Our monthly Groundfloor Asset Management series remains committed to highlighting key performance metrics and other relevant data managed by our Asset Management team. In this month's blog, we continue to deliver the key metrics you expect from this series, as well as provide highlights from the month.

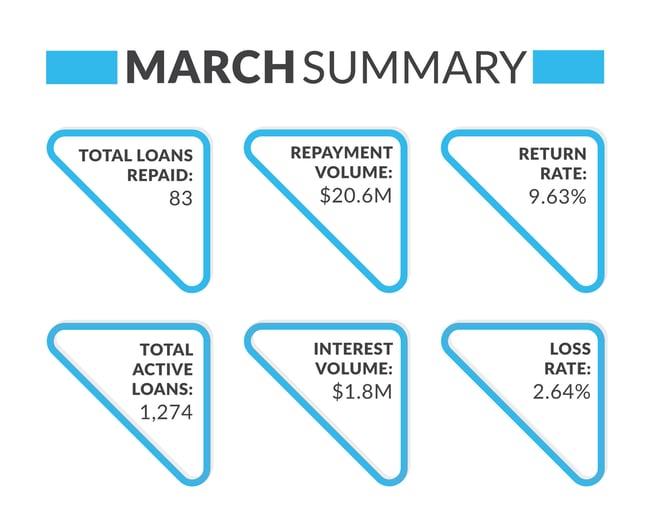

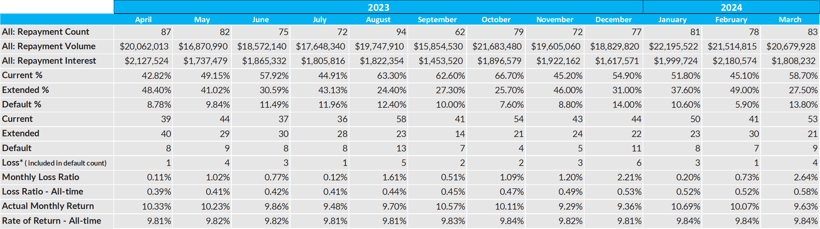

By The NumbersWithin this segment, we present insights into the metrics relating to the loan portfolio performance for the month of March. Our assessment will encompass loan payoffs, repayment and interest volume, rate of return, and loss ratios. Additionally, we have included comprehensive views of our loan performance states and a detailed overview of the data from the last twelve months.

Loan Repayments

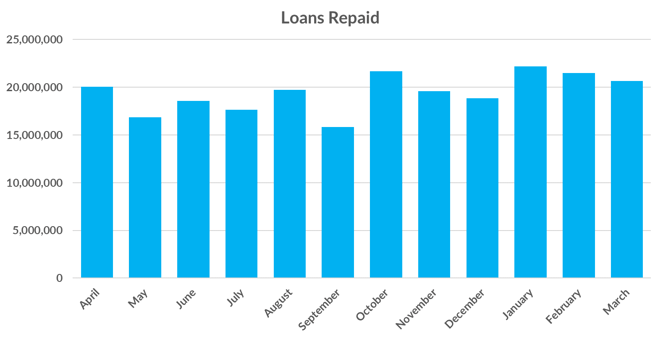

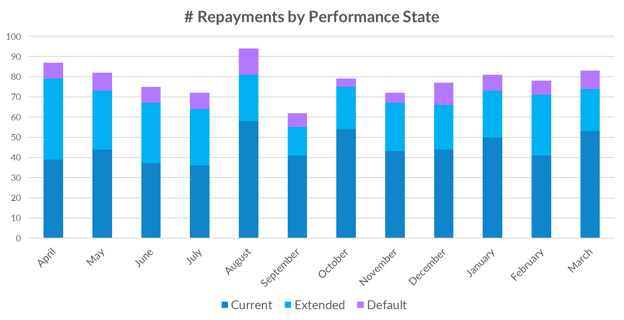

Groundfloor recorded 83 loan repayments in March. A total of 942 loans have been paid over the last 12 months.

Notwithstanding the continued economic challenges, ongoing asset management efforts have contributed to stability in loan repayment activity. Despite factors such as inflation, rising interest rates, and borrower struggles, the performance rates for loan repayments have remained consistent.

Below is a monthly breakdown of the loans repaid and repayment volume over the last twelve months:

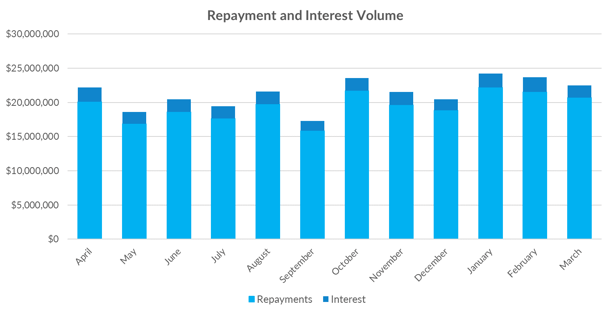

Repayment & Interest Volume

The repayment volume for the month of March saw a total of $20,679,928. Interest volume for March returned $1,808,232.

