If you’re new to the real estate investing world, you may be finding it difficult to understand the various grading factors we share with you on a given loan’s detail page. What do they mean? How do they relate to the overall attractiveness of the loan as an investment opportunity? We get a lot of questions about these factors, so we thought it would be of interest to our investors to provide a handy glossary of the terms we use and how they can help inform your investment decisions.

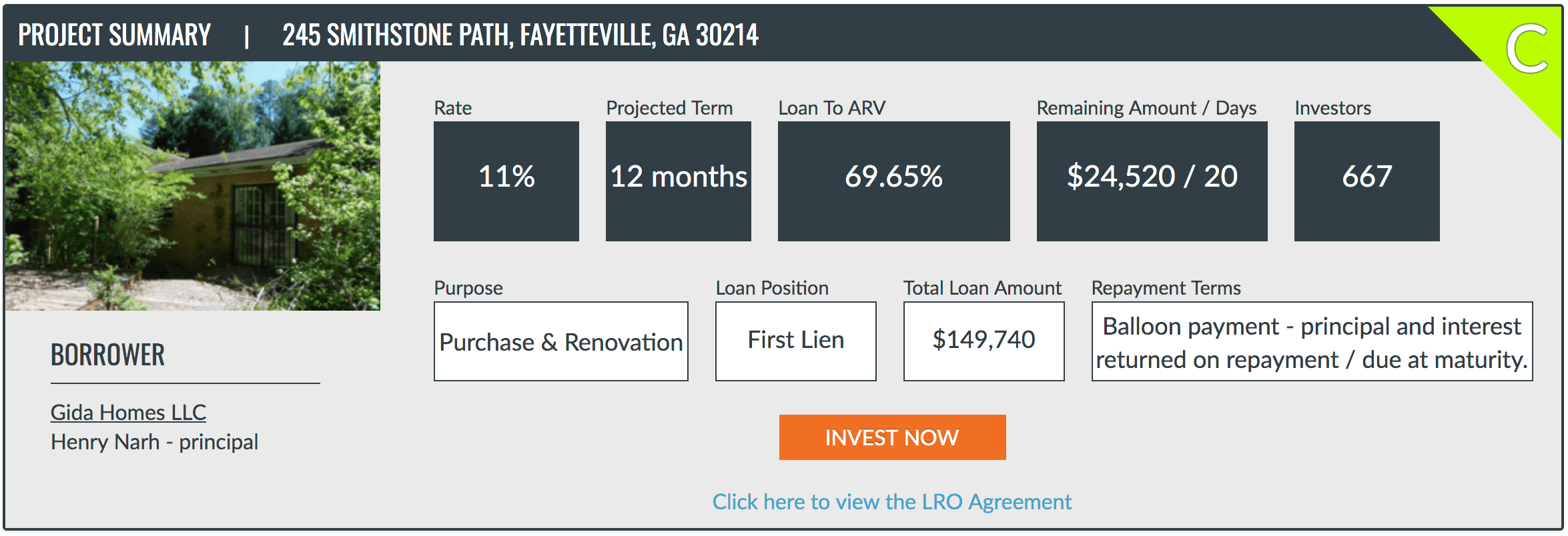

Let's look at the following loan as an example:

