Our monthly Groundfloor Asset Management series remains committed to highlighting key performance metrics and other relevant data managed by our Asset Management team. In this month's blog, we continue to deliver the key metrics you expect from this series, as well as provide highlights from the month.

By The Numbers

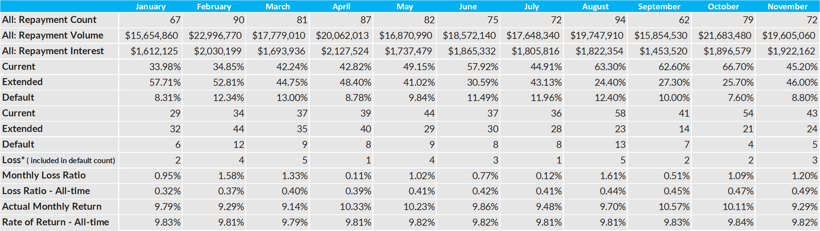

Within this segment, we present insights into the metrics relating to the loan portfolio performance for the month of November. Our assessment will encompass loan payoffs, repayment and interest volume, rate of return, and loss ratios. Additionally, we have included comprehensive views of our loan performance states and a detailed overview of the data from the beginning of the year for enhanced clarity.

Loan Repayments

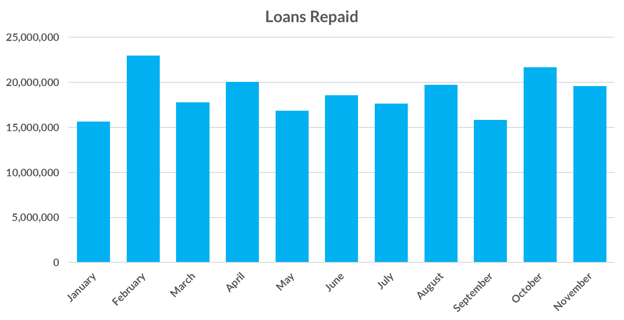

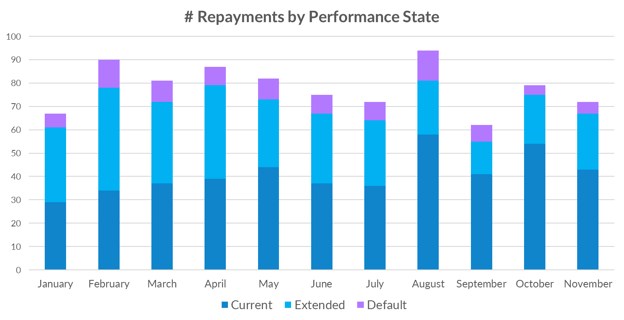

Groundfloor recorded 72 loan repayments in November. A total of 861 loans have been paid year to date.

Notwithstanding the continued economic challenges, ongoing asset management efforts have contributed to stability in loan repayment activity. Despite factors such as inflation, rising interest rates, and borrower struggles, the performance rates for loan repayments have remained consistent. This trend is encouraging as we near the close of the year.

Below is a monthly breakdown of the loans repaid and repayment volume to date in 2023:

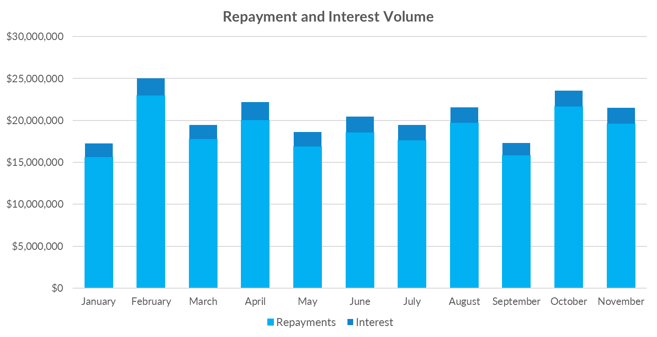

Repayment & Interest Volume

The repayment volume for the month of November saw a total of $19,605,060. Interest volume for November returned $1,922,162.

![]()

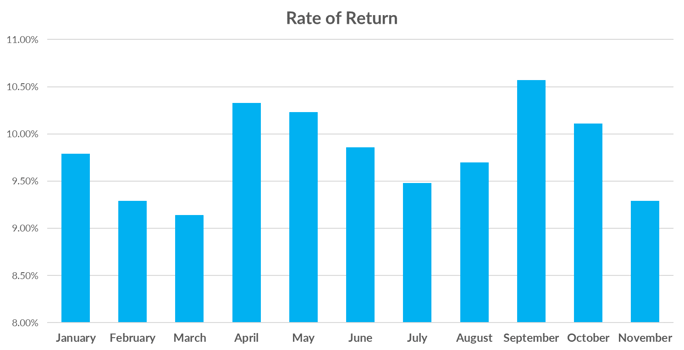

Rate of Return

During the month of November, the rate of return was 9.29%. Groundfloor continues to uphold an impressive overall rate-of-return of 9.82%, signifying sustained strength and performance over an extended period.

