Introduction

As our 10th anniversary celebrations continue this month, we’re focusing on demonstrating the power of the Groundfloor investment platform and how a passive investing strategy in our real estate offerings earns you real, tangible income.

We understand that everyone has a different strategy, different approach, and a different way to use the tools within your investor account because after all, we all have different investment goals.

In this blog series, we’re going to have a little bit of fun. Each week throughout June, we’re going to focus on a different profile as if they were a Groundfloor investor, giving a high-level, purely theoretical overview of their investment background, strategies, and goals.

Furthermore, for this “10 for 10” blog series, we are going to use these very fictitious profiles to demonstrate the very real returns Groundfloor offers based on a future-looking 10-year financial model, born from Groundfloor's 10 years of consistent 10% returns.

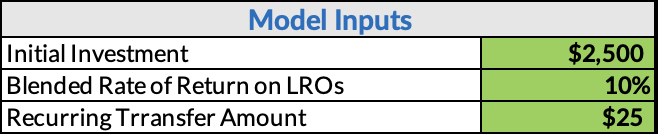

Finally, and perhaps most importantly, you'll be able to access our 10 for 10 financial model on your own. Once you download it, you'll be able to add your own inputs such as initial investment and recurring investment amount to see for yourself what the next 10 years look like when investing with Groundfloor.

Character Profiles

Name: Jack Jackson

Age: 39

Gender: Male

Occupation: Manufacturing

Education: School of Life

Income: $65,000/yr

Jack's Investor Profile

Jack is a family man. He is the primary breadwinner for the family, and while he makes a steady, annual income, he is looking for ways to make his money work harder and smarter. Jack needs a more stable, low-risk investment strategy, especially if it provides a real opportunity for passive income.Jack doesn’t have a history with investing, he just knows it’s the smart thing to do. He is intimidated by the large investment firms and their high fees. He is equally intimidated by the do-it-yourself online brokerage houses that still require a good deal of knowledge, forethought, and fee payments to launch and maintain an investment strategy.

Jack is attracted to Groundfloor’s real estate investment platform as he knows real estate is a historical asset class that provides stability and real, consistent returns. Jack's investment strategy is to utilize Groundfloor’s Investment Wizard, where he can set a moderate investment strategy and take advantage of the automation.

Jack has consumed the many blogs and helpful articles on the Groundfloor website and was particularly inspired by the “Masterclass” webinar series of videos.