Project Summary card for 245 Smithstone Path, Fayetteville, GA 30214

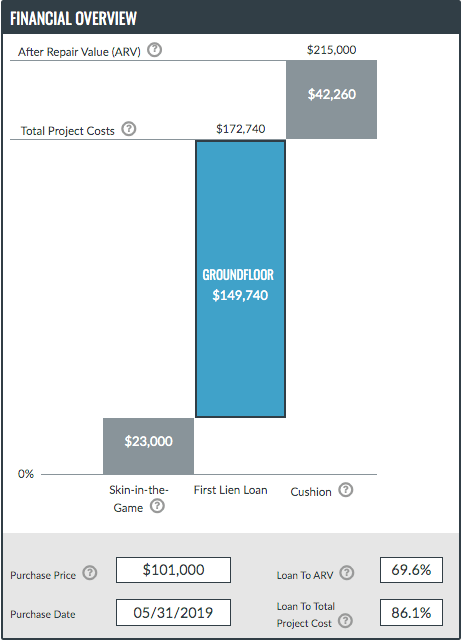

Financial Overview card for 245 Smithstone Path, Fayetteville, GA 30214

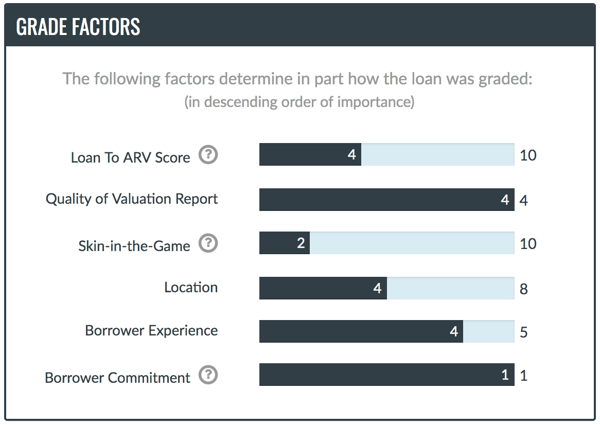

The Grade Factors for 245 Smithstone Path, Fayetteville, GA 30214

Interest Rate

One of the easiest factors to understand, the interest rate is the rate we charge to the borrower for the use of our funds. Investors earn the same rate over the course of time their money is active in the loan, and they begin earning 100% of the stated interest rate from the time of commitment until repayment.

In the Project Summary card shown above, the interest rate assigned to this loan is 11%. The Interest rate is closely related to the loan grade (explained below). As such, it’s important to decide how much risk you’re willing to take on before making any investment decision.

Loan Grade

The loan grade is the letter grade Groundfloor's proprietary grading algorithm assigns to a loan once underwriting is complete. The loan grade in the above example is a C.

Loans can be assigned one of seven letter grades from A to G, and each grade generally reflects the overall risk of the loan. For example, Grade A loans generally have lower expected returns, lower expected loan losses, and corresponding lower interest payments; whereas on the other end of the spectrum, Grade G loans have higher expected returns, higher potential loan losses, but correspondingly higher interest rates. With Groundfloor, you create a custom portfolio of real estate investments based on your own investment criteria and risk tolerances.

Currently, our grading scale and corresponding rate floors (the minimum amount Groundfloor will offer borrowers for any given letter grade) are as follows:

Grade A: 5% | Grade B: 6% | Grade C: 8% | Grade D: 9% | Grade E: 12% | Grade F: 14% | Grade G: 15%

The grading algorithm we use has been qualified by the U.S. Securities & Exchange Commission and takes into account 1) the valuation and strength of a particular project and 2) the experience and risk profile of the borrower. The exact scores of the grading algorithm are available on the loan detail page for each loan.

Loan to ARV (After-Repair Value)

Usually expressed as a percent, the loan to ARV is the ratio of the loan amount (plus any other debt on the property) to the after-repair value (ARV) of the property. In the example cited above, the loan to ARV ratio is 69.65%.

The ARV is the projected valuation of the project after completion of the proposed repairs, enhancements, and construction -- in other words, it corresponds roughly to the price you’d expect the property to fetch in its new and improved condition. A given property’s ARV estimate is informed by a variety of factors, including independent appraisals and comparable property sale prices.

For more information about how Groundfloor arrives at ARV estimates, please refer to our blog post.

Groundfloor extends loans of up to 75% of a given project’s ARV. In general, the higher the loan to ARV ratio, the higher the risk, since higher ratios indicate that Groundfloor is loaning more money against the property’s eventual ARV.

Loan Position

The loan position indicates the position of the Groundfloor loan to be repaid in the event of a default. The loan position of the example loan at the top of the page is first lien.

