Welcome to Groundfloorville, a quaint town tucked away in the cozy corner of your imagination. Groundfloorville is a friendly town and the Groundflooridians that live here are quick with a smile and full of endless optimism. Not only are the folks here a friendly bunch, but they also boast impressive financial acumen and a flair for real estate investing.

Groundflooridians are investors who see the town not just as a physical space, but as a thriving hub of opportunity, growth, and prosperity. You see, in Groundfloorville, every house is a home, and every home has a story. It's a town where you can see dreams turn into reality, brick by brick, door by door, home by home.

Join us as we meet some of the fine citizens of Groundfloorville. As you get to know them, you can also better understand their investment strategies, their path to consistent 10% returns, and what their next 10 years look like with the real returns provided by Groundfloor.

Best of all, you can access our financial model on your own. By adding your own inputs based on initial investment and recurring investment amounts, you’ll see for yourself what the next 10 years look like with Groundfloor.

Groundfloorville Citizen Profile #5:

ALAN J. BRENTFORD, JR.

Age: 72

Gender: Male

Occupation: Business Owner/Semi-Retired

Education: Post Grad

Income: $1,000,000+

Investor Profile

Alan’s interest in using a crowdfunding real estate platform like Groundfloor may stem from a desire to diversify his investment portfolio and potentially generate additional income streams. Real estate investing offers the potential for passive income through rental properties or real estate investment trusts (REITs), as well as the possibility of long-term appreciation in property values.

One of Alan’s biggest challenges when it comes to real estate investing is finding investment opportunities that align with his unique investment needs and preferences. As an ultra-high-net-worth individual with a sophisticated investment portfolio, Alan requires access to exclusive investment opportunities that are not available to the general public.

Another challenge for Alan is the time and expertise required to effectively manage his investments.

Despite these challenges, Alan’s investment goals include maximizing his wealth and achieving long-term financial security for himself and his family. He is also interested in using his investments to support philanthropic causes and to leave a financial legacy for future generations.

By Groundfloor, Alan can access a range of exclusive investment opportunities that are not available to the general public. The platform's transparent and accessible approach to real estate investing also aligns with Alan’s values and investment philosophy. Furthermore, the platform's online tools and resources help Alan more effectively manage his investments and achieve his investment goals.

Overall, Alan’s investment strategy may focus on acquiring rental properties or investing in REITs to generate passive income and long-term appreciation. With the right tools and resources, he can potentially achieve his investment goals and diversify his portfolio through platforms like Groundfloor.

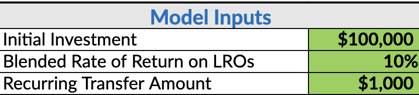

Alan chooses to initially invest $100,000 and decides to put forth another $1,000 monthly.

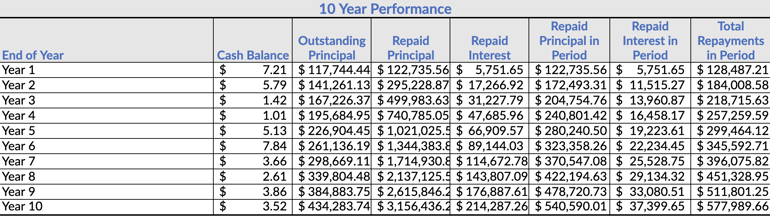

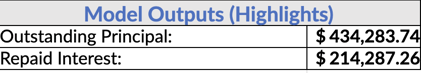

The below charts and graphs demonstrate a real-world balance sheet over the course of the next 10 years of Alan's investments.

Interested in seeing how your own investment strategy will look after 10 years? Download our worksheet here. Next, simply save your own copy of the workbook, then enter your “Initial Investment” amount in cell B2 and your monthly “Recurring Transfer Amount” in cell B7. The 10-year performance and charts will automatically update, as will the accompanying graphs below.