The Groundfloor Asset Management Monthly Update provides a view into our overall loan portfolio. On a monthly basis, we provide details on overall performance and the key statistics needed to understand how Groundfloor manages our existing portfolio and the monthly repayments. We also highlight specific projects.

Monthly Highlights

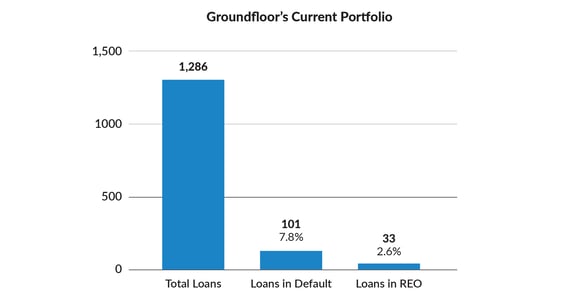

Groundfloor's overall portfolio has 1,286 active LROs, a growth of 145 LROs compared to October.

Defaults and REOs continue to be a small proportion of our overall, stable portfolio.

November Principal and Interest Repaid

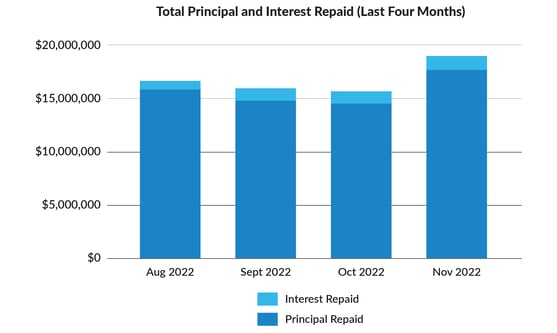

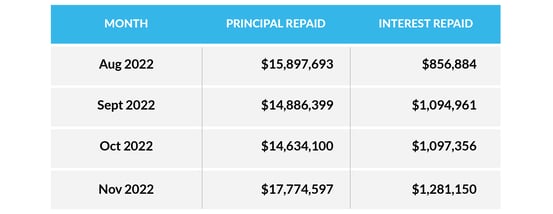

In October, Groundfloor reported a company record for the highest monthly repayment of interest. In November, we did it again with interest repayments to investors growing 16.7% to more than $1.2 million.

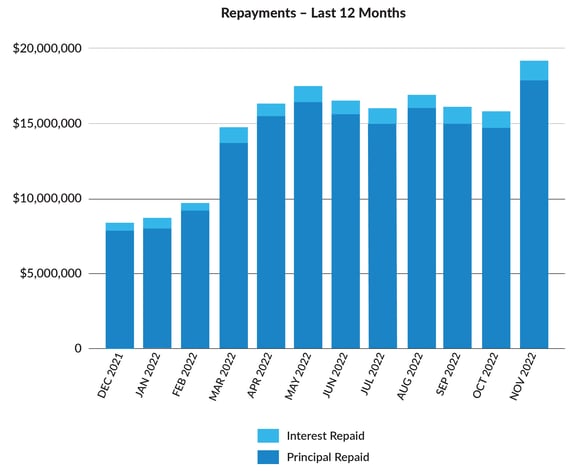

Groundfloor's monthly repayments have almost tripled and have grown 131% compared to the period 12 months ago, in spite of economic headwinds that have impacted the larger construction industry.

Rate of Return

November's portfolio performance saw both the actuals for the Current and Extended LROs exceeding that of the expected return. Furthermore, even those LROs that went into default saw dollars recouped back to investors thanks to the hard work and diligence of our Asset Management Team.

Performance Metrics

The table below provides aggregated data as a snapshot of our portfolio performance for November, Q4 and year-to-date periods. Our asset management team continues to perform at a consistently high level, with the continued realization of low loss ratios as the most important performance indicator.

.png?width=2368&height=1359&name=blog_01-09%20(1).png)

For a detailed view of November's performance metrics, we have provided you access to this data here.

November Asset Management Highlights

Our asset management and default servicing teams work diligently to ensure the best possible recovery for our investors, no matter the situation. Below are this month’s highlights:

- As previously stated, but worth noting again in this highlight's section, November saw $19,055,746 of principal and interest repaid to our investors, another incredibly strong month, outperforming last month's total.

- The asset management team has been actively targeting older loans for resolution. The success of these efforts causes an increase in the average term length of loans repaid in such periods. Securing the return of investor capital as quickly and efficiently remains the top priority of our teams.

- We continue to see declines in loss ratios within the Groundfloor portfolio. A combination of smart underwriting guidelines coupled with a highly performing asset management team has allowed us to stay ahead of stressed LROs and proactively resolve many issues before losses grow.

November Project Spotlights

Below in this month's Project Spotlights, we look at three projects from our Atlanta market, highlighting before and after photos, and demonstrating some of the great work done by our Borrowers.

1080 Kingston, Atlanta, GA

(Refinance-Rehab)

Repaid LRO

Repaid Date: November 8, 2022

LRO Amount: $662,480

Interest Rate: 8%

Total # of Investors: 2,315

140 Kings Mill Court, Roswell, GA

(Purchase & Renovation)

Repaid LRO

Repaid Date: November 14, 2022

LRO Amount: $400,650

Interest Rate: 6.5%

Total # of Investors: 1,619

1680 Van Vleck Ave SE, Atlanta, GA

(Purchase & Renovation)

Repaid LRO

Repaid Date: November 17, 2022

Loan Amount: $366,110

Interest Rate: 12%

Total # of Investors: 1,187

Groundfloor Borrower Spotlight

Featured as our November “Stud of the Month” in our “Down to the Studs” Borrower Newsletter series, Laron Moses with Friendly Helpers LLC, is one of Groundfloor’s Georgia-based real estate entrepreneurs. He has been in this industry for over 21 years and has completed over 30 projects in the Atlanta area. His experience with Groundfloor “has been nothing short of amazing.” Laron is currently working on a new construction project just southwest of downtown Atlanta with a Groundfloor loan.

Understanding our Loan Status Definitions:

Repaid Loans - this is when the borrower has paid back the current loan on their property and the interest is distributed back to the investors of the LRO associated with that particular property.

Current Loans - these are performing loans with active renovation projects which have corresponding LROs that have been sold on our investment platform.

Extended Loans - these are loans where the project completion and/or loan repayment did not happen before the intended maturity date and the borrower has signed an extension agreement to pay penalty interest which will be passed through to LRO investors when it repays.

Defaulted Loans -these are loans where Groundfloor's Default Servicing team has engaged with counsel to file legal foreclosure proceedings to take possession of the property as collateral for the defaulted loan.

REO (Real Estate Owned) - this is when Groundfloor takes ownership of the property through the foreclosure process and works to sell the asset in order to recoup as much principal and interest for our investors as possible.