Groundfloor typically holds the first lien position on all loans we extend, meaning that we (and by extension our investors) would be the first institution to be repaid if the borrower defaults on the loan and the property must be used as collateral for the debt. First liens have priority over all other claims on a property, and as a result, loans that hold first lien positions provide more security to investors.

Cushion

The cushion is the difference between the total project cost and the estimated after-repair value of the property. A bigger cushion generally means there is more flexibility in the final selling price of the property and can also indicate the project’s ability to absorb any unexpected hardships or complications during renovations.

The cushion of the example loan at the top of the page is found on the Financial Overview card, and is $42,260.

Loan to ARV Score

The loan to ARV score is one of six factors that contribute to the loan’s overall letter grade and is one of the most important factors we consider when making letter grade determinations. Every loan starts out with 10 points, and points are subtracted for the loan to ARV ratio. For example, a project with a loan to ARV ratio of 40% would have 4 points subtracted from the starting 10, resulting in a loan to ARV score of 6.

In the example loan at the top of the page, the loan to ARV score is a 4 (as can be seen on the Grade Factors card). In general, a higher loan to ARV score indicates a lower risk.

Quality of Valuation Report

We obtain one of four different kinds of valuation reports of a given property in order to calculate the loan to ARV ratio. However, not all of the valuation reports are of the same quality or reliability, as the reliability of the data presented in the reports depends, in part, on the methods used to collect the data, the expertise of the party/parties that prepared the report, and the appropriateness of the valuation approaches.

In general, the quality of the valuation reports is assessed on a four-point scale as follows:

Certified Independent Appraisal - 4

This is an independent appraisal prepared by a certified appraiser and exclusively commissioned to evaluate the project. It is recently prepared (within one month) and is delivered directly to Groundfloor by the appraiser.

Broker’s Price Opinion - 3

This is a report prepared by a licensed realtor that compares the property to several similar properties in the local market. The BPO may also make further adjustments based on a site visit or walkthrough. It is exclusively commissioned to evaluate the project, is recently prepared (within two months), and is typically delivered directly to Groundfloor by the realtor.

Borrower Provided Appraisal - 2

This is an appraisal commissioned by the borrower at some point in the past six months prior to applying for a loan. While the appraiser is still subject to the customary professional standards, this appraisal is not commissioned for the purposes of our loan and it may not be as recent, meaning the valuation will be less current.

Borrower Provided Comps - 1

This is a collection of comparable property listings gathered and prepared by the borrower. The listings may be from a listing service website or they may be from a book of listings from various real estate agencies. Because this can be compiled by the borrowers themselves (rather than by a certified third party), this is considered the riskiest kind of valuation report.

In the example loan above, the quality of the valuation report received a score of 4, meaning the valuation report obtained was of the highest/most accurate quality. Not all projects will have this score, however. Rather than requiring borrowers to always provide a certified independent appraisal, which is the highest quality but most expensive and time consuming to prepare, the quality of whatever valuation report received is accounted for through Groundfloor's loan grading algorithm, giving you even more information to inform your investing decisions.

Skin-in-the-Game

“Skin-in-the-game” is the amount of the borrower’s money that is tied up in the project, and any other equity contributed to the project by parties other than the borrower.

Real estate developers who have a significant amount of their own money tied up in a project, especially relative to the amount they are borrowing, are generally less likely to default. Thus, the more skin-in-the-game a borrower has in a project relative to the amount they are borrowing, the lower the risk of the project. A borrower’s skin-in-the-game is assessed on a 10-point scale. The higher the ratio of the borrower’s skin-in-the-game, the higher the score, and thus the lower the risk of the project.

The skin-in-the-game score of the example loan above is 2, indicating the borrower in question does not have a high ratio of his or her own money tied up in the project.

Location

The location of a given loan is another factor to consider when making investment decisions. Each local market is different and may affect how well the completed property will sell and how much it will fetch. Lower-risk projects tend to be located in areas with strong real estate markets.

