Welcome to our Asset Management Monthly Update series, which we began in May 2020 to give Groundfloor investors a monthly snapshot of how our asset management team is managing our outstanding loan portfolio. This report provides details on loans repaid in August, as well as insight into how Groundfloor acted to manage troubled loans. Overall, our monthly performance was strong as 54% of loans that repaid in August did so at or prior to the month of maturity.

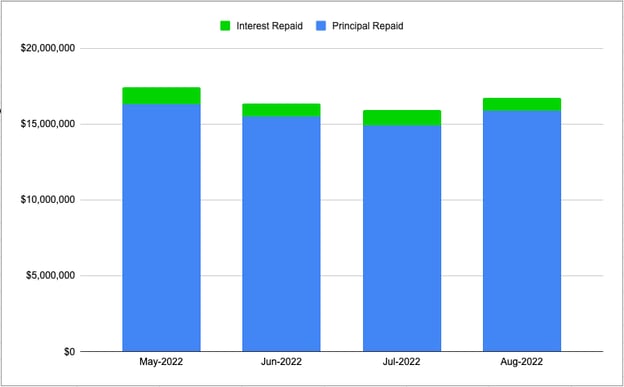

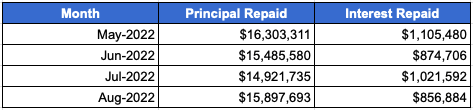

Principal and Interest Repaid Over The Past Months

First, let’s take a look at the total principal and interest repayments disbursed to investors over the past four months:

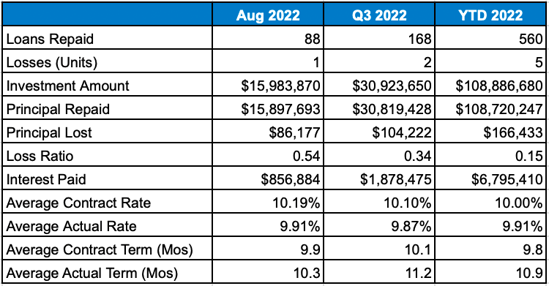

Aggregated Performance Metrics

Next, let’s take a deeper dive into repayment activity over the past months to get a better picture of how our recently repaid loans have been performing. We examine the metrics of loans repaid within the last month, loans repaid since the start of Q3 2022, and loans repaid year-to-date in 2022.

