As we continue to expand the types of real estate investment products we offer on our platform, we’re proud to announce that we’re starting to offer LROs that incorporate multiple positions within the same loan. We are excited for this new development because it not only allows us to originate bigger loans for larger-scale renovation projects (thereby enabling us to better serve our borrowers’ needs), but also to offer a wider range of possible returns to help our investors diversify their portfolios.

It’s important to note here that though each piece of a given LRO may have its own specific position with respect to the order of payment of investment returns, we still hold the first lien position in the overall loan and therefore are still lending based on the total value of the underlying real estate asset. This method of splitting the loan into multiple LROs simply allows investors the ability to enter into various investment opportunities on the same property at different risk/return profiles.

This post explains how this is accomplished in detail.

Context and Concept

As our current lending policy states, we can provide developers with loans up to $1,000,000 to fund their projects. In practice, however, it’s been rare for us to extend loans that approach that $1 million maximum as most residential fix-and-flip projects are on the lower end of this scale. However, as we enter into other types of real estate projects, such as new construction or multi-family, tapping into the upper end of our lending capacity is more important.

So, as is common with many construction loans, we can now split a given LRO into two pieces -- an “A” piece and a “B” piece, each assigned its own specific interest rate. The weighted average of the rates assigned to each LRO equate to the overall interest rate agreed upon with the borrower. Groundfloor still holds a first lien position on behalf of our investors. The process of repayment remains essentially unchanged from our normal LRO offerings, except for the order of priority in which investors are repaid.

The idea of a “repayment waterfall” (or “waterfall” for short) is a useful metaphor for illustrating the concept of payment order or priority. In this metaphor, the water represents proceeds from the repayment of the underlying loan. Normally, in a full repayment there is enough water (money) to flow to investors in the A piece (the “A”) and then down to investors in the B piece (the “B”) alike. Both are repaid full principal and interest. In the event of a default in which a principal loss is incurred on the underlying loan, however, investors in the “A” will be treated differently from investors in the “B”.

The “A” portion of a given A-B LRO is in first payment position in the repayment waterfall. "A" investors' principal is always repaid in full before any other investors receive their repayments out of any remaining funds. Then, repayment flows to the "B" investors' principal. Remaining funds are then dispersed to satisfy interest payments, beginning with "A" investors and then flowing to "B" investors. While there is no guarantee that proceeds will be sufficient to repay the “A” investors in full, due to their position in the waterfall that is more likely than it will be for investors in the “B”. The “A” therefore carries less risk and offers a correspondingly lower interest rate.

The “B” occupies the second repayment position in the waterfall. It is riskier because in the event of a loss on the underlying loan, principal on the “B” pieces is only paid after principal is first paid to the “A” piece. While investors in both pieces benefit from Groundfloor's first lien position, investors in the “A” benefit more so than investors in the “B” by virtue of being paid first. As mentioned, principal is first recovered for the “A” investors, then for the “B” investors. Afterwards, funds left over will be assigned to the “A” portion of the interest. Only when the “A” interest is fully satisfied will remaining funds be assigned to the “B” portion of the interest. Investors in the “B” are therefore rewarded with a higher interest rate to compensate for the greater level of risk they are taking on.

Benefits for Borrowers

This new method of splitting a loan into risk-adjusted portions affords us the ability to extend larger loans to borrowers. Borrowers can obtain the financial leverage from Groundfloor that they need to successfully complete larger-scale projects, instead of taking their business to competing lenders.

Benefits for Investors

Splitting loans in this manner is also beneficial for our investors. As mentioned above, stratifying a loan into multiple LROs with different risk profiles affords our investors an even greater ability to diversify further with risk profiles that best fit their investing strategies. Investors comfortable with shouldering more risk can choose to invest in the “B” portion of a given LRO, while those who prefer less-risky options can put their money to work in the “A” portion.

Additionally, because splitting LROs allows us to originate larger balance loans overall, we can now expand into new product categories, which again provides even more chances for our investors to diversify their holdings.

The New Loan Detail Page, Explained

To reflect this new capability to split up our LRO offerings, we’ve made some changes to the way the Loan Detail Page will look for loans that have been divided into multiple LROs. Let’s use the example of the $518,770 loan we recently originated on 201 Clay Street SE in Atlanta. Since this is a large balance loan, we elected to split it up into smaller pieces for release to investors.

The “A” portion of the loan is $363,140, while the “B” portion is for $155,630.

The "A" Portion

Here is the Project Summary card for the “A” loan (indicated by labeling the loan as [1st Payment Position] in the title, and again in the Loan Position box). As can be seen here, the stated loan amount of $363,140 is for that particular portion of the overall loan, as are the rate (11%) and letter grade (C).

