In January, we published an updated diversification analysis on the range of returns realized in the portfolios of over 2,900 GROUNDFLOOR investors up until that time. We’ve updated and enhanced that analysis. This is our third edition. The data now includes 3,330 portfolios, with over 312 loans repaid representing $33,776,232 in principal invested. The scale has increased from 2,950 portfolios, 209 loans repaid and $21,000,000 in principal invested in our January analysis.

As we wrote in our original:

As many readers know, diversification is a risk management technique that mixes a wide variety of investments within a portfolio. When properly diversified, a portfolio should yield higher returns and lower risk more reliably than will a single investment or small number of concentrated investments held in a similar portfolio. Diversification is a strategy intended to negate risk events that are unique to any particular investment in a portfolio. With diversification, the negative performance of some investments is expected to be countered by the positive performance of others.

The Effects of Diversification on Portfolio Returns

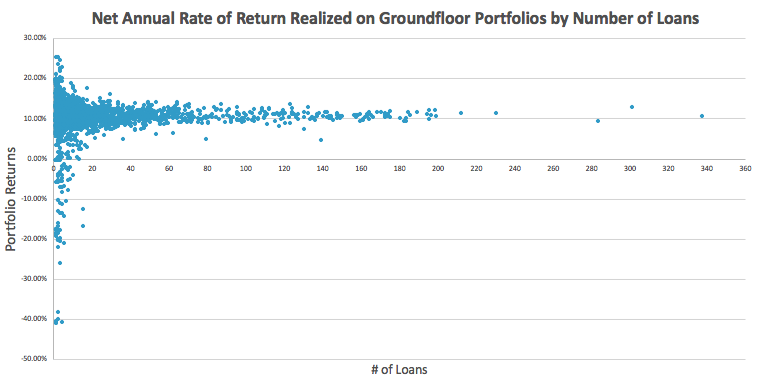

Our updated analysis shows how investors portfolios have performed overall time in the four years since GROUNDFLOOR first started offering its investments. As a refresher, or for those readers not familiar with the previous two editions (in July 2017 and January 2018) the chart shows the relationship between portfolio returns realized and the number of loans held in each portfolio. Each dot represents an anonymous individual investor portfolio containing a number of loans (plotted along the x-axis) and having realized a given annualized rate of return (plotted along the y-axis).

Our analysis shows that a hypothetical model portfolio composed of an equal investment made in all 312 loans repaid to date would've earned an annualized net return of 11.39%. All portfolios containing more than 15 loans realized a positive return.

Net Annual Rate of Return Realized on GROUNDFLOOR Portfolios by Number of Loans

For this analysis, we maintained the same method of calculating portfolio returns as we employed previously. As we described it in our original edition of the analysis:

We calculate portfolio returns by dividing the amount of interest earned for each investment by the amount of principal invested, and then annualizing that figure. Each annualized return is then weighted by the amount invested as a proportion of all principal invested in the portfolio. Reinvestments are accounted for as new, separate investments. Balances held as available cash in GROUNDFLOOR Accounts are not included in the analysis, since they are not invested and can be withdrawn upon demand.

Once again, as the theory of diversification predicts, portfolios invested in the largest number of loans realized the most reliable returns. This is true even though GROUNDFLOOR investors, unlike investors in REITs or other funds, decide not only which loans to include in their portfolios, but how much capital to allocate to each loan, relative to the others. The power of diversification is that strong -- and GROUNDFLOOR investors are achieving a greater level of it than is provided by competing online REIT products.

This chart also shows the risk of not diversifying one’s investments. A small number of portfolios at the extremes put all their eggs in a few baskets. Portfolios containing only a handful of loans or less realized a wide variety of returns, including some significant losses for those who bet big on our one high-yield (23.8%) F-grade loan that lost principal.

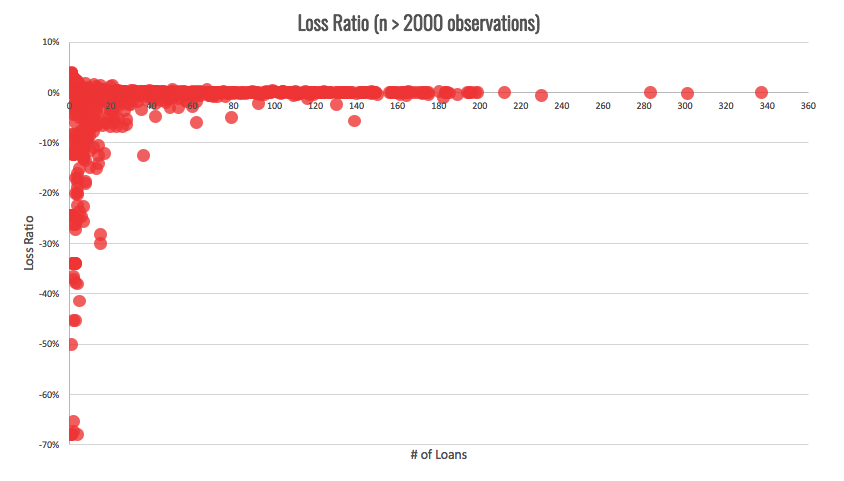

The Effect of Diversification on Loss Ratios

The portfolio returns reported above are reported net of losses. This means losses are taken into account in calculating the return presented. Many investors want to understand not only the net return figure, but also the losses they can expect when investing to get to that net return.. The measure of losses is known as the “loss ratio.”

