for how the market would change as a result. In Q2 2020 (April-June), real estate markets came to a complete halt as public health concerns, stay-at-home orders, and economic uncertainty led to fewer buyers looking for homes and fewer sellers wanting to list their properties. Such a slowdown led many lenders -- including us, as discussed in our May 2020 Portfolio Stress Test Analysis -- to postulate that home prices would drop in response to decreased demand. As a result, we anticipated ARV variance would be smaller than historical performance, or possibly even positive.

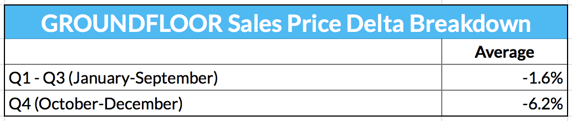

In reality, the real estate market exhibited a surprising rebound, with home sales starting to increase in Q3 2020 and taking off in Q4 2020. Housing supply remained scarce even as demand recovered, which contributed to a considerable and unanticipated increase in home prices in Q3 and Q4. This dynamic can be distinctly observed in our data. Throughout Q1, Q2, and Q3 (January-September), Groundfloor's ARV estimates were off by an average of 1.6% from the true sales prices; in Q4 (October-December), however, our ARV estimates were off by an average of 6.2%.

Overall, in 2020 the Groundfloor team erred on the side of more conservative evaluations of property value in the face of an unprecedented public health crisis. We anticipate that we will continue to see this reflected in Q4 2021 and early 2022 as the loans originated during 2020 begin to repay. Given the circumstances, we feel this approach was prudent as we endeavored to assess risk and protect our investors in such an uncertain market environment.

We hope this analysis provides insight into how our underwriting team arrives at ARV estimates and how they generally measured up to actual home values last year. As always, you are welcome to leave questions and comments in the comments below, or email us directly at support@groundfloor.us. We always appreciate hearing from you.