The Groundfloor Asset Management Monthly Update provides a view into our overall loan portfolio. On a monthly basis, we review the prior month’s aggregate performance and the key statistics you need to understand how Groundfloor manages our existing portfolio. We highlight monthly repayments and specific projects to give you deeper insights into the ongoings of our Asset Management team.

Monthly Highlights

Groundfloor's overall portfolio had 1,248 active LROs at the end of January, which is down from 1,269 due to a strong LRO repayment month. However, our current default number increased due to properties being incomplete, which is explained in more detail below. There was also a reduction of two loans from REO.

For an expanded commentary on our Asset Management approach, we have published a companion piece to our monthly reports, found here.

The Groundfloor loan portfolio continues to perform for investors. Real Estate Owned (REO) LRO’s remain around 2% of the overall portfolio. Several files were moved to Default in February increasing the total loans managed by our Default Servicing Team.

Please note, “Default” does not necessarily mean a “loss” in our overall portfolio. See our “Rate of Return” section below for additional clarity on Defaults. or visit out Asset Management Supplement, which dives deeper into our portfolio management processes.

February Principal and Interest Repaid

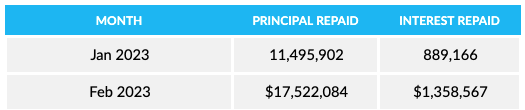

February was Groundfloor’s best ever performing month for LRO repayments to retail investors and second best overall for LRO repayments in total. In February, Groundfloor repaid $1,358,567 in interest to investors representing a 52.8% increase from January, and a new record for LRO interest repaid. In addition, principal repayments increased by 52.4% to $17,522,084.

Groundfloor's February repayment performance improved over that of January and indicates a strong first quarter for Groundfloor investors. As we approach seasonal lifts in real estate activity, this is a leading indicator of more to come.

Rate of Return

In February, portfolio performance met predicted returns. A total of twelve loans repaid from a Default status. Of those, eight returned 100% principal or better returns. Four experienced a principal loss, impacting overall returns for the month as reflected below.

Performance Metrics

The table below presents aggregated data on our portfolio performance in February 2023, as well as comparing it to where we stand currently in Q1 and YTD 2023. February saw our portfolio perform well for the month despite four anticipated losses due to being older foreclosed properties.

*It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

To access and download a detailed view of February performance metrics, click here.

February Asset Management Highlights

Our asset management and default servicing teams are dedicated to providing our investors with exceptional returns on their investments. Here are some highlights from this month's activities:

- 1085 Osborne St - This property was the fourth most aged LRO in inventory at 50 months from origination. After an insurance claim was filed due to a fire at the property, the recovery check was held by the bank and not released to Groundfloor due to a discrepancy regarding the deposit. After relentless follow up with the borrower, insurance company, adjuster, and banking officials, a new check was finally issued. Within a week of that issuance, investors were repaid with interest. A recovery by some was considered impossible, however the Groundfloor asset management teams’ persistence enabled this recovery for Groundfloor investors.

- 176 Vanira A and B - After over twenty four months and nearing the foreclosure sale date, the Groundfloor default services team was able to secure repayment of these two LRO’s for investors. Not only was a full payoff received, but Groundfloor investors experienced a recovery of 11.16% interest compared to the 8% interest initially contracted on the properties.

February Project Spotlights

This month we feature three unique projects from a variety of states that we offer loans in as part of this month's Project Spotlights.

80 Shults Road, Bluffton, SC

(Purchase & Renovation)

Repaid LRO

Repaid Date: February 27, 2023

LRO Amount: $509,820

Interest Rate: 10%

Total # of Investors: 3,077

3035 N. Olcott Avenue, Chicago, IL

(Purchase)

Repaid LRO

Repaid Date: February 1, 2023

LRO Amount: $310,700

Interest Rate: 10%

Total # of Investors: 1,588

340 Eugenia Street Southwest, #101, Atlanta, GA

(New Construction)

Repaid LRO

Repaid Date: February 22, 2023

Loan Amount: $301,970

Interest Rate: 8%

Total # of Investors: 781

Groundfloor Borrower Spotlight

Askaree Martin is an Atlanta-based real estate entrepreneur who has been in the industry for nearly 5 years. He got his start with affiliate marketing and was introduced to real estate.

For the past 2 years, Askaree has been working with Groundfloor and loves it - he is grateful to have a Business Development Manager who looks out for him. In the two years since joining Groundfloor, Askaree has completed two projects, has one completed and listed for sale, and is currently working on two more.

One of Askaree's true passions lies in teaching people from underprivileged communities about real estate - something many of them would never have access to otherwise. He enjoys sharing his knowledge and advising others as they start out in the industry. As he puts it, you don't always need a lot of money to get started; you just need the right property.

Read more about Askaree and see some of his Groundfloor projects here.

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here.

Understanding our Loan Status Definitions:

Repaid Loans - this is when the borrower has paid back the current loan on their property and the interest is distributed back to the investors of the LRO associated with that particular property.

Current Loans - these are performing loans with active renovation projects which have corresponding LROs that have been sold on our investment platform.

Extended Loans - these are loans where the project completion and/or loan repayment did not happen before the intended maturity date and the borrower has signed an extension agreement to pay penalty interest which will be passed through to LRO investors when it repays.

Defaulted Loans -these are loans where Groundfloor's Default Servicing team has engaged with counsel to file legal foreclosure proceedings to take possession of the property as collateral for the defaulted loan.

REO (Real Estate Owned) - this is when Groundfloor takes ownership of the property through the foreclosure process and works to sell the asset in order to recoup as much principal and interest for our investors as possible.