Additionally, location also heavily influences the ease of foreclosure in the event it is necessary, which may be a factor worth considering for some investors. There are two types of foreclosures that vary based on the state in which the property is located. The first type is a Judicial Foreclosure, which is ordered by the courts. Judicial Foreclosures are typically a much longer process than a Non-Judicial Foreclosure -- Judicial Foreclosures can potentially take six months to three years for completion. If the property is in a Non-Judicial Foreclosure state, Groundfloor does not have to go to court to foreclose on the property and the process is much quicker.

Judicial States: Connecticut, Delaware, Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, New Jersey, New Mexico (sometimes), New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, and Wisconsin.

Non-Judicial States: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Washington D.C., Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico (sometimes) North Carolina, Oklahoma (unless the homeowner requests a Judicial Foreclosure), Oregon, Rhode Island, South Dakota (unless the homeowner requests a Judicial Foreclosure), Tennessee, Texas, Utah, Virginia, West Virginia, and Wyoming.

Please be sure to refer to state-specific laws for the most recent foreclosure guidelines, which may periodically change.

The location score of the example loan at the top of the page is a 4, indicating this project has a decent amount of risk associated with where it is located.

Borrower Experience

This is a measure of the borrowers themselves and indicates the general confidence an investor can expect to have in their work. Lower-risk borrowers will have significant experience in real estate development, in terms of years and number of projects developed, and will have successfully completed projects of a similar type and scope -- as a result, they will have a higher Borrower Experience score.

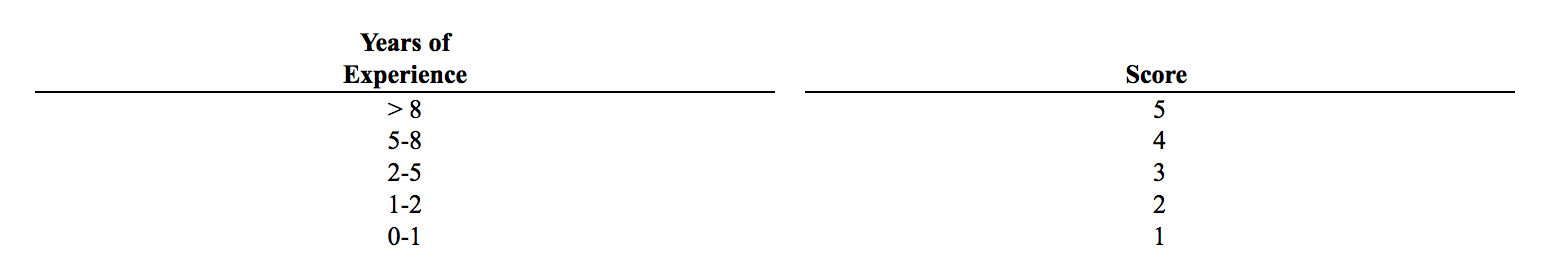

A borrower's experience is scored from one (1) to five (5). The general breakdown of these scores is illustrated below:

A borrower's experience is scored from one to five based on their years of applicable work experience.

The example loan at the top of the page received a Borrower Experience score of 4, indicating this borrower has been engaging in real estate development for 5-8 years.

Borrower Commitment

Borrowers who are in the real estate development business on a full-time basis (versus part-time) are considered to be lower-risk, and as such will receive a higher Borrower Commitment score. Part-time borrowers receive a zero (0) score, while full-time borrowers receive a one (1) score.

The example loan at the top of the page received a Borrower Commitment score of 1, indicating the borrower is involved in real estate development work full-time. This score is added to the scores of the grading factors explained above to arrive at a final tally that corresponds to the letter grade we assign to the loan.

We hope this has provided some insight into the factors we provide that can influence investment decisions. For more information about our proprietary grading algorithm and for an even deeper dive into each of the factors described above, please refer to our Offering Circular starting on page 50.

As always, don’t hesitate to reach out to support@groundfloor.us should you have any further questions, or leave us a comment below.