It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

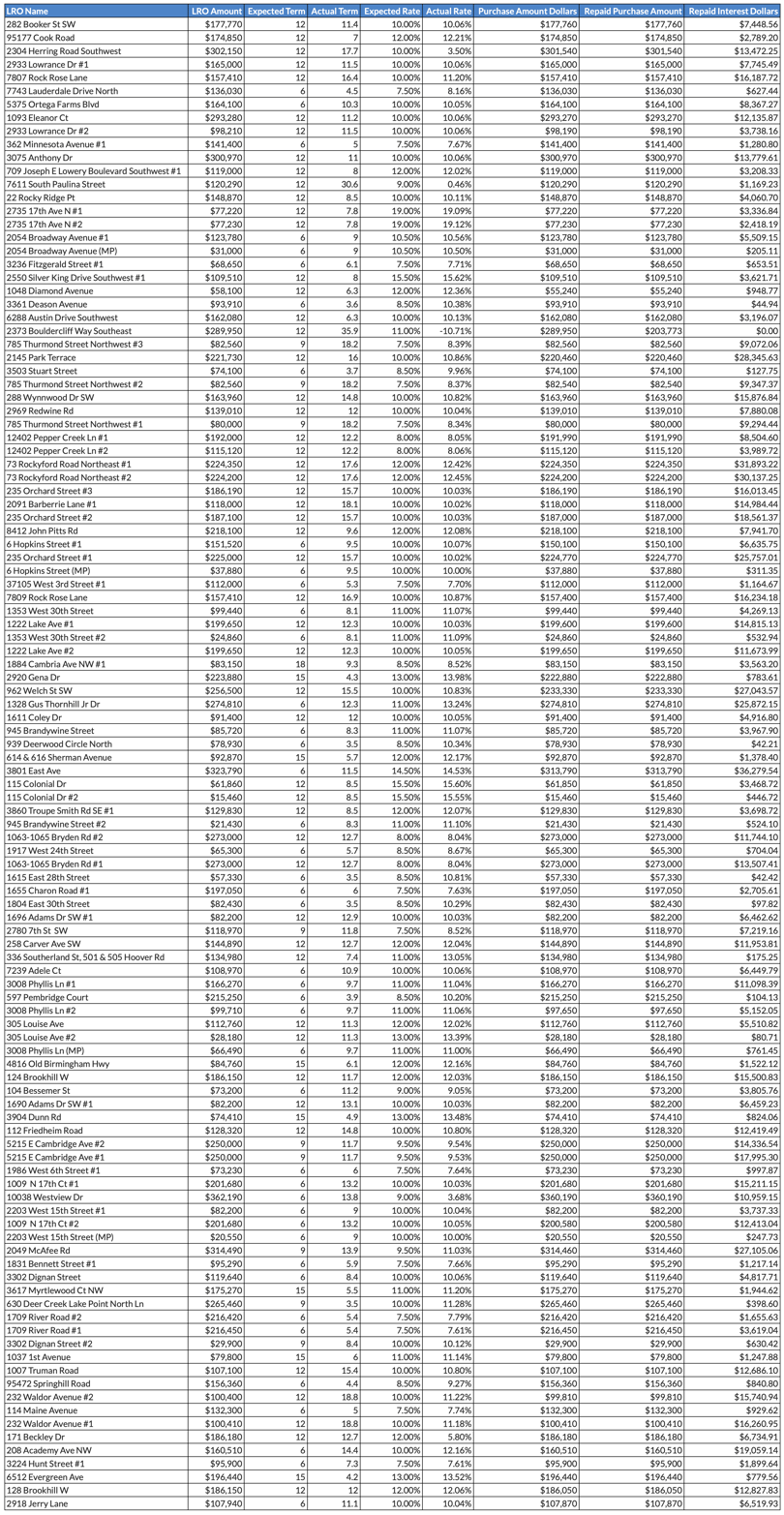

Repayments - August 2022

This table presents loans that were repaid within August, with details on the purchase amount, actual vs. expected term, and actual vs. expected rate:

*NOTE: Actual rate is not inclusive of any promotions. Individual repayments are dependent on how long your principal is active in a given loan.

Special Situations Repaid in August

Next, we provide a monthly overview of special situation loans we resolved in the prior month. In August, a total of 69 loans were repaid, and 37 of them were current or repaid within a month of maturity. 28 loans were granted an extension and 38 were repaid after the stated maturity date and two were repaid out of default. We go into a couple of our special situation loans in greater detail below:

1328 Gus Thornhill Jr Dr - Extended

This loan became effective in August of 2021. Work began and progress was monitored. Due to delays in city permitting and supply chain issues the loan passed its maturity date. The Asset Management team continued to engage with the borrower, provide directions and feedback while the borrower completed the project and listed the property for sale. Due to market conditions the borrower altered their exit strategy and decided to refinance the loan. The loan repaid in August 2022 with an effective rate of 12.53% vs. the original contract rate of 10% leading to a better than expected return for investors.

208 Academy Ave NW - Extended

This loan became effective in June of 2021. There were delays due to material supplies and Groundfloor Asset Management remained in communication with the borrower and provide support and guidance. The loan repaid in August 2022 with an effective rate of 11.74% vs. the original contract rate of 10% leading to a better than expected return for investors.

Special Situations Activity Last Month

Finally, our asset management team moved forward with the following special situation loans last month. As a reminder, all performing loans are monitored for repayment status starting at 120 days prior to maturity.

Loan Activity:

We went into workout agreements on 28 loans in total in August. We proceeded with foreclosure actions on 12 properties. We took possession of two new properties last month: 1711 Floyd and 4527 Westhampton. We went under contract to sell two properties in August: 196 Wadley and 647 Ruff. No real estate owned properties were sold during the month.