All of us at Groundfloor are excited about our plans for 2018. Before the new year gets too much further underway, though, let’s take a look back at the progress the company made in 2017. From total investments and interest paid to loan originations and principal repaid, 2017 was another record year that set the stage for more to come. Check out our graphical summary below to put it in perspective. You can download the graphic here.

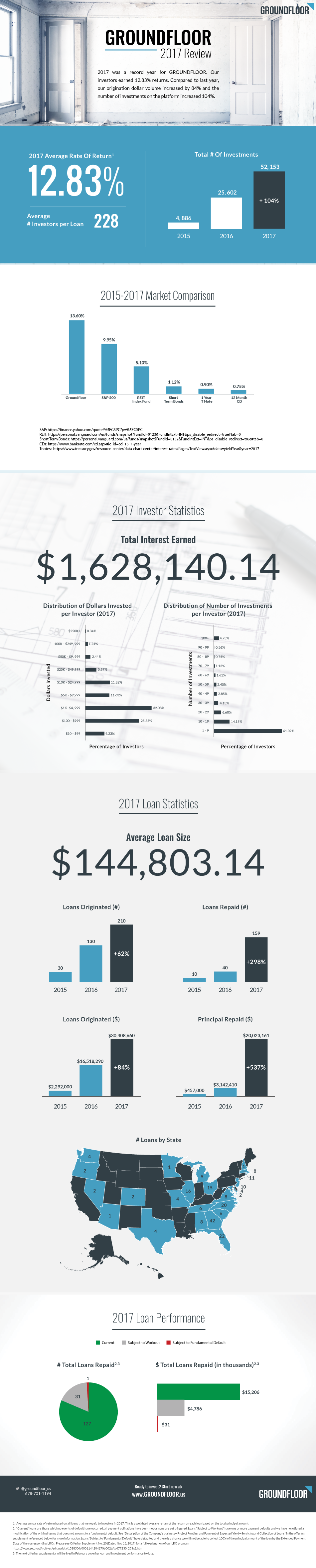

Investor Activity. In 2017, the word really got out about Groundfloor. The number of investments on our platform grew by 100%, from 25,602 in 2016 to 52,153 in 2017; and the average number of investors per loan shot up to 228.

Loan Originations. With 210 loans originated in 2017, we offered our investors an unprecedented array of loan yields, grades, and types, allowing greater portfolio diversification on the platform than ever. Our loan origination volume nearly doubled to over $30 million on 210 loans originated. Average loan size increased by $17 thousand to almost $145 thousand.

Interest Paid. We repaid over $1.6 million in interest to our investors in 2017--an increase of over 6X over--delivering a 12.83% average rate of return1 on over $20 million in principal across 159 loans. Our underwriting and asset management teams continued to deliver returns despite the increased workload imposed by our origination growth, with only 1 of 159 loans subject to fundamental default and 31 subject to workout.2

The numbers tell just part of the story. More important than the short-term results, we also laid important cornerstones for the long-term growth and expansion of Groundfloor.

New Products and Partnerships. In March, we announced a partnership with IRA Services Trust Company to launch tax-advantaged real estate investing. Shortly after, we began inviting investors to fund their accounts directly through their 401(k) and IRAs. In September, we introduced monthly payment loans, the first of many benefits our individual investors can expect a result of our $100 million partnership with Direct Access Capital (DAC).

As 2017 drew to its close, we announced the launch of our new loan origination network, originated a record quarterly loan volume of $11.1 million and put the finishing touches on achieving regulatory qualification to expand nationwide (announced shortly after the new year). To help build on the success of the year past and propel growth in the years ahead, we also announced our plans to raise equity capital for the company in 2018 via an online public offering.

Looking ahead, we’re excited to offer our investments in all 50 states and welcome aboard as shareholders the very investors who are helping to build Groundfloor as customers. Given our mission to open to private capital markets for everyone, it makes perfect sense to share potential upside in the company over the long term, in addition to the ongoing yield from our growing volume of loans in the short term.

In whatever way you’re with us, we thank you and invite you to participate by posting comments and questions below, emailing us directly at founders@groundfloor.us or contacting our support staff at support@groundfloor.us.

If you would like to download the graphic below, click here.

1. Average annual rate of return based on all loans that we repaid to investors in 2017. This is a weighted average return of the return on each loan based on the total principal amount.

2. “Current” loans are those which no events of default have occurred, all payment obligations have been met or none are yet triggered. Loans “Subject to Workout” have one or more payment defaults and we have negotiated a modification of the original terms that does not amount to a fundamental default. See “Description of the Company’s business—Project Funding and Payment of Expected Yield—Servicing and Collection of Loans” in the offering supplement referenced below for more information. Loans ‘Subject to ‘Fundamental Default’” have defaulted and there is a chance we will not be able to collect 100% of the principal amount of the loan by the Extended Payment Date of the corresponding LROs. Please see Offering Supplement No. 20 (Dated Nov 16, 2017) for a full explanation of our LRO program https://www.sec.gov/Archives/edgar/data/1588504/000114420417060026/tv477230_253g2.htm