Our monthly Groundfloor Asset Management series remains committed to highlighting key performance metrics and other relevant data managed by our Asset Management team. In this month's blog, we continue to deliver the key metrics you expect from this series, as well as provide highlights from the month.

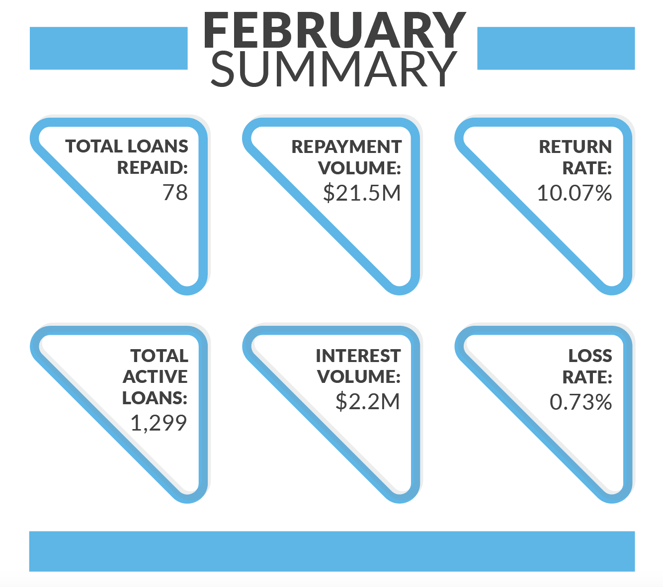

By The Numbers

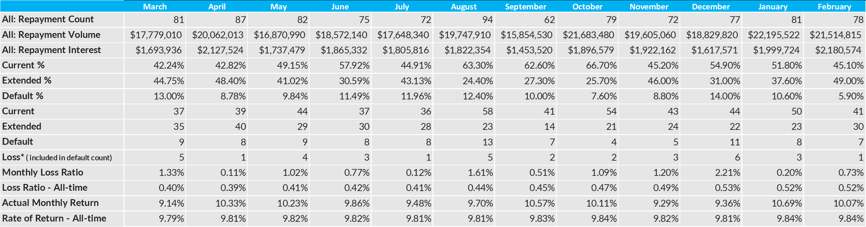

Within this segment, we present insights into the metrics relating to the loan portfolio performance for the month of February. Our assessment will encompass loan payoffs, repayment and interest volume, rate of return, and loss ratios. Additionally, we have included comprehensive views of our loan performance states and a detailed overview of the data from the last twelve months.

Loan Repayments

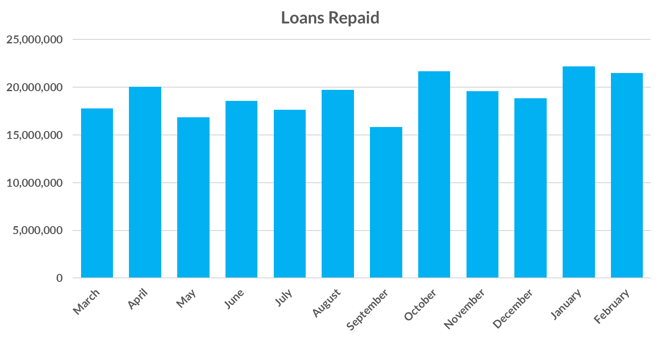

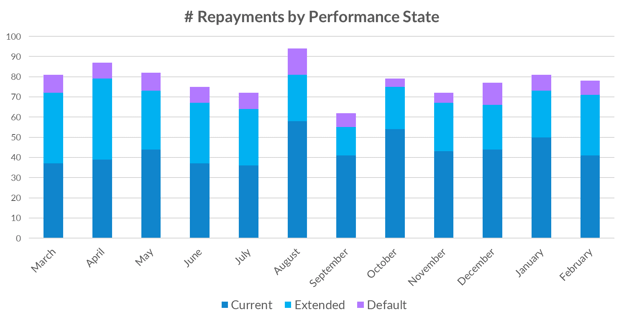

Groundfloor recorded 78 loan repayments in February. A total of 940 loans have been paid over the last 12 months.

Notwithstanding the continued economic challenges, ongoing asset management efforts have contributed to stability in loan repayment activity. Despite factors such as inflation, rising interest rates, and borrower struggles, the performance rates for loan repayments have remained consistent.

Below is a monthly breakdown of the loans repaid and repayment volume over the last twelve months:

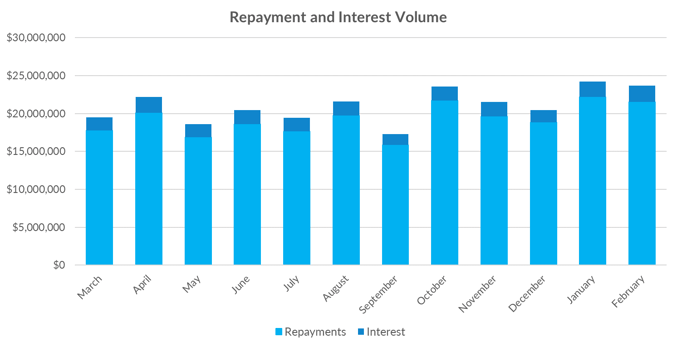

Repayment & Interest Volume

The repayment volume for the month of February saw a total of $21,514,815. Interest volume for February returned $2,180,815.