![201 Clay Street SE [1st Payment Position]](https://blog.groundfloor.com/hs-fs/hubfs/Screen%20Shot%202019-10-24%20at%201.49.58%20PM.png?width=600&name=Screen%20Shot%202019-10-24%20at%201.49.58%20PM.png)

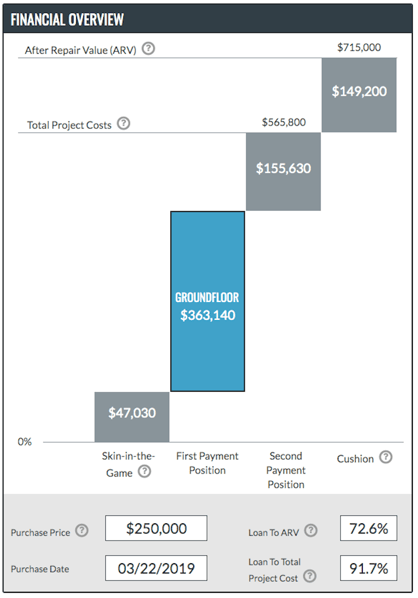

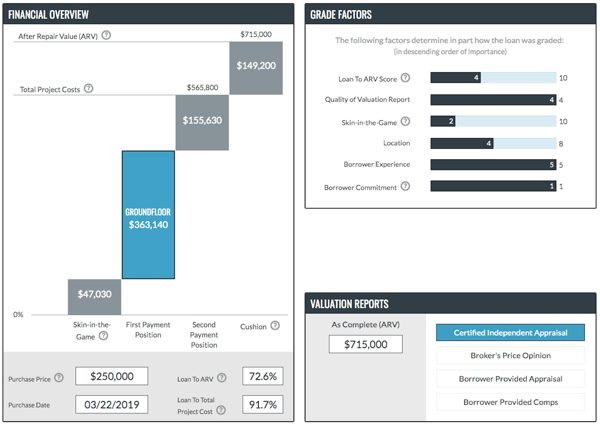

Continuing down the page, we arrive at the Financial Overview graphic. Here, we can see that instead of the Groundfloor loan being depicted in one bar (as it is with a single LRO offerings), it has now been broken up into two bars, each of which reflect the “A” and “B” LROs and their respective repayment positions.

The bar shown in blue represents the loan portion in which you are investing -- in the below example, the investor is investing in the “A” LRO, which is for $363,140.

The "B" Portion

Now let’s examine the “B” portion of the LRO. Just as with the “A” portions of the loan, the Project Summary card for the “B” piece of the loan will show the loan amount for that particular portion -- in this case, $155,630 -- as well as the appropriate rate and letter grade. As we can see below, the “B” portion has a higher rate and letter grade, corresponding to the fact that it has a riskier loan profile of second position. Again, the second payment position is indicated in the loan title as [2nd Payment Position] and is also listed in the Loan Position box.

![201 Clay Street SE [2nd Payment Position]](https://blog.groundfloor.com/hs-fs/hubfs/Screen%20Shot%202019-10-24%20at%201.50.04%20PM.png?width=600&name=Screen%20Shot%202019-10-24%20at%201.50.04%20PM.png)

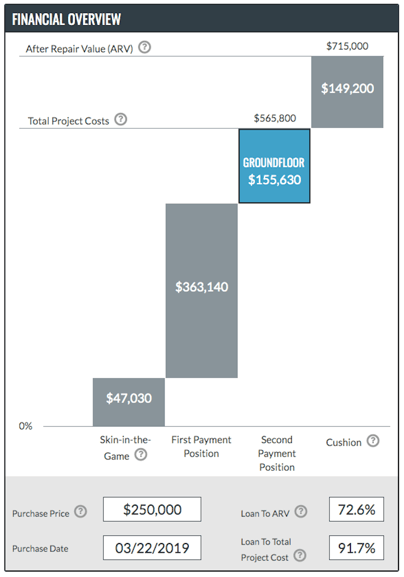

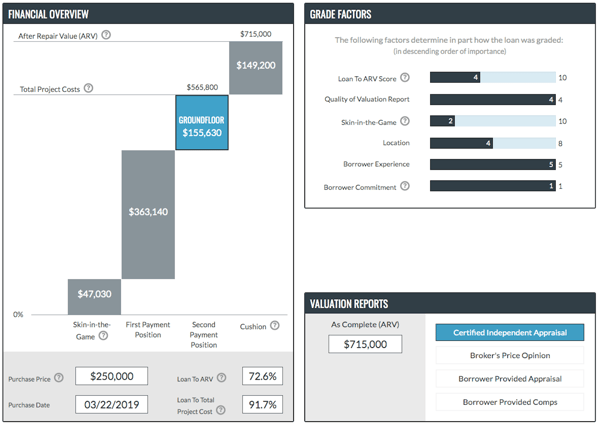

Moving down to the Financial Overview chart, we see that the “B” portion of the loan has now been highlighted in blue, indicating this is the loan piece we are looking at. Again, the “B” LRO of the loan is for $155,630 and is clearly noted to be in the second repayment position relative to the “A” LRO.

It’s also important to note here that the loan-to-ARV (72.6%) and the loan-to-total project cost (91.7%) figures reflect those of the overall loan. This is why those figures remain unchanged on the Financial Overview charts we’re showing here. The same is true for the Grade Factors as well as the Valuation Reports -- these correspond to the overall loan as opposed to a specific portion of it.

