Click to expand and see the entire infographic.

Click to expand and see the entire infographic.

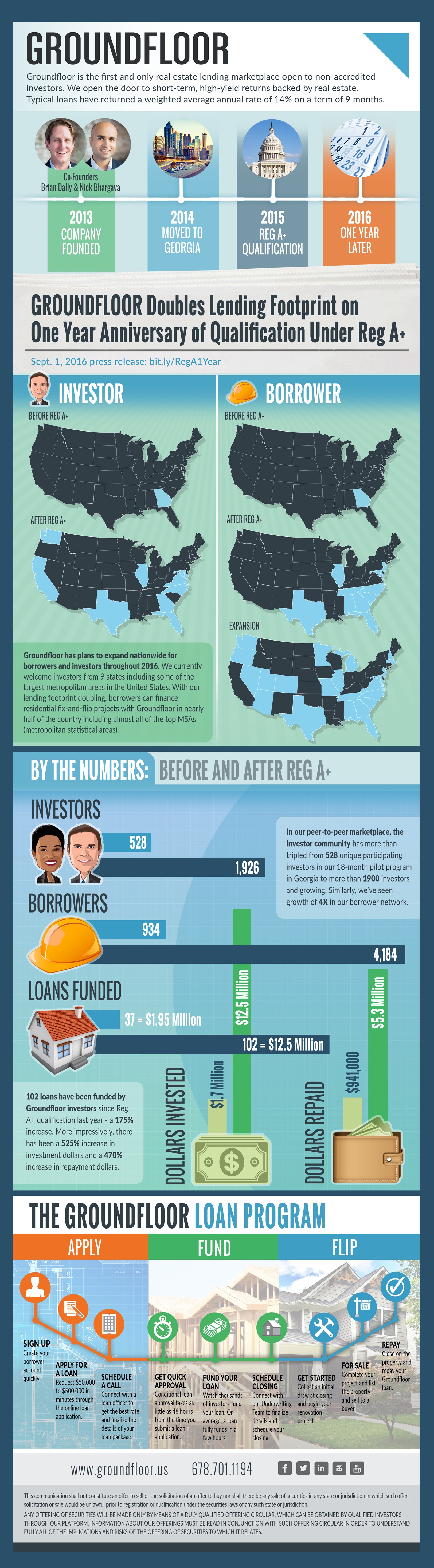

Yesterday, we celebrated a significant milestone by announcing a significant expansion.

First, the milestone. It was just one year ago that Groundfloor became the first-ever (and still only) real estate lending marketplace to be qualified by the Securities and Exchange Commission. We joined Lending Club and Prosper as the third issuer ever authorized to allow non-accredited investors in the United States to participate in the funding of high-yield loans.

Since then, our community of lenders has more than tripled. Early adopters are using Groundfloor to take control, building self-directed portfolios of loans they choose rather ceding control to a REIT or fund manager, and paying dearly for the privilege. Together during this year we’ve funded over 100 loans for $12.5 million in aggregate. Our underwriting standards practices are stronger than ever, and our discipline to restrain growth to a manageable level has paid off: Our lenders have earned average annual rates of return of approximately 14 percent, with no loss of capital on over 40 loans successfully repaid to date.

Second, the news. Groundfloor remains in a limited release while we prepare to open our doors fully in the new year. In the meantime, we’re ready to expand by doubling our lending footprint, which will now extend to 23 states.

Why? First and foremost, to supply more loans sooner--without lowering our standards. Before starting our nationwide expansion a year ago, funding five loans for $250,000 took us a full month. Just last night, at 5pm ET, we did that in 15 minutes with 142 lenders getting in on the action. Our investors have been ready for us to expand, and now are our lending operation is ready too.

We continue taking steps to bring Groundfloor to more investors, to continue opening up more capacity for everyone to participate and to ensure there are enough loans to go around. Today’s news is a helpful step in that direction, and one that signals confidence in the lending operation we’ve built in 2016. Stay tuned for more exciting developments on the horizon--more features, more loans, and more geographic expansion. One year in, we are as fired up as ever and continue to appreciate your continued interest, support and trust.