As we explained in our original analysis:

The “loss ratio” is the amount of principal lost expressed as a ratio to the principal invested. A loss ratio of -0.05, for example, would mean that $50 was lost out of every $1,000 invested. Similar to the rate of return chart, the chart above illustrates loss ratios realized by individual portfolios compared by the number of loans held in each portfolio.

Loss Ratios Realized in GROUNDFLOOR Portfolios by Number of Loans

A model portfolio composed of equal investments in all 312 loans repaid to date would've experienced a loss ratio of -0.0035 (in percentage terms: -0.35%).

This is significantly improved over the -0.74% we reported a year ago. The improvement was driven by the repayment of 185 additional loans with virtually no loss of principal since then. The loss ratio (and the gross returns) also benefited from our ability to extract default interest from loans that did not perform as expected (see discussion in the next section below).

The reduction of loss ratios benefits everyone. It’s a virtuous cycle. The lower the loss ratio realized over time (currently 0.35%), the more certain investors can be of realizing their expected returns (11.39% net). The more certain we are of realizing investor returns, the lower rates we can then start offering our borrowers. That, in turn, helps us to originate more loans while holding quality constant or improving it.

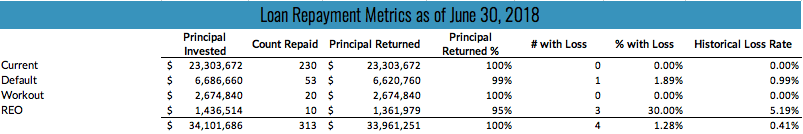

Loan Status At Resolution

In response to feedback from our original analysis, in January we also provided additional data to help investors assess where future performance might net out. Actual investment experience cannot guarantee future performance, but it can provide insight to potential return scenarios.

Our previous analysis provided a historical loss ratio for loans in Workout and Default states. In this edition, we’ve improved upon that to add a full stratification of repaid loans by performance state:

-

Current - loan remained current through the term,

-

Default - loan was put into default, but did not advance beyond that state,

-

Workout - a workout plan was put into effect and the loan was resolved under the terms of the workout agreement, and

-

REO - GROUNDFLOOR assumed title to the property (either through foreclosure or deed in lieu) and sold the property.

Loan Repayment Metrics as of June 30, 2018

The table shows that loans falling into REO status experience the highest loss rate, at 4.33%. This was based on 9 loans repaid from that state, two of which took losses.

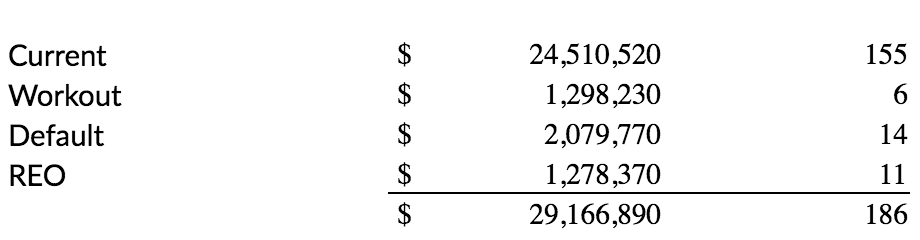

Reaching beyond repaid loans, overall there are currently 186 loans totaling $29,166,892 outstanding. A similar stratification of the active portfolio yields the following:

Stratification of Active GROUNDFLOOR Portfolio By Performance State

While the final performance of the outstanding book has yet to be determined, we can measure how it currently stands relative to the repaid portfolio. Significantly, 69.0% of the repaid loan volume was current at repayment while 84.0% of the outstanding book is current. That is a significant improvement in underwriting and asset management performance. Similarly, 19.8% of repaid loans were in default, while the current book has 4.5% of loans in default.

The outstanding book does have a slightly higher REO rate. This is due to problem loans in judicial foreclosure states that achieved title transfer following the necessarily long and involved legal process to reach that point. Taking all of the data into account, while a definitive performance projection cannot truly be based on past performance, it can objectively be said that the outstanding book is in a stronger position compared to the repaid portfolio.

Over five years ago, GROUNDFLOOR was founded to enable the everyday American to invest in high-yield securities previously reserved for the top 5%. As GROUNDFLOOR continues to expand its loan origination capabilities, the degrees to which our investors can diversify their portfolios has become unprecedented in the real estate investment space. In line with our mission, we will continue to empower our investors to develop and execute their own investment strategies. If and how you take advantage of this degree of freedom is up to you.

We share this kind of information to help support our investors’ success. If you have any questions or comments about this report, do not hesitate to reach out to us. You can comment below, tweet to @groundfloor_com, or send an email to support@groundfloor.us.