Since its onset in 2020, the COVID-19 pandemic has caused significant challenges across almost every aspect of our society. It’s been hard to miss the news of supply chain disruptions, labor shortages, and inflationary prices that have been plaguing nearly every industry. Real estate development (such as the renovation and construction projects Groundfloor finances) has proven to be no exception.

Our team at Groundfloor has been monitoring market conditions closely, and reports from across the country indicate that COVID-19 and ongoing issues with the global supply chain continue to disrupt business as usual. The same product, labor, and material shortages that have caused grocery store shelves to sit empty have also impacted the homebuilding industry. As a result, many developers are struggling to finish their projects on time.

While Groundfloor’s investor returns have remained strong despite these industry-wide challenges, many of our investors have felt the impact of these construction delays on their own portfolios. As projects take longer to complete, repayment timelines are stretching out longer than expected as well. We understand the concern and frustration this can cause investors, especially as larger economic conditions remain uncertain. In response to these continuing macroeconomic issues, Groundfloor continues to take proactive steps to help our borrowers navigate this new reality, while also providing increased transparency for our investors funding their projects.

Macroeconomic factors affecting real estate projects

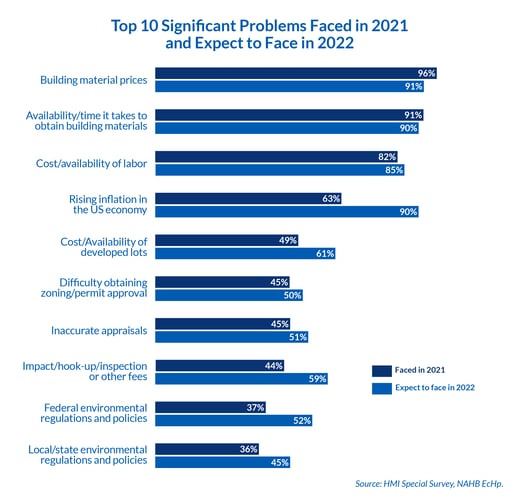

According to the NAHB/Wells Fargo Housing Market Index (HMI) survey, over 90% of builders around the country reported that prices and availability of building materials represented significant issues last year, and roughly the same number of builders say they expect these to remain problematic in 2022.

Material delays and shortages have caused significant scheduling disruptions as homebuilders are forced to wait months to receive the products they need. As a result, a record number of fully-permitted housing starts currently sit idle and unable to move forward with construction. The shortage of materials is also resulting in price inflation as demand continues to outpace available supply – especially supply with the certainty of delivery. Almost every key material used in the construction and renovation of homes has seen recent increases in cost; the high price of lumber, for example, has added a whopping $18,600 to the price of an average single-family residence since September 2021. Such rapid fluctuation in material costs can make it difficult for developers to stay on budget, which often translates to further delays in project completion, or requiring them to refinance the loan altogether.

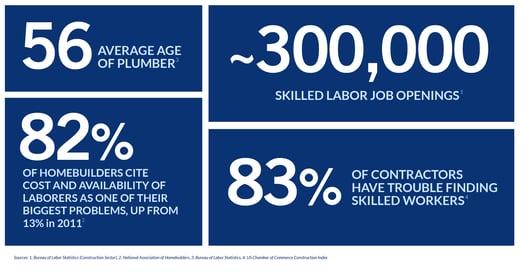

Labor issues are also plaguing the construction industry, with 72% of general contractors anticipating that a shortage of workers would be their biggest hurdle this year. The latest reports claim the homebuilding industry needs to add over 2 million more workers over the next three years in order to keep up with booming housing demand. Yet finding skilled workers is getting harder and harder as the industry already suffers from an aging workforce (the average age of a plumber, for example, is 56).

Delays in permitting are also slowing down housing projects. Case backlogs from court and office closures as well as scheduling delays among inspectors and other relevant parties are all causing permit processes to take anywhere from two to six months, depending on a number of circumstances. Anecdotally, Groundfloor’s base of borrowers cites city and county permitting delays as the main cause of projects falling behind schedule.

How Groundfloor is responding

Delays in project completion are affecting the entire homebuilding industry, and shortages of needed supplies and labor are being felt everywhere. As we adjust to this new reality, our team has mapped out several actions in response to these market conditions that both improve our investors’ experience and simultaneously support our borrowers.

More realistic timelines for repayments

Many delinquent projects due to material, labor, or permitting delays are otherwise performing, and often simply need more time to be finished and repaid. If the project is at least 65% complete at maturity with a clear path to completion, it qualifies for a 3-month extension. Should an extension be exercised, the borrower will still pay the negotiated, increased interest rate. The LRO will be classified as “Extended” on your investor dashboard. As always, and unlike other platforms, we pass 100% of the interest that we charge borrowers directly to investors, including any increased interest during this extension period.

Given the current environment and delays real estate developers are experiencing, for newly funding LROs, we are adding 3 months on top of the actual loan duration to the maturity date for the corresponding LROs. Loans with 6-month terms, for example, will have a corresponding LRO that matures in 9 months, 12-month loans will have LROs coming to maturity in 15 months, and so on. We believe this change will better set expectations for our investors and reflect a more realistic timeline for actual repayments. Investors will continue to earn the interest rate until the loan is repaid, which may still happen before the maturity date. As always, we will keep investors apprised of loan progress throughout the lifecycle of the project and investment via the monthly investor updates.

More options for borrowers

If projects don’t qualify for an extension but are otherwise in good standing and the deal structure is favorable under our current lending guidelines, we will work with borrowers to refinance their loans through our new Internal Refi program. Like the name indicates, this program enables qualified borrowers to refinance their loan with us. When loans are refinanced, existing investors will be repaid on the old loan, and a new loan will be underwritten with a new on-site collateral inspection, a new Statement of Work (budget), and a new Market Valuation for After Repair Values. These new loans will follow our normal SEC qualification process and will be released on the platform for investment with the appropriate new investment grade based on the new loan’s risk and market factors.

The Bottom Line

As the world continues to grapple with the pandemic and its ensuing challenges, it’s possible that loan repayment timelines will continue to experience delays, at least for the foreseeable future. At the outset of COVID-19, in February 2020, we anticipated that delays in project completion due to the pandemic could cause repayment timelines to extend out longer than originally expected and modeled the impact on investments. In line with our models, loans that have extended past maturity have historically delivered strong returns for Groundfloor investors, nearly on par with loans that were repaid on time.

Our Asset Management team continues to diligently monitor all loans and partner with borrowers to guide loans past maturity to a successful and timely repayment. And it works – in the 9 years since our inception, our loss ratio (the ratio of total principal lost to total principal invested on our platform, expressed as a percentage) has consistently remained under 1%. Put another way, Groundfloor investors have historically seen full repayments of their principal and interest for the overwhelming majority of loans on the platform – even those that have been repaid past the initial maturity date.

As we continue into another year under the shadow of COVID-19, material and labor shortages are showing no signs of improvement as of yet. But even in a prolonged downturn with extended terms, we still believe our LROs provide an attractive return with a high degree of liquidity and relatively low volatility – especially compared to the performance of other financial markets and asset classes during this time. Our team continues to monitor market developments closely, and we remain committed to protecting your financial interests and delivering the support and care you have come to expect.

As always, we welcome your comments and questions. Feel free to leave them below, or contact us directly at support@groundfloor.us. On behalf of all of us at Groundfloor, thank you for continuing to place your trust in us and supporting our mission with your investments.