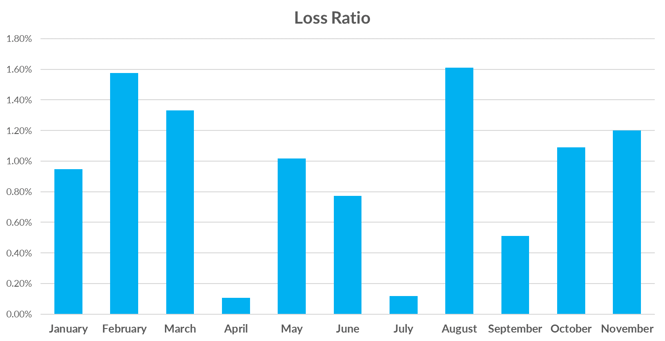

Loss Ratio

In November, Groundfloor encountered only 3 losses, resulting in a loss rate of 1.20%. The year-to-date average loss ratio stands at 0.93%. Groundfloor maintains an impressively low overall historical loss rate of 0.49%.

Further Detail

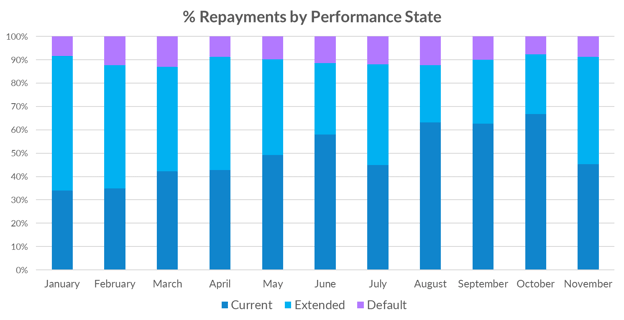

Groundfloor identifies three distinct loan states within our portfolio: Current, Extended, and Default. The charts below offer a month-over-month depiction of repayments from all loan portfolio states year-to-date. Losses are reflected within the default loan state.

Lastly, we present a full view into our overall loan portfolio, broken out into expanded detail for your assessment.

What We’re Seeing

The Groundfloor Asset Management team is working with borrowers to keep their projects moving in the right direction. The below highlights some team adjustments as well as some observations we are seeing in the marketplace:

- Improved repayment volumes over the past few months as rate movement stabilizes and eases slightly.

- The housing market remains incrementally complex since the pandemic. With uncertainty surrounding home prices, fluctuating mortgage rates, and shortages of inventory throughout the country, Groundfloor remains committed to working with borrowers to provide support and guidance where needed.

- Draw requests remain elevated compared to previous periods which continues to reflect strong borrower activity, especially amongst new construction loans.

Highlights from the Month

Here are some of the notable loan achievements from last month:

2041 West 6th Street

- The loan matured in April 2022.

- Borrower continued to have the property fall in and out of contract for sale.

- Property went under contract and was able to close in November 2023 with principal and some interest recovery for investors.

938 South Bumby Ave.

- This loan matured in October 2022.

- Borrower experienced numerous permitting and construction delays and was placed in forbearance to allow the borrower to continue work on the project.

- Borrower was unable to continue progress after the forbearance period and was placed into foreclosure and referred to Groundfloor’s Default Servicing team.

- The borrower was able to repay the loan with principal and some interest.

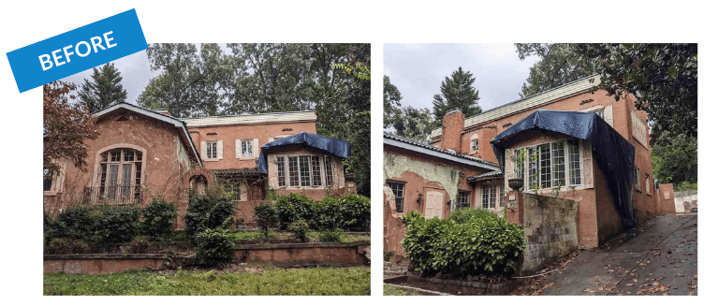

November Project Spotlights

Repaid Date: November 15, 2023

3241 Ruckle St., Indianapolis IN

768 E 3rd St., Mount Pleasant, SC

Property Purchased For: $535,000

Repaid Date: November 10, 2023

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here and your Auto Investor Account through the Groundfloor app.

If you don’t have an Auto Investor Account, transfer funds today via the app for easier automated investing.

Further Reading:

- Take a look at our latest Diversification Analysis report

- Read our Asset Management Supplement