![]()

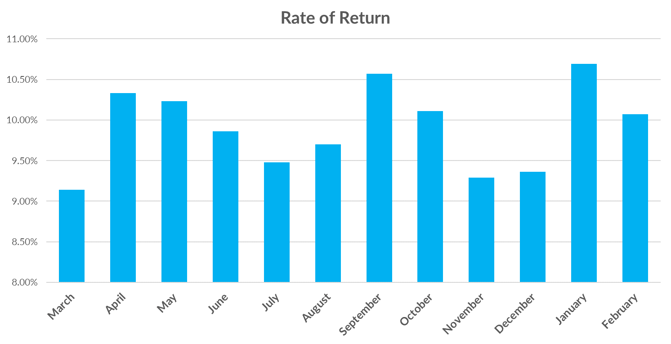

Rate of Return

During the month of February, the rate of return was 10.07%. Groundfloor continues to uphold an impressive overall rate-of-return of 9.84%, signifying sustained strength and performance over an extended period.

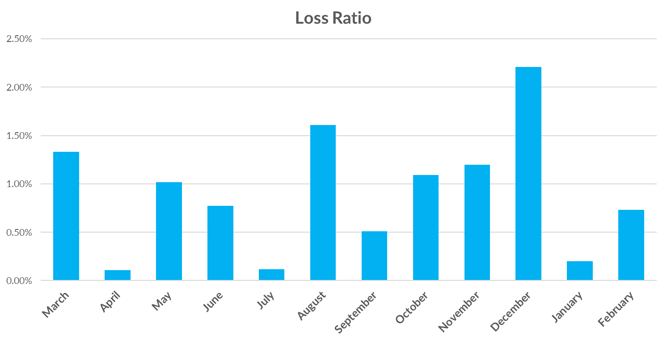

Loss Ratio

In February, Groundfloor encountered only 1 loss, resulting in a loss rate of 0.73%. The last twelve month average loss ratio stands at 0.91%. Groundfloor maintains an impressively low overall historical loss rate of 0.52%.

Further Detail

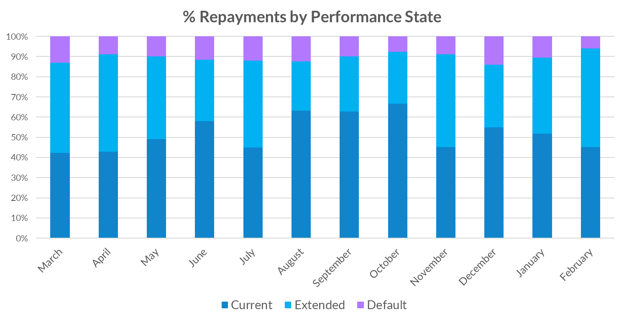

Groundfloor identifies three distinct loan states within our portfolio: Current, Extended, and Default. The charts below offer a month-over-month depiction of repayments from all loan portfolio states for the last twelve months. Losses are reflected within the default loan state.

Lastly, we present a full view into our overall loan portfolio over the last twelve months, broken out into expanded detail for your assessment.

Highlights from the Month

Here are some of the notable loan achievements from last month:

746 Bonnie Brae

- The loan matured in April 2022.

- Foreclosure began in November 2022.

- A bankruptcy filing in July 2023 canceled the foreclosure actions by Groundfloor.

- A relief of stay was filed by Groundfloor to force the court to require the borrower to fulfill their obligations per the loan documents.

- Borrower was able to successfully repay the loan in February 2024, returning principal and full interest to investors.

134 North Harrison

- This loan matured in July 2023.

- Borrower continued to attempt refinancing and sale unsuccessfully.

- The property was refinanced in February 2024 which led to a principal and full interest recovery for investors.

February Project Spotlights

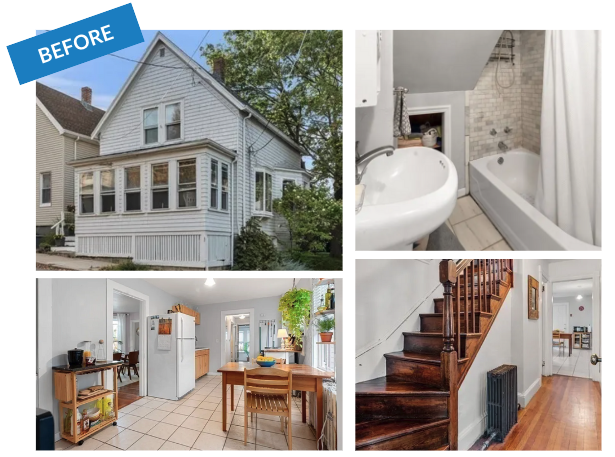

We're highlighting some of the properties that were repaid last month and showcasing their before-and-after outcomes in the section below.

111 Moreland Street, Somerville MA

(Purchase & Renovation)

Total Loan Amount: $550,000

Term: 12 months

Repaid Date: February 27, 2024

Property Sold For: $710,000

2415 S Tuttle Ave., Sarasota FL

(Purchase & Renovation)

Property Purchased For: $310,000

Total Loan Amount: $360,490

Term: 12 months

Repaid Date: February 26, 2024

Property Sold For: $430,000

541 Westmeath Dr. SW, Atlanta, GA

(Purchase & Renovation)

Property Purchased For: $187,500

Total Loan Amount: $341,360

Term: 12 months

Repaid Date: February 21, 2024

Property Sold For: $499,900

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here and your Auto Investor Account through the Groundfloor app.

If you don’t have an Auto Investor Account, transfer funds today via the app for easier automated investing.

Further Reading:

-

- Read our 2023 Year in Review post

- Check out our recent Monthly Market Trends Blog

- Read our Asset Management Supplement