![]()

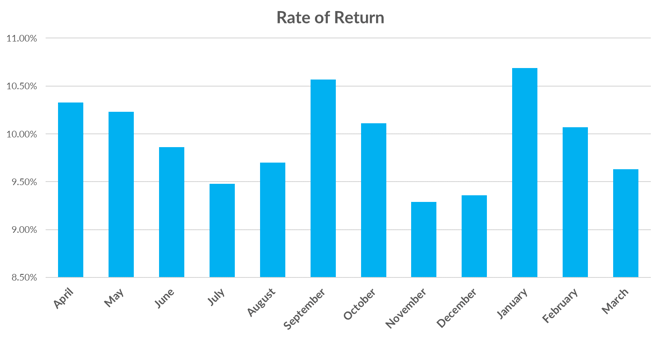

Rate of Return

During the month of March, the rate of return was 9.63%. Groundfloor continues to uphold an impressive overall rate-of-return of 9.84%, signifying sustained strength and performance over an extended period.

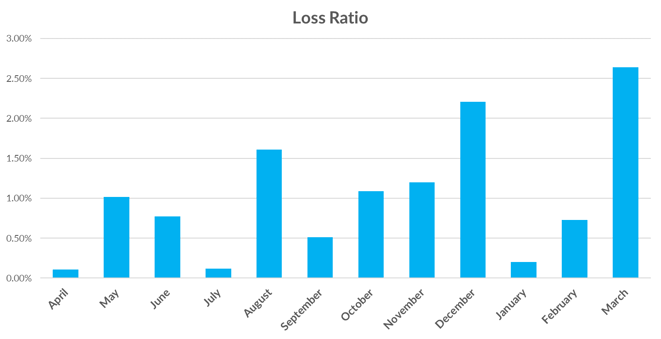

Loss Ratio

In March, Groundfloor encountered 4 losses, resulting in a loss rate of 2.64%. The last twelve month average loss ratio stands at 1.02%. Groundfloor maintains an impressively low overall historical loss rate of 0.58%.

Further Detail

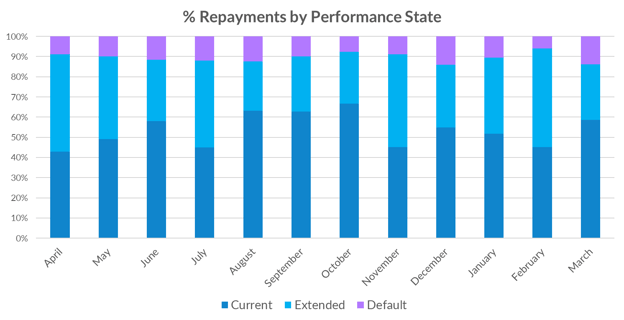

Groundfloor identifies three distinct loan states within our portfolio: Current, Extended, and Default. The charts below offer a month-over-month depiction of repayments from all loan portfolio states for the last twelve months. Losses are reflected within the default loan state.

Lastly, we present a full view into our overall loan portfolio over the last twelve months, broken out into expanded detail for your assessment.

Highlights from the Month

Here are some of the notable loan achievements from last month:

4848 Castle Dargan Drive

- The loan matured in February of 2022.

- Foreclosure began in July 2022.

- Groundfloor Asset Management continued to engage with the borrower throughout the foreclosure process

- Borrower was able to successfully repay the loan in March 2024, returning principal and interest to investors.

3009 Orion Drive

- This loan matured in August 2022.

- The borrower continued work on the property after maturity and it was listed for sale.

- Foreclosure began in November 2023

- The property went under contract and was able to close and fund just before the foreclosure sale date with a full recovery for investors

March Project Spotlights

We're highlighting some of the properties that were repaid last month and showcasing their before-and-after outcomes in the section below.

3264 Swamp Willow Ct. Jefferson GA

(New Construction)

Total Loan Amount: $607,320

Term: 18 months

Repaid Date: March 1, 2024

Property Sold For: $899,500

1336 Bernard Street NW, Atlanta GA

(New Construction)

Total Loan Amount: $358,520

Term: 18 months

Repaid Date: March 7, 2024

Property Sold For: $608,900

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here and your Auto Investor Account through the Groundfloor app.

If you don’t have an Auto Investor Account, transfer funds today via the app for easier automated investing.

Further Reading:

-

- Read our 2023 Year in Review post

- Check out our recent Monthly Market Trends Blog

- Read our Asset Management Supplement

Have Questions or Comments?

Please reach out to customer support at support@groundfloor.us or 404-850-9223, Monday through Friday, 9am – 5pm EST.