Welcome to the eighth installment of our Diversification Analysis, a series we began in July 2017. As with previous installments, this analysis looks at the actual investment outcomes achieved by real Groundfloor investors since the company’s inception, and explores the question: What is the relationship between the number of loans held in an investor’s portfolio, and the investment results that portfolio achieves?

Groundfloor’s unique investment product, the limited recourse obligation (LRO), gives investors the opportunity to hand-select from, and invest directly in, a wide range of real estate development projects made available on our platform. Tt takes only $1000 to get started, invest in $10 increments., investors have the ability to spread their dollars across many different projects, rather than concentrating in just a few. This technique, diversification, is a powerful and proven method of managing a portfolio’s risk and achieving consistent and predictable returns.

And as we have reported previously, the evidence is clear: investors who have invested in many LROs, rather than just a few, have seen their portfolios deliver more consistent and predictable returns, with less pronounced loss ratios, evidencing better protection against the occasional loss.

Since our last installment in this series (an analysis performed as of July 30, 2021), we have seen a significant increase in lending activity, enabled by tremendous growth of our investor base. Our data now includes 25,436 portfolios with at least one repaid LRO, with 2,098 LROs repaid in total, and over $298 million in principal invested (as of May 17, 2022).

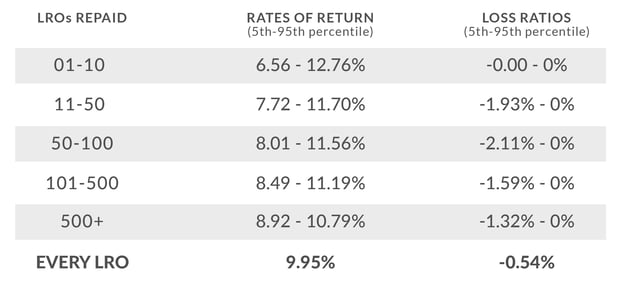

The Effects of Diversification on Portfolio Returns

The relationship between diversification and portfolio returns -- and the power of diversification generally -- is represented graphically in the chart below. Every dot in the chart represents a portfolio of an actual Groundfloor investor. Along the x-axis, we see the number of repaid LROs the portfolio has delivered; along the y-axis, we see the annualized, weighted average rate of return the portfolio has achieved.

Our analysis shows that a model portfolio composed of an equal investment made in all 2,098 LROs repaid to date would have earned an annualized net return of 9.95%. Analyzing our current outstanding loan portfolio would similarly yield an annualized net return of 10.02%, assuming all outstanding loans perform and deliver the contract interest rate.

As the theory of diversification predicts, portfolios invested in the largest number of LROs realized the most reliable returns. This is true even though Groundfloor investors, unlike investors in REITs or other funds, decide not only which LROs to include in their portfolios but also how much capital to allocate to each LRO, relative to the others. The diversification enabled by the Groundfloor platform is that strong -- and Groundfloor investors are able to achieve a greater level of it than is provided by competing online REIT products.

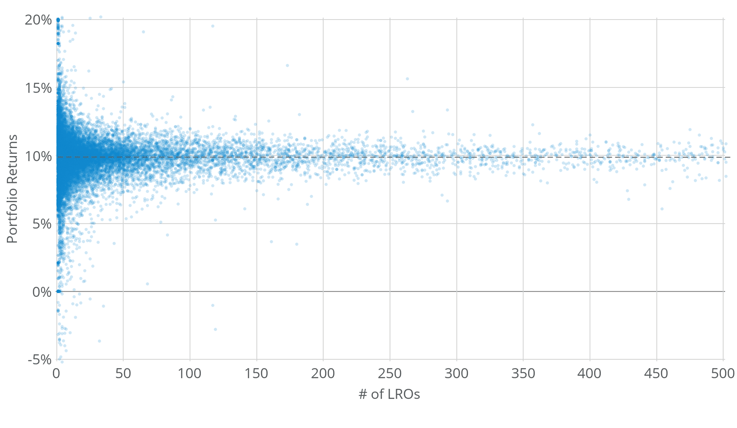

The Effects of Diversification on Loss Ratios

The portfolio returns reported above are reported net of losses. This means losses are taken into account in calculating the return presented. Many investors want to understand not only the net rate of return but also the level of losses they can expect when investing to get to that net return. This measure of losses is encapsulated in a useful metric called the loss ratio.

The loss ratio is the amount of principal lost expressed as a ratio to the principal invested. A loss ratio of -5.0%, for example, would mean that $50 was lost out of every $1,000 invested.

As with rates of return, the relationship between diversification and loss ratios can also be represented graphically, to powerful effect. Every red dot in the chart below represents an actual Groundfloor investor’s portfolio; along the x-axis is the number of repaid LROs a portfolio has received, and along the y-axis is the loss ratio the portfolio has experienced.

-3.png?width=737&name=image%20(1)-3.png)

A model portfolio composed of equal investments in all 2,098 LROs repaid to date would have experienced a loss ratio of -0.54%. Just as it has been every year since Groundfloor was founded in 2013, our loss ratio continues to be well less than 1%, even as more and more loans are added to our repaid portfolio. While most LROs deliver positive returns and loss situations are rare, the occasional loss does occur, as no investment is without risk. And as the data show, it is the most diversified portfolios that provide the best insulation against those occasional losses.

Portfolio Returns and Loss Ratios for Loans Repaying Past Maturity

The powerful effects that diversification can have on portfolio returns remain valid even when looking at loans that were repaid past maturity (i.e., loans that were extended or in default).

As we have advised before, loans that go into default or are granted an extension do not necessarily (or even usually) result in losses. In fact, in most cases, the borrower has made significant progress on the project, or our Asset Management team has worked on a positive resolution with the borrower to ensure full repayment. As a result, loans that we have labeled as “default” or “extended” (i.e., those past maturity), have historically still returned over 9% yield on average.

A model portfolio consisting only of the LROs that repaid past maturity (861 of them to date) would have generated an annualized net return of 9.13%, while experiencing a loss ratio of only -1.22%. Even if by some stroke of bad luck, every loan held by a hypothetical investor repaid past the maturity date, that investor would still have experienced strong returns and limited losses, as long as they were diversified across many LROs.

Summary

As the data show, diversification is a powerful strategy for achieving steady returns and managing risk, and Groundfloor investors who have diversified their investments across as many loans as possible have reaped the benefits, in the form of more predictable returns and better protection against losses. For new investors especially, we recommend spreading your dollars across many LROs rather than concentrating them in just a few. Thanks to Groundfloor’s low minimum investment it takes only $1000 to get started, invest in $10 increments.

Groundfloor was founded to give everyday investors all over the country the opportunity to invest in high-yield securities previously only available to the top 5% of wealth holders and income earners. As we continue to expand our loan origination capabilities and lending geography, the extent to which our investors can diversify their portfolios has reached levels that are unprecedented in the real estate investment space. In line with our mission, we will continue to empower our investors to develop and execute their own investment strategies. Whether and how you take full advantage of this degree of freedom is up to you.

If you have any questions or comments about this report, you can comment below or send an email to support@groundfloor.us. We always appreciate hearing from you.