We’ve all heard the old proverb, “Don’t put all your eggs in one basket.” Whether it’s referring to applying for several jobs instead of just one, or not throwing your entire life savings behind one venture, this phrase cautions about the risk of concentrating all your resources in one area. In investing, this piece of wisdom is known as the principle of diversification.

What is Diversification?

Diversification is an investing strategy designed to help lower risk. Rather than directing funds towards one single investment or type of investment, it is generally considered better for investors to diversify their investments into many different companies, industries, and asset classes that are not exposed to the same risk. The idea is that a portfolio constructed of different kinds of investments will, on average, yield higher long-term returns and lower the risk associated with any individual investment.

Diversification isn’t meant to maximize returns, however. Spreading your money out over lots of investments necessarily means you won’t earn as much if one of those investments performs well. But on the flip side, if one of those investments performs poorly, it won’t affect a diversified portfolio as much. This stabilizing effect is the key reason why many investors- especially those just getting started- choose to diversify.

Diversification Strategies

By Asset Class

A simple way to diversify your portfolio is to make sure it includes investments from different categories or asset classes. Asset classes are broadly divided into traditional investments (usually stocks, bonds, and cash) and alternative investments (such as real estate, cryptocurrencies, and commodities). Different asset classes vary in how they respond to economic ebbs and flows, which is why it can be advantageous to have a variety of investments from different asset classes within your portfolio.

While investments such as stocks and bonds are widely available to the everyday investor, some alternative investments such as real estate have historically only been available to accredited investors. However, with the advent of technology-based platforms like Groundfloor which open up access to real estate investment opportunities to everyone, regular investors can more easily diversify their portfolios across more investment categories, which can help build and safeguard wealth.

Within Asset Classes

In addition to diversifying across asset classes, it is also important to consider diversifying within asset classes. For example, if your portfolio is heavily concentrated in stocks from companies like Apple, Google, and Facebook, you may want to consider expanding your holdings into non-technology companies. Since companies in the same industry tend to have similar characteristics and will respond similarly to economic changes and cycles, it can be wise to balance them out with holdings in other sectors. Stocks can also be diversified in terms of company size (also known as market capitalization) and location (whether foreign or domestic).

This is also applicable to other asset classes. Bonds, for example, can be differentiated by the type of issuer (the government, a municipality, or a corporation), term length, and credit risk level. Similarly, diversification in real estate can be achieved by investing in a variety of property types (i.e., commercial vs. residential), properties in a variety of sizes and locations, and properties that have a variety of risk profiles.

While diversification is beneficial for most investors, it can be difficult to achieve. Choosing where to invest your money requires time and research, and investing across and within different asset classes can be expensive, especially for the individual investor. However, there are ways to facilitate the process. Individual investors often choose to invest in pre-bundled groups of securities in the form of mutual funds, index funds, and exchange-traded funds (ETFs), which allows them to achieve instant diversification without the headache of researching each offering.

Additionally, alternative investing platforms with low minimum investments have arisen to help ease the financial burden of diversification. Groundfloor's real estate investment platform, for example, has a minimum investment size of just $10 per project, which enables meaningful diversification for everyone, on any budget. With an investment budget of $1,000, investors can diversify into as many as 100 different projects of their choosing. If sorting through each loan isn't for you, Groundfloor's Investment Wizard tool can help you quickly locate available loans that fit your investing criteria, so diversification becomes a cinch.

Investors frequently ask what returns can be expected from investing with GROUNDFLOOR. The answer to that largely depends on the allocation decisions investors make. For example, we’ve noticed that some of our investors choose to concentrate in the highest-yielding loans (grades C or lower). Others allocate more to loans at the lower end of the risk scale (grades A and B). With over 127 loans repaid and over $11 million in principal returned to date, we now have ample data to analyze and answer the question empirically.

We recently performed an analysis to quantify the effect of diversification on GROUNDFLOOR returns. The analysis is based on data for over 2,400 individual portfolios reflecting the allocation decisions made by our investors over time. The results are colored by two loans that realized losses (4626 Brooks St and 174 Timothy Drive), eleven high-risk loans that successfully returned full principal and interest with yields of over 18%, and a handful that repaid penalty or other interest in excess of the contracted rate.