The Financial Overview Charts for the "A" portion of the loan.

The Financial Overview charts for the "B" portion of the loan.

The Fine Print: Risk Factors

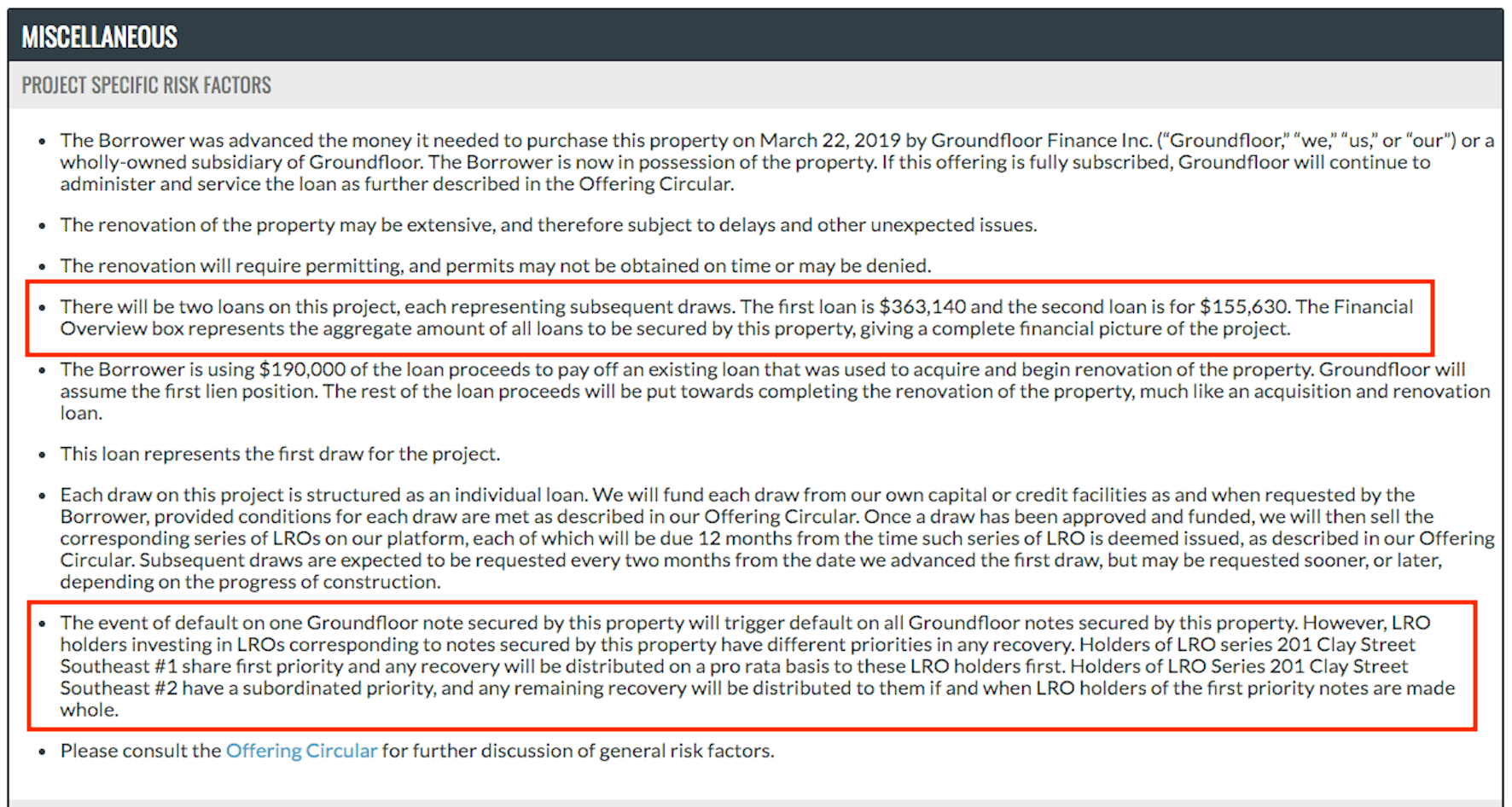

As we stated when we first began examining the Loan Detail Page on 201 Clay Street, the loan was split into two LROs -- one “A” LRO and one “B” LRO. But upon first look, how can we tell that that’s actually what happened? The answer lies at the bottom of the page in the listed Risk Factors for the loan:

As we can see, the Risk Factors clearly state that there will be two LROs on the project, the first one for $363,140 and the second one for $155,630. It also states that the second LRO is subordinate to the first and that the first one has priority for repayments.

The Bottom Line

As such, it is vitally important to carefully read the Risk Factors listed for any and all LROs being considered for funding, as this is the only way to know whether a loan has been split up and, if so, into how many pieces it has been split.

We hope this has helped clear up any questions you may have about this new product offering.

Splitting a large loan into pieces as described above allows us to take a single deal and stratify it to get different risk profiles that can then offer even more diversification options for our investors. As always, if you have any further questions, you are welcome to post them in the comments below or reach out to our Customer Success team directly at support@groundfloor.us.