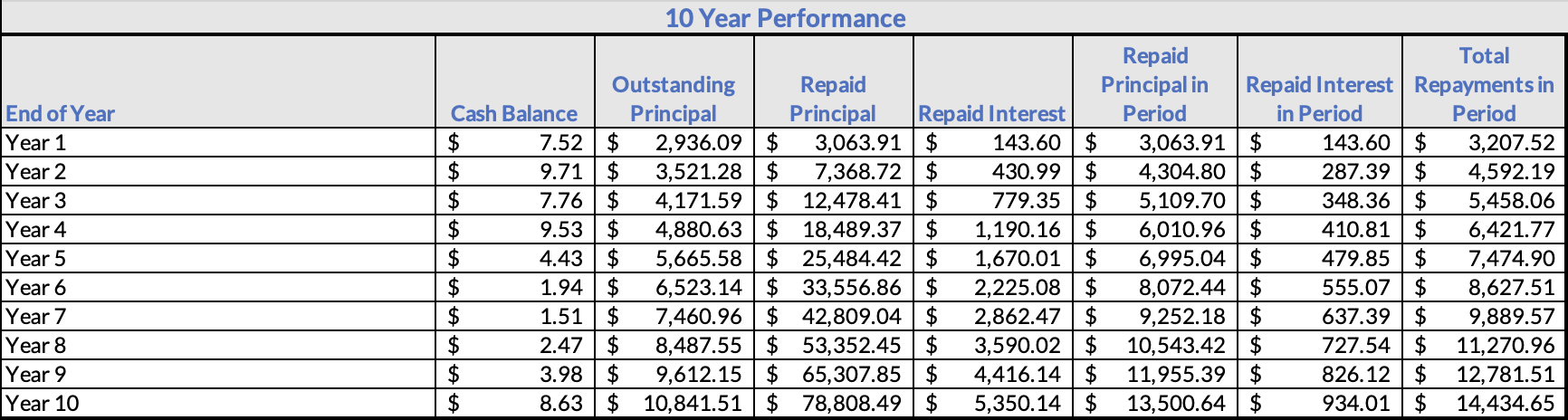

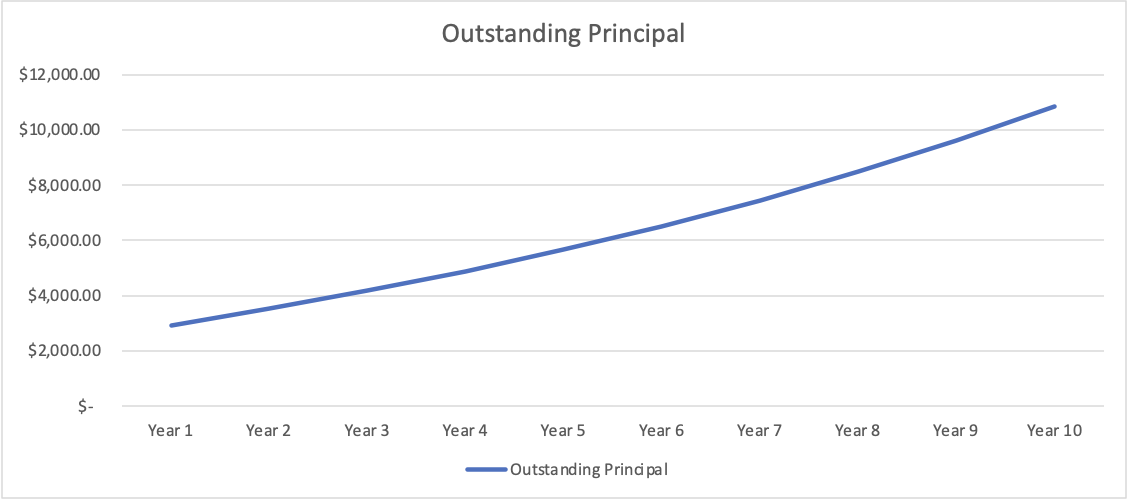

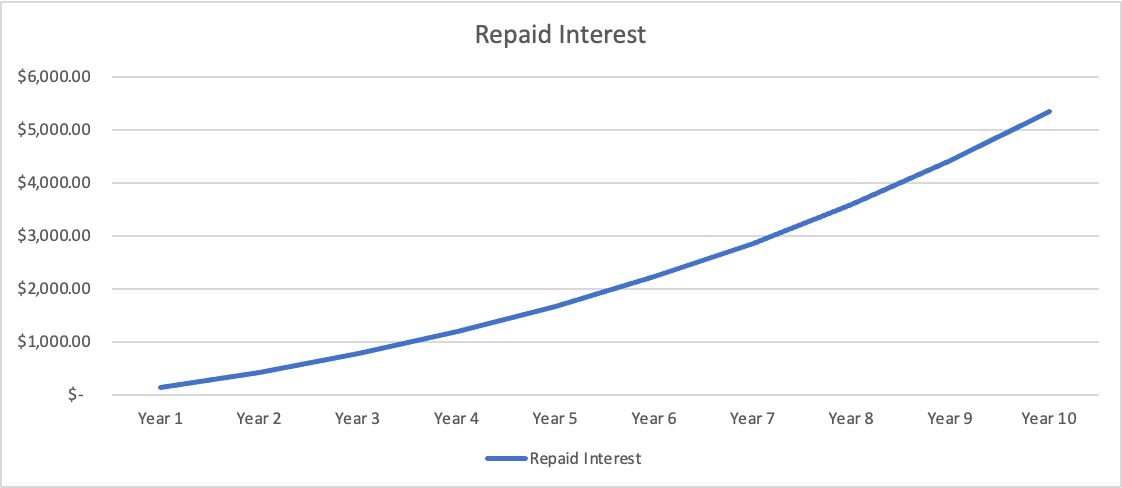

By initially investing $2,500 and allocating an additional $25 each month by cutting down on his daily coffee habit, Jack's 10-year outlook with Groundfloor’s consistent 10% returns yields the below performance. After 10 years, Jack earned a total of $5,340.14 in Repaid Interest, from a total Outstanding Principal of $10,841.51.

The Proof

Use Our Investment Worksheet

Interested in seeing how your own investment strategy will look after 10 years? You can enter your own Initial Investment amount in cell B18 and your Recurring Transfer Amount in cell B23.

To do so, you can access our worksheet here.

NOTE: You must download your own version by going to File --> Make a Copy to work in your web browser, or go to File --> Download to work in Excel. We cannot grant access as it is a locked document.

Disclaimer: Groundfloor's claim of consistent 10% returns is based on previous historical returns and current available investments, which range from 4% - 14% barring any losses. Investing is not without risk, including potential loss of invested principal. Groundfloor cannot guarantee your rate of return or cash flows represented in this model. This model and your use of it are purely for demonstration purposes.