The Groundfloor Asset Management Monthly Update provides a view into our overall loan portfolio. On a monthly basis, we review the prior month’s aggregate performance and the key statistics you need to understand how Groundfloor manages our existing portfolio. We highlight monthly repayments and specific projects to give you deeper insights into the ongoings of our Asset Management team.

Monthly Highlights

Groundfloor's overall portfolio had 1,269 active LROs at the end of January, as well as a reduction of six loans from REO.

Despite volatile market conditions, the Groundfloor loan portfolio continues to remain stable. Properties that are Real Estate Owned (REO) continue to make up a small portion of the overall portfolio. Of note, the REO portion of our portfolio reduced by 6 from December (36) to January (30).

Please note, “Default” does not necessarily mean a “loss” in our overall portfolio. See our “Rate of Return” section below for additional clarity on Defaults.

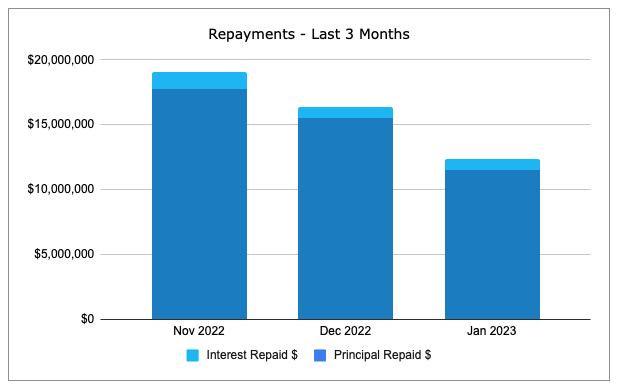

January Principal and Interest Repaid

In January, Groundfloor disbursed $889,166 in LRO interest to investors. This represents an increase from the $884,334 of interest repaid in December. Principal LRO repayments decreased by 26% to $11,495,336, though this was expected due to a slow down in activity attributed to seasonality.

While January 2023 LRO repayment activity was lower than the previous month, year over year it was 45% higher than January 2022.

Seasonal delays stemming from reduced holiday schedules produced fewer repayments in the first week of the month. A deep dive reflected the extent of the holiday impact, as you can see in the below chart. The last week of January also included only 2 business days.

January's stats saw a higher number of repayment on extended or defaulted loans, meaning investors who bought into those LROs had been holding onto these loans for an extended period and/or received default interest in addition to the initial contract rate. This meant that while the principal repayment was lower, the interest paid was more.

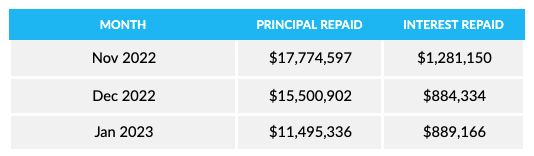

Rate of Return

In January, portfolio performance reflected an as expected return. Loans in the “Extended” status exceeded expectations and overall returns were higher than initial forecasts. Six loans repaid from Default status during the month of January. Two loans that repaid from Default returned higher than contract interest to investors. Additionally, two projects experienced a loss in principal which impacted the overall average return sum for that category.

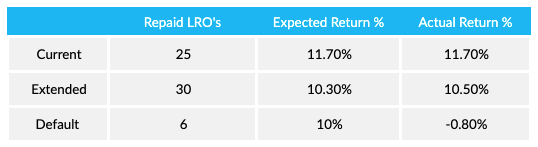

Performance Metrics

The table below presents aggregated data on our portfolio performance for the month of January 2023, with comparison to January 2022 and Q4 2022. We can see that there has been an increase in both interest and principal payments over the course of the year. Our loss ratio percentage increased in January due to the two loans that experienced a principal loss as mentioned above.

*It's important to note that the above table shows the performance of loans that were repaid during the time periods noted, not the performance of loans originated during these timeframes.

To access and download a detailed view of January’s performance metrics, click here.

January Asset Management Highlights

Our asset management and default servicing teams are committed to ensuring that our investors receive a maximum return on their investments. Here are some of the highlights from this month:

- 18075 Roselawn - This loan originated in December 2019 and due to Covid related delays, the borrower was granted a series of extensions. However, due to multiple missed deadlines, the file was referred to Groundfloor’s default servicing team in July 2022. In December, a successful foreclosure action was completed. As per Michigan state regulations, the borrower had a six-month redemption period following the foreclosure sale. In a concerted effort not to lose the property, the borrower was able to pay off their loan plus penalty interest at an amount of 11.78%, as opposed to its original 9% contract rate. This is a good example of how a loan that is in REO can not only repay in full, but also deliver additional default interest rates to our LRO investors.

- 1402 Arkansas Ave - This loan originated in November 2019. After the completion of work on the property, the borrower attempted to repay the loan through a sale and then through refinance. However, these efforts faced obstacles and eventually led to a foreclosure action being filed in June 2022. The borrower requested a payoff, and after nearly 40 months was successful in obtaining the necessary funds to pay off the loan. This resulted in an actual interest rate of 13.68%, which was higher than its initial contact rate of 10.2%, and provided a positive outcome for the investors.

January Project Spotlights

In this month's Project Spotlights, we showcase three separate projects in our home state of Georgia.

509 Peggy Lane, Villa Rica, GA

(Purchase & Renovation)

Repaid LRO

Repaid Date: January, 25, 2023

LRO Amount: $142,230

Interest Rate: 12.0%

Total # of Investors: 715

1556 Overland Terrace Southeast, Atlanta, GA

(Purchase & Renovation)

Repaid LRO

Repaid Date: January 12, 2023

LRO Amount: $356,860

Interest Rate: 10%

Total # of Investors: 1,543

3871 Cochran Lake Drive, Marietta, GA

(New Construction)

Repaid LRO

Repaid Date: January 9, 2023

Loan Amount: $456,560

Interest Rate: 10%

Total # of Investors: 2,502

Groundfloor Borrower Spotlight

Jonathan "Jon" Reid is one of our well-known Atlanta-based real estate investors who has been in the industry since he was in college. He has a wealth of experience and knowledge about the market and is always looking for new opportunities to invest in.

Jon has completed over 50 projects, predominantly fix-and-flip, and has already closed four projects with Groundfloor. He is currently working on several more projects with us.

One of his latest passions is developing more affordable housing options, such as tiny home communities. He’s all about helping others start to build wealth, and these kinds of properties offer a more reasonable entry into homeownership for many people. This is a cause he’s very passionate about, and he’s always looking for new ways to make a difference. We are pleased to have him as a repeat client with Groundfloor.

Read more about Jonathan and see some of his Groundfloor projects here.

Review your Groundfloor Investor Account

To review your current portfolio's performance, and discover and invest in new LRO's, please visit your Investor Account here.

Understanding our Loan Status Definitions:

Repaid Loans - this is when the borrower has paid back the current loan on their property and the interest is distributed back to the investors of the LRO associated with that particular property.

Current Loans - these are performing loans with active renovation projects which have corresponding LROs that have been sold on our investment platform.

Extended Loans - these are loans where the project completion and/or loan repayment did not happen before the intended maturity date and the borrower has signed an extension agreement to pay penalty interest which will be passed through to LRO investors when it repays.

Defaulted Loans -these are loans where Groundfloor's Default Servicing team has engaged with counsel to file legal foreclosure proceedings to take possession of the property as collateral for the defaulted loan.

REO (Real Estate Owned) - this is when Groundfloor takes ownership of the property through the foreclosure process and works to sell the asset in order to recoup as much principal and interest for our investors as possible.