The Groundfloor Asset Management Monthly Update provides a view into our overall loan portfolio. On a monthly basis, we will review the prior month’s aggregate performance and the key statistics needed to understand how Groundfloor manages our existing portfolio. We will highlight monthly repayments and specific projects to give you deeper insights into the ongoings of our Asset Management team.

Monthly Highlights

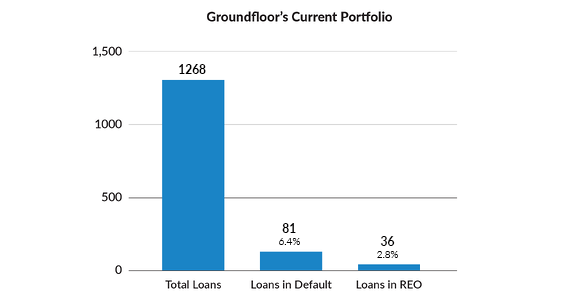

Groundfloor's overall portfolio had 1,268 active LROs at of the end of December, a strong showing considering seasonality, as well as a reduction of 20 Loans in Default compared to November.

Defaults and REOs still make up a small portion of our portfolio, which remains stable overall, despite market conditions. Note, “Defaults” does not necessarily mean a “loss” in our overall portfolio. See our “Rate of Return” section below for additional clarity on Defaults.

December Principal and Interest Repaid

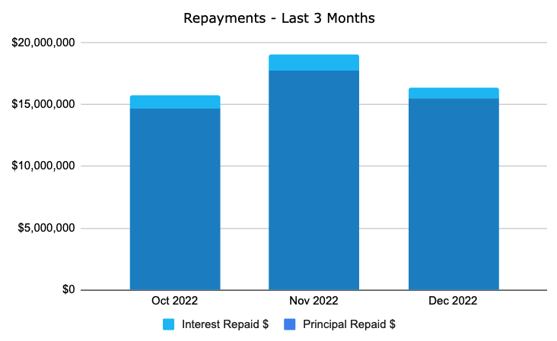

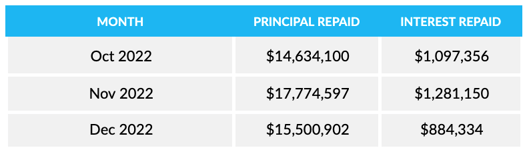

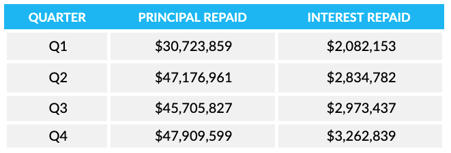

October and November saw consecutive company records for the highest monthly repayment of interest. The amount of interest repaid in December amounted to $884,334. Principal repayments remained strong at $15.5M and finished in line with quarterly performance. The interest repaid in December continued to reflect Groundfloor’s strong end-of-year performance capping off the best performing quarter of the year.

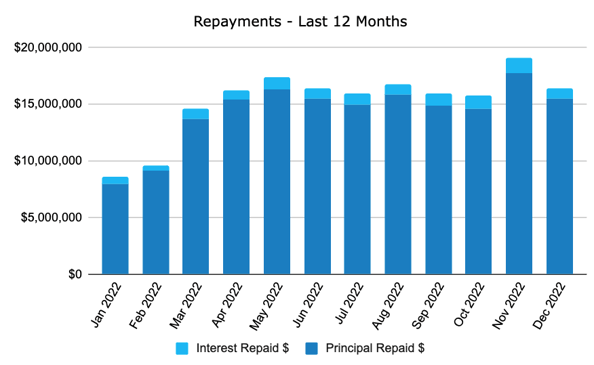

When looking at the overall principal and interest repayments, Q4 has been the strongest performing quarter across the calendar year. December performance reflects the fourth strongest month of the year, and while below November’s total, December did outperform October’s Principal Repayment totals.

When analyzing the full year for both Interest and Principal Repayments, Groundfloor’s overall portfolio performance, growth and stability remain strong despite continued economic and industry headwinds.

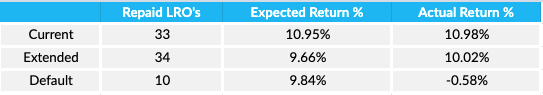

Rate of Return

December’s portfolio performance once again saw both the actuals for the Current and Extended LROs exceeding that of the expected return. Furthermore, despite the average actual returns of loans repaying in a Defaulted status, most investors recouped all principal and interest. Of the 10 Default LROs that repaid in December, 3 projects experienced a loss in principal with no interest repayment, which lowered the actual return average overall for this category.

You can view the full details of all 77 December repayments here.

Performance Metrics

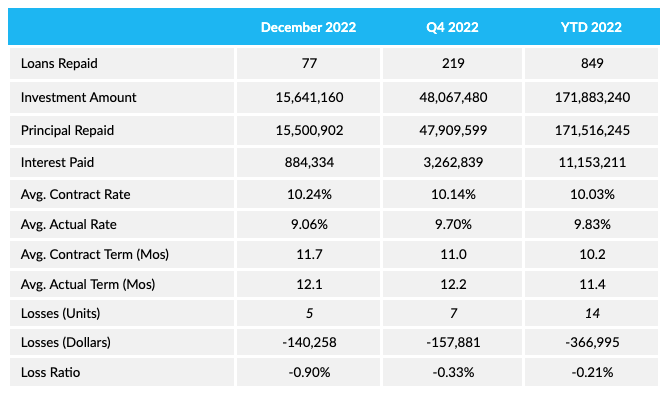

The table below presents aggregated data on our portfolio performance for the month of December, Q4 and overall 2022 statistics. For the month of December, Groundfloor accepted offers and closed on several REO and severely aged defaulted loans that resulted in an increase to our loss ratio for the month.

