Last week we discussed secured lending and how it reduces the risk of your investment. If you remember, we mentioned that the property’s value is really the key variable that an investor must consider to determine whether or not a particular investment is suitable for her/him. Recall that if a borrower defaults on a loan, investors are protected to the degree that the value of the home (less foreclosure and sales & marketing costs) is no less than the loan amount (plus) interest.

So how do you determine a property’s value and what are the tools and resources that can be used?

There is no shortage of textbooks, university and Masters classes and academic papers that address the topic of valuation. Moreover, there are numerous methods that investors use to determine an asset’s value. Valuation is as much art as it is science, and it’s one reason why investment bankers and fund managers are paid enormous salaries. Needless to say, asset valuation can be an extremely complicated subject and one that can be quite intimidating even to the most sophisticated investor. However, real estate valuation, while still quite complex, has numerous shortcuts, resources and tools that any investor can use to determine a property’s value. In fact, if you’ve ever sold a home you’ve used one of the most common and powerful tools available: comparables.

Sales Comparables (MLS)

The local MLS, or multiple listings service, for the property is one of the best resources for public comparables. The data is provided by local real estate agents, and you can find current properties on the market as well as sold properties. You can also typically search based on a number of criteria such as zip code, number of bedrooms, number of bathrooms, year built and so on. Why use comparables? If your neighbor bought a car for $10k and wanted to turn around and sell it to you the very next day, wouldn’t you expect to pay approximately $10k (assuming your neighbor didn’t make any changes to the vehicle and the car’s condition had not changed)?

Appraisals

Appraisals are commonly used to value real estate. Appraisers are real estate valuation professionals. They use different methods to value a property depending on the type of property. For example, with residential property one of the primary resources appraisers use is comparable sales--the same tool that you have access to! If it’s an investment property, appraisers will also consider how much cash (from rent) a property will produce. The sum of cash from rent (projected into the future) helps them determine the property’s value.

Developer/Sponsor’s Projected Value (or After Repair Value or “ARV”)

Whenever a project sponsor invests in a real estate project, they should have a projected sales value for their completed project. based on their construction, renovation or improvements. While this estimate may certainly be biased, skilled sponsors can see value that others often miss. After all, they are investors themselves. The more skilled a sponsor is at identifying value overlooked by others, the more money they will make on their project. Additionally, their reputation (and ability to raise future capital) is improved or destroyed by their ability to accurately value a property.

Purchase Price

As a lender, it’s important that you not only estimate a property’s expected value (or the value it would likely sell for), but also a conservative estimate since your investment is secured by that property. For example, a property that is purchased in foreclosure can provide a reasonable benchmark of the asset’s value in a distressed sale. Many of our borrowers acquire their investment properties through foreclosure sales, so the price they pay provides you the asset’s value in a distressed sale. Keep in mind however, that the the purchase price does not take into account any improvements made by the borrower. In some cases, the property’s land value alone might cover the value of the loan. A property’s own purchase price is arguably the best sales comparable there is for a conservative estimate of value, particularly if the project sponsor is an experienced real estate investor. The more experience that a project sponsor has with a particular neighborhood or project type, the more accurate they should be. Although the purchase price is not as helpful for new construction, it can be particularly helpful for renovations or flips.

Other Internet Resources

The Internet provides numerous resources that can be used to estimate a property’s value. Websites like Zillow, Trulia and Redfin all provide sales data as well as information on the neighborhood (crime rate, trends, school information, etc.). Many of these websites even have an estimate for the property’s value based on different data sources and their own proprietary algorithms.

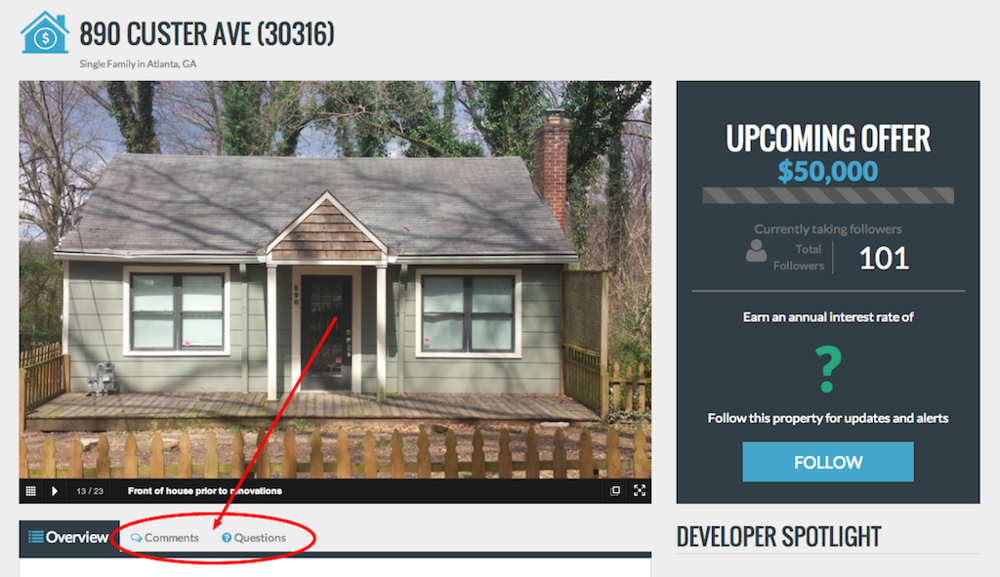

Public Opinion (Other GROUNDFLOOR Investors)

We think one of the best resources can be other investors on the GROUNDFLOOR website. Many of our investors are in the real estate industry as developers themselves, real estate agents and brokers to name a few. Additionally, if you don’t know the particular neighborhood or the developer, there is a chance that one of your fellow GROUNDFLOOR investors does.

Did you know that there is a “Questions” and “Comments” section for every project that we have on the website? Why not start a conversation by asking a question or providing your opinion?

Speaking of which, we always appreciate hearing from you--and to prove it we always make a point of responding quickly and thoroughly. Please chime in with your own thoughts about valuation, or questions about the information we’ve provided above.

Was this helpful? Until next time, we’ll look forward to your feedback and input.