As many readers know, diversification is a risk management technique that mixes a wide variety of investments within a portfolio. When properly diversified, a portfolio should yield higher returns and lower risk more reliably than will a single investment or small number of concentrated investments held in a similar portfolio. Diversification is a strategy intended to negate risk events that are unique to any particular investment in a portfolio. With diversification, the negative performance of some investments is expected to be countered by the positive performance of others.

The Effect of Diversification on Returns

.png)

Net Annual Rate of Return Realized on GROUNDFLOOR Portfolios by Number of Loans

This chart shows the relationship between portfolio returns realized and the number of loans held in each portfolio. Each dot represents a portfolio containing a number of loans (plotted along the x-axis) and having realized a given annual rate of return (plotted along the y-axis).

For reference, our analysis shows that a hypothetical model portfolio composed of an equal investment made in all 127 loans repaid to date would've earned an annualized return of 12.36%.

We calculate portfolio returns by dividing the amount of interest earned for each investment by the amount of principal invested, and then annualizing that figure. Each annualized return is then weighted by the amount invested as a proportion of all principal invested in the portfolio. Reinvestments are accounted for as new, separate investments. Balances held as available cash in GROUNDFLOOR Accounts are not included in the analysis, since they are not invested and can be withdrawn upon demand.

As the theory of diversification predicts, portfolios invested in the largest number of loans realized the most reliable returns. This is true even though GROUNDFLOOR investors decide not only which loans to include in their portfolios, but how much capital to allocate to each loan, relative to the others. The power of diversification is that strong.

This chart also shows the risk of not diversifying one’s investments. A small number of portfolios at the extremes put all their eggs in one or two baskets. Portfolios containing only a handful of loans or less realized a wide variety of returns, including some significant losses for those who bet big on our one high-yield (23.8%) F-grade loan that lost principal.

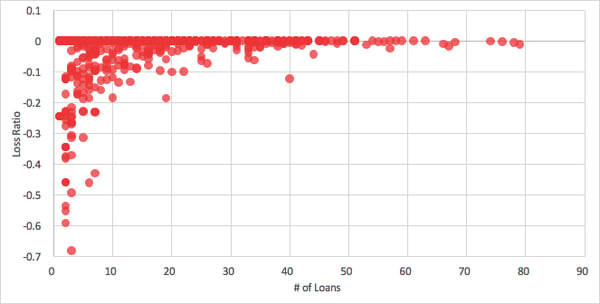

The Effect of Diversification On Loss Ratios

Loss Ratios Realized on GROUNDFLOOR Portfolios by Number of Loans

The “loss ratio” is the amount of principal lost expressed as a ratio to the principal invested. A loss ratio of -0.05, for example, would mean that $50 was lost out of every $1,000 invested. Similar to the rate of return chart, the chart above illustrates loss ratios realized by individual portfolios compared by the number of loans held in each portfolio.

A model portfolio composed of equal investments in all 127 repaid loans repaid to date would've experienced a loss ratio of -0.0074.

Any given ratio may be acceptable to an investor if the returns realized in relation to the risk are high enough to offset the losses. For example, the vast majority of investors with more than 20 loans experienced loss ratios of -0.05 or less. Looking at the previous chart, those investors also earned returns high enough to keep overall net returns in strongly positive territory (generally over 10% -- after subtracting losses). A handful of portfolios experienced losses significant enough to reduce their returns to less than 5% -- because they either bet big on a loan that realized a loss, or allocated heavily to lower-yielding, safer loans that did not adequately offset their losses in other loans. Again, for investors who didn’t diversify, loss ratios were higher on average and their net returns lower.

The model portfolio described above earned net returns of 12.36%, after accounting for losses of 0.74%.

The takeaway

Diversification is a powerful tool to help mitigate risk and achieve steady returns within your portfolio. As the financial and investing world becomes increasingly accessible to everyday investors through the power of technology, it is easier than ever to take advantage of the variety of diversification strategies available to help you build and preserve wealth.

Ready to add real estate to your investment portfolio? Groundfloor provides a marketplace of residential real estate projects to choose from to build your custom portfolio of private real estate investments, starting with only $1000 to get started, and invest in $10 increments. Join today to take advantage of the power of real estate in your investment portfolio.