*It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

*It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

To access and download a detailed view of December's performance metrics, click here.

December Asset Management Highlights

Our asset management and default servicing teams are dedicated to maximizing recovery for our investors. Here are a few highlights for the month:

- It is worth reiterating that in December, Groundfloor investors received $16,385,236 of principal and interest repayments. This brought the total for Q4 to $51,172,438, which represents 28% of all repayments for the year 2022.

- The asset management team is actively prioritizing resolutions for our longest standing delinquent and defaulted loans. As a result, the repayment of several aged loans brought down our overall actual return percentage for these default loans, as noted in the Rate of Return table. Our Asset Management team continues to prioritize loans showing signs of entering default, and those currently in that state in an effort to best recoup dollars to the best of our ability, as we believe strongly this is in the best interest of our investors.

December Project Spotlights

In this month’s Project Spotlight, we highlight two new construction projects from our home state of Georgia, and another project from Illinois, highlighting a substantial Fix and Flip effort. Congratulations to our Borrowers who continue to do great work revitalizing communities across the country.

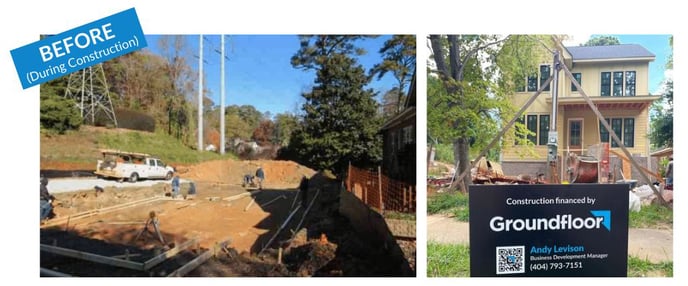

796 E. Morningside Drive NE, Atlanta, GA

(New Construction)

Repaid LRO

Repaid Date: December 2, 2022

LRO Amount: $1,000,000

Interest Rate: 8.5%

Total # of Investors: 1,831

2572 Gate Park Drive, Bethlehem, GA

(New Construction)

Repaid LRO

Repaid Date: December 28, 2022

LRO Amount: $365,330

Interest Rate: 12.5%

Total # of Investors: 1100

5620 Fernwood Court, Matteson, IL

(Purchase & Renovation)

Repaid LRO

Repaid Date: December 27, 2022

Loan Amount: $181,980

Interest Rate: 10%

Total # of Investors: 1,495

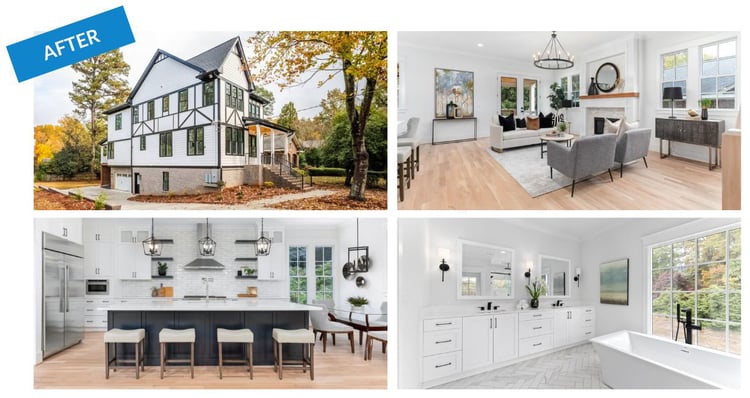

Groundfloor Borrower Spotlight

Bernard Harris, an Atlanta-based real estate investor with over 27 years of experience in the industry, was featured as the December "Stud of the Month" in our "Down to the Studs" Borrower Newsletter series. Bernard has completed more than 100 renovation, fix & flip, and construction projects throughout his career and is currently working on his sixth project with Groundfloor - 2818 Scenic Terrace. He has enjoyed working with the Groundfloor team on several projects to date, and hopes to continue his passion of flipping houses.

Bernard Harris, an Atlanta-based real estate investor with over 27 years of experience in the industry, was featured as the December "Stud of the Month" in our "Down to the Studs" Borrower Newsletter series. Bernard has completed more than 100 renovation, fix & flip, and construction projects throughout his career and is currently working on his sixth project with Groundfloor - 2818 Scenic Terrace. He has enjoyed working with the Groundfloor team on several projects to date, and hopes to continue his passion of flipping houses.

Read more about Bernard and see some of his Groundfloor projects here.

Understanding our Loan Status Definitions:

Repaid Loans - this is when the borrower has paid back the current loan on their property and the interest is distributed back to the investors of the LRO associated with that particular property.

Current Loans - these are performing loans with active renovation projects which have corresponding LROs that have been sold on our investment platform.

Extended Loans - these are loans where the project completion and/or loan repayment did not happen before the intended maturity date and the borrower has signed an extension agreement to pay penalty interest which will be passed through to LRO investors when it repays.

Defaulted Loans -these are loans where Groundfloor's Default Servicing team has engaged with counsel to file legal foreclosure proceedings to take possession of the property as collateral for the defaulted loan.

REO (Real Estate Owned) - this is when Groundfloor takes ownership of the property through the foreclosure process and works to sell the asset in order to recoup as much principal and